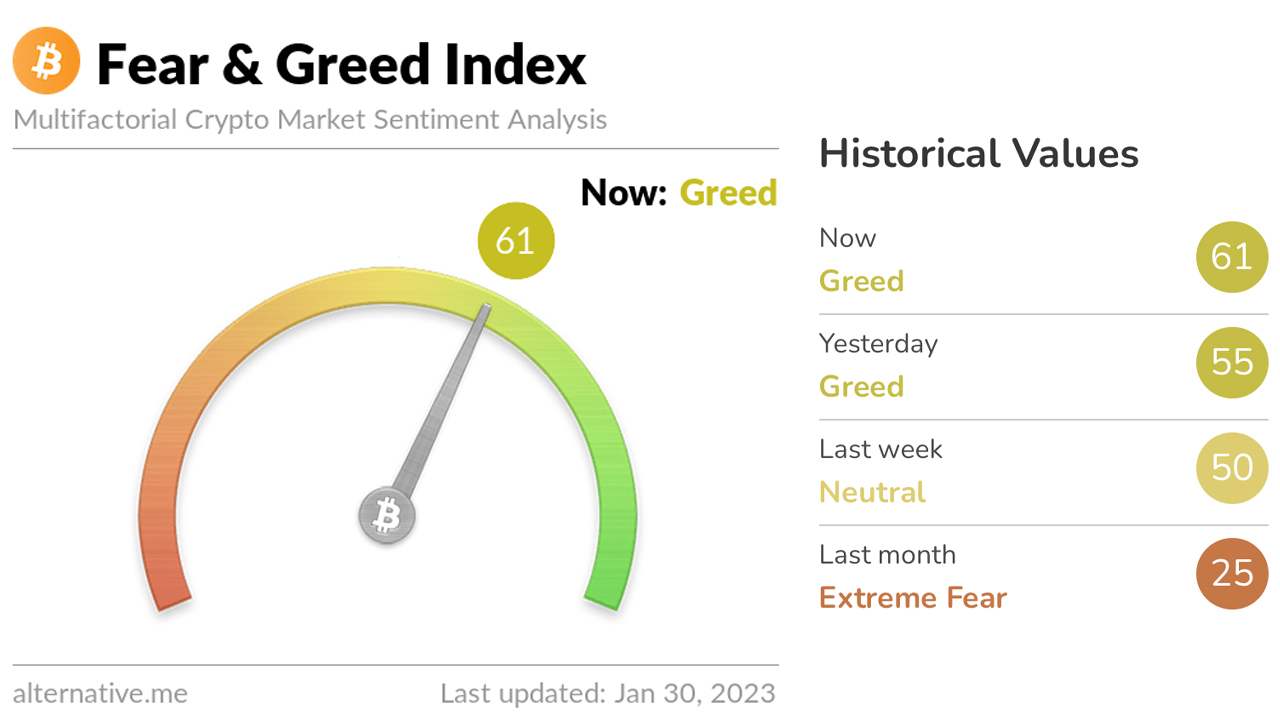

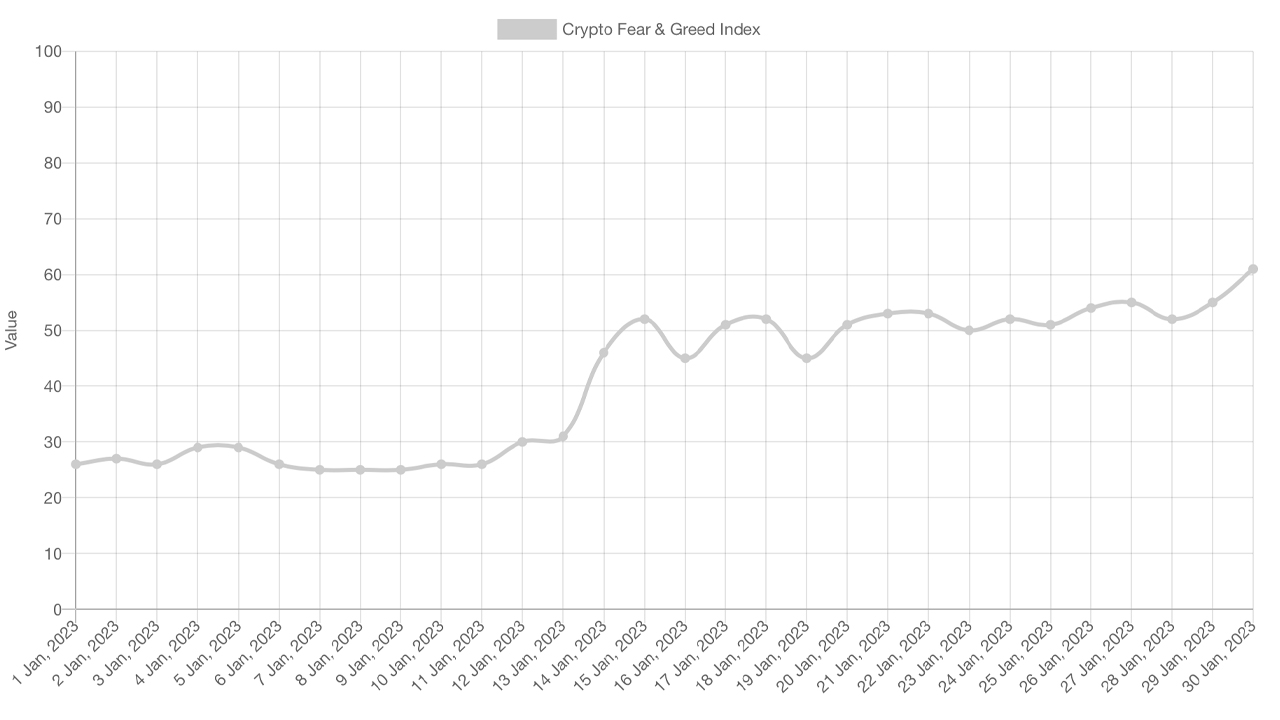

Last month, statistics showed that the Crypto Fear and Greed Index (CFGI) had a score of 25, indicating “extreme fear.” Thirty days later, with a 39% increase in bitcoin prices against the U.S. dollar, the current CFGI score on Jan. 30, 2023, is 61, reflecting “greed.”

Crypto Fear Index Jumps to ‘Greed,’ Etoro Market Analyst Attributes Bitcoin’s Rise to Shift in Investor Expectations

Records show bitcoin (BTC) saw significant value growth in the first month of 2023, with a 39% increase against the U.S. dollar. On Jan. 29, 2023, BTC reached a 30-day high of $23,954 per unit, with prices ranging from that value to a low of $22,988 over the past 24 hours. This rise has significantly raised the Crypto Fear and Greed Index (CFGI) hosted on alternative.me, moving it from the “extreme fear” zone to the “greed” range in the course of the month.

Last week, CFGI records showed a score of around 50, indicating “neutral,” according to alternative.me. Seven days later, the CFGI score rose to 61, meaning “greed.” The website states that when crypto investors become too greedy, it signals the market is due for a correction. The CFGI score has remained above the neutral range of 50 since Jan. 23, 2023, after spending a significant amount of time below 45 prior to Jan. 14, 2023. On Monday, bitcoin (BTC) prices saw weakness against the U.S. dollar as traders took profits.

In a note sent to Bitcoin.com News, Etoro’s market analyst, Simon Peters, attributed the halt in crypto price declines to a change in investor expectations regarding inflation and interest rate hikes from the Federal Reserve. Peters also noted that financial institution Goldman Sachs “published a positive note on Bitcoin,” citing a market performance sheet that was recently published, which shows Bitcoin outperforming all other major asset classes, including gold, real estate, and emerging markets.

“Bitcoin has performed extremely well so far in 2023, rising nearly 43% since 1 January on the eToro platform. From its lowest point in the past year – $15,523 – reached on 9 November, it’s up just over 50%,” Peters wrote. “With inflation and interest rate expectations now turning, most asset classes have halted the declines witnessed in 2022 as investors begin to think ‘where next’ for their portfolios beyond the 2022 rate hike crash,” the Etoro market analyst added.

What do you think is driving the increase in bitcoin prices and the shift in the Crypto Fear and Greed Index towards ‘greed’? Share your thoughts in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons