Key Notes

- Large holders liquidated over 50,000 BTC in two weeks, creating downward momentum despite retail buying attempts.

- Mining profitability reached 14-month lows as network difficulty remained elevated and prices declined sharply.

- Tech sector weakness amplified crypto losses as Bitcoin continued tracking NASDAQ 100 movements amid rate concerns.

Bitcoin

BTC

$73 661

24h volatility:

1.3%

Market cap:

$1.47 T

Vol. 24h:

$73.98 B

tumbled below $73,000 on Feb. 4, 2026, hitting twice its lowest point since April 2025, while publicly traded mining companies suffered steep losses as the crypto market correction deepened.

Bitcoin briefly touched $72,039 on Binance for the second time before recovering slightly to trade near $73,020 at the time of writing. That extends its retreat from October 2025’s all-time high above $125,500—a roughly 40% drop in just four months. Large holders sold more than 50,000 BTC over the past two weeks, creating steady selling pressure even as retail investors tried buying the dip.

Bitcoin / USD 4h | Source: Tradingview

Bitcoin Mining Sector Takes Steep Losses

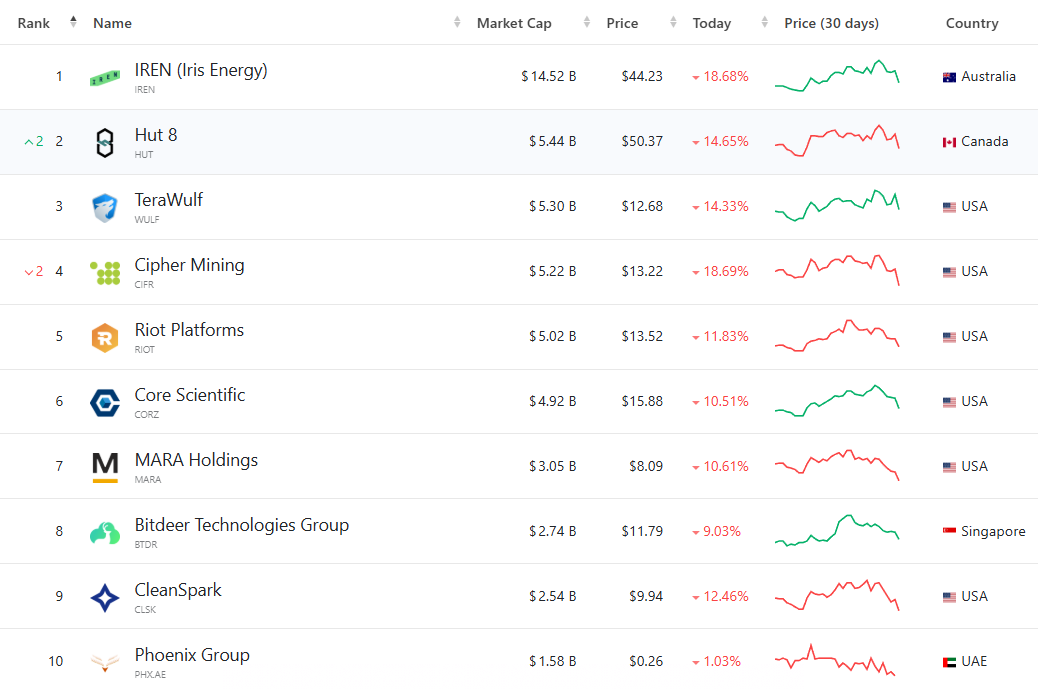

Mining stocks took the hardest hit. Marathon Digital Holdings traded near $8.09, while Riot Platforms hovered around $13.52, CleanSpark fell to $9.94, and others posted drops of more than 10% in today’s session. Only the Phoenix Group in the United Arab Emirates has a 1% drop.

Mining profitability dropped to a 14-month low, squeezed by falling Bitcoin prices and elevated network difficulty. All these conditions are causing the hashrate reported on the Bitcoin network to drop as of June 2025, according to network data.

Top 10 largest public bitcoin miners by market capitalization | Source: Companiesmarketcap

Other crypto-exposed companies faced similar pressure. Strategy, formerly MicroStrategy, continued its slide despite CEO Michael Saylor‘s ongoing Bitcoin accumulation strategy. MSTR stock hit a 52-week low in late January and has struggled to recover. Unrealized gains on its Bitcoin treasury have shrunk below 10%.

Tech Selloff Adds to Crypto Weakness

Bitcoin’s decline came alongside falling tech stocks, adding to investor concerns. Software companies posted a bad day in the markets, fueled by AI worries, pulling down risk assets. Bitcoin has historically tracked tech equities, particularly the NASDAQ 100, making it vulnerable to sector-wide selloffs driven by Federal Reserve policy and interest rate fears.

Falling BTC prices and shrinking mining profits point to sustained pressure on the Bitcoin mining sector until network difficulty adjusts or prices stabilize above profitable levels for operators.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

José Rafael Peña Gholam is a cryptocurrency journalist and editor with 9 years of experience in the industry. He wrote at top outlets like CriptoNoticias, BeInCrypto, and CoinDesk. Specializing in Bitcoin, blockchain, and Web3, he creates news, analysis, and educational content for global audiences in both Spanish and English.