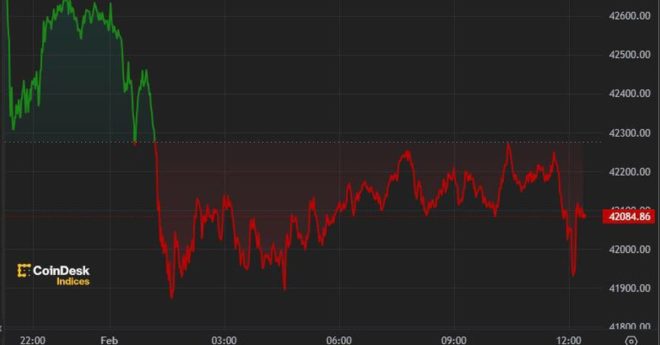

Bitcoin traded just above $42,000 in the European morning after Fed Chair Jerome Powell cooled hopes of an interest-rate cut in March yesterday. “The message from the Fed last night is that a March cut is not the base case, and they need to gain greater confidence that inflation will remain at these levels before moving,” said Nick Chatters, a fixed income investment manager at Aegon Asset Management. “Having said that, confidence is building, and Chair Powell was open in communicating that a cut will come this year. No surprise in any of that.” BTC dropped as low as $41,870 on Wednesday night, and while it has ticked slowly upward, it remains some way short of $43,000, where it started the week. The CoinDesk 20 Index, which measures the performance of the top digital assets, is down around 1.1% in the last 24 hours.

Bitcoin Regains $42K Following Wednesday’s Dip