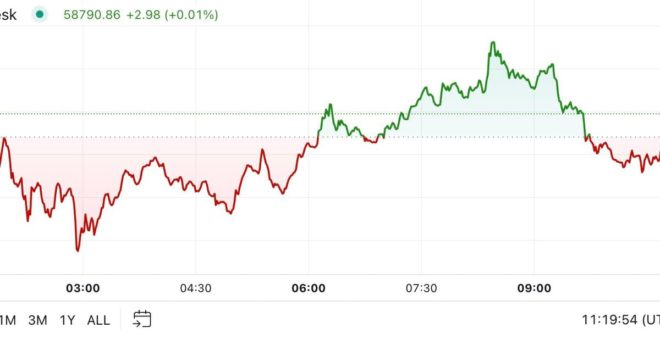

Bitcoin sank below $59,000 having spent much of the weekend above the $60,000 mark. BTC traded around $58,550 in the European morning, a drop of 2.4% over 24 hours at the start of a week in which traders worldwide expect the Federal Reserve to make its first interest-rate cut in more than four years. The broader digital asset market as measured by the CoinDesk 20 Index (CD20) is 3.6% lower. Crypto markets were buoyed by favorable U.S. economic data on Friday, which sparked a short-term rally. Bitcoin ETFs saw inflows of over $263 million, their highest since July 22, while the ether equivalents added around $1.5 million.

Bitcoin Pulls Back Before Probable Fed Rate Cut