Ether continues to underperform the wider crypto market following $152 million of outflows from ETH exchange-traded funds. Current cumulative flow for the ETFs since they started trading this week is negative $178.68 million. That’s mainly owing to withdrawals from Grayscale Ethereum Trust (ETHE), which converted to an ETF. “This situation is very similar to the bitcoin ETF product launched at the beginning of the year,” CoinShares analysts said in an emailed note. Outflows from the Grayscale Bitcoin Trust (GBTC), which converted from a closed-end structure into an ETF that allowed redemptions for the first time in 10 years, weighed on bitcoin’s price over the first weeks. Ether has risen by around 2% in the last 24 hours, sitting at $3,240 at the time of writing.

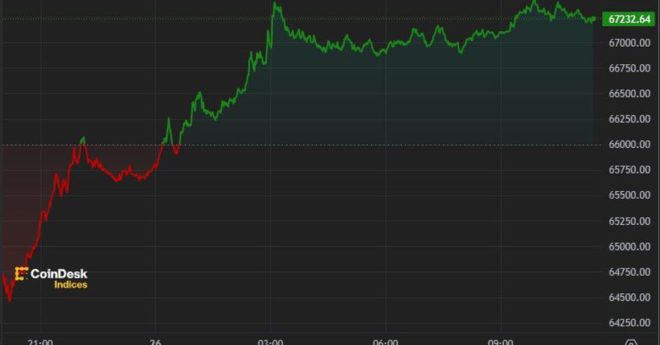

Bitcoin Regains $67,000, Adds Nearly 5% in 24 Hours