The price of Bitcoin is finally on the move after weeks of being stuck in a tight trading range. The number one cryptocurrency by market cap stands at support with the potential for another re-test of the lows if bulls cannot push it higher.

As of this writing, Bitcoin trades at $28,500 with a 2% loss in the past 24 hours. Over the previous week, the cryptocurrency recorded a 3% loss, while other assets in the top 10 underperformed and trended lower. The nascent industry could be a short-term crossroads.

Bitcoin Price Loses $29,000 Level, But A Recovery Is Likely?

As NewsBTC has been reporting, Bitcoin’s volatility reached a multi-year low after all major narratives previously influencing it diminished its strength. Now, the spike in volatility favored the downside, but how much pressure can the bears exercise?

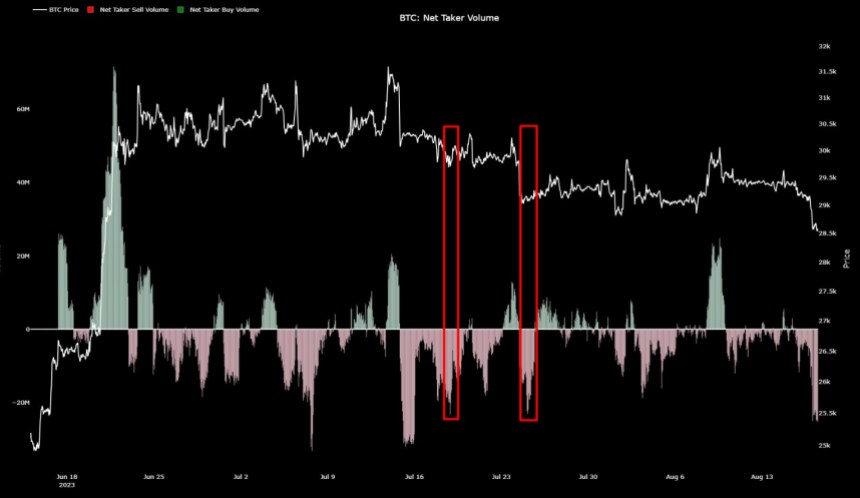

According to a CryptoQuant analyst, the recent price action marks one of the highest in recent months. As seen in the chart below, the last time that Bitcoin saw similar selling pressure was in late July. The analyst stated:

This marks the strongest surge in selling since July 15th. It wouldn’t be surprising to witness the pinnacle of selling pressure at this very moment.

As seen in the chart above, the price of Bitcoin bounced back from support each time that sellers pushed into the current levels, as measured by the Net Taker Volume. However, sellers could still push the metric into the July 15th levels and induce a capitulation event.

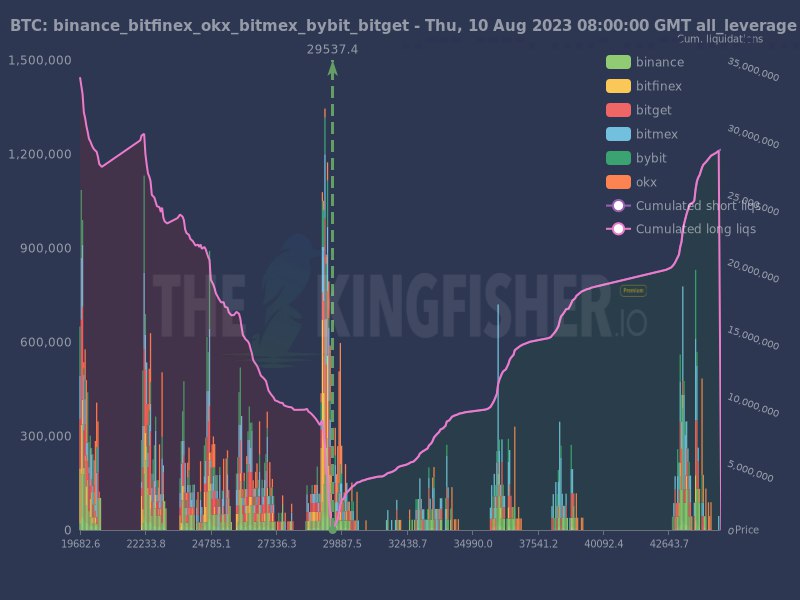

There is some evidence to support the above. The chart below shows that BTC’s long positions have fueled the downside price action by providing liquidity and accelerating the fall.

If this continues, Bitcoin could continue trending downwards into the liquidity pool created by long positions at $27,000 and $24,700 if bulls give it. On the latter, crypto analytics firm Material Indicators noted:

Bitcoin price and liquidity continuing to erode and a critical test of support is eminent. IMO… Losing $29k would be purely psychological. Losing $28.5k would be technical. Holding $28.3k is critical. Losing the buy wall at $27.9k would cause a cascade.

Cover image from Unsplash, chart from Tradingview