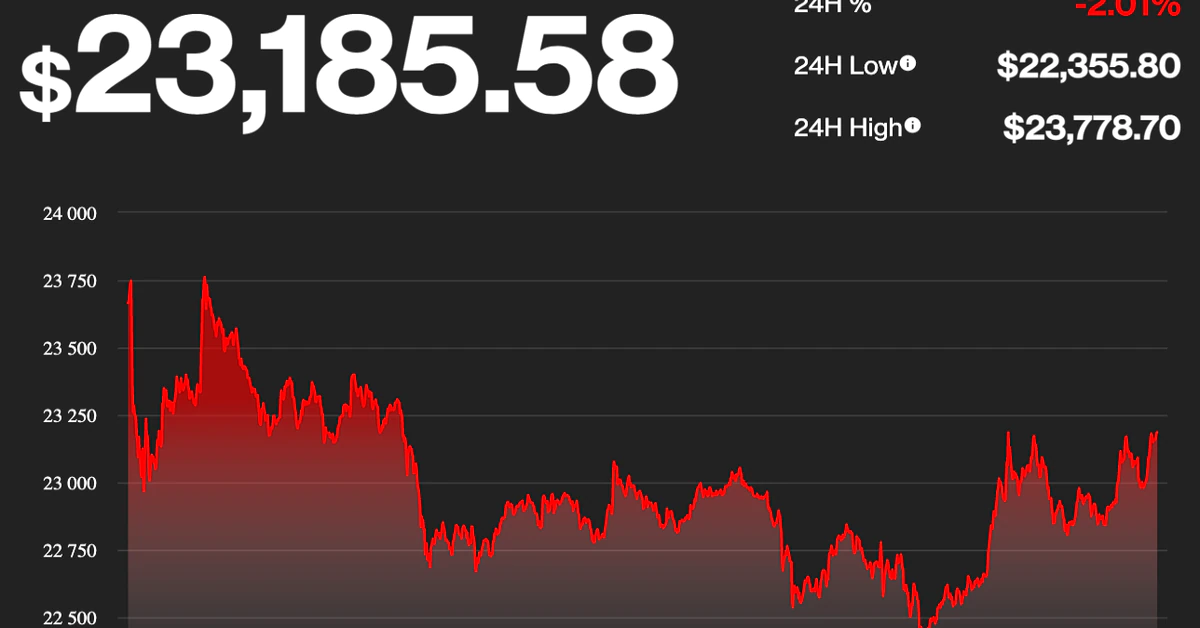

Additionally, the Average True Range (ATR) for BTC prices has been in decline since mid-June, indicating a narrower trading range. Also of note is BTC’s 10-period moving average crossing above its 20-period MA, as well as BTC prices themselves briefly touching the 50-period moving average. The decline in volume, however, implies uncertainty, and we expect that investors are viewing the $23,000 range as an area of potential resistance.

Bitcoin Stalls at $23K but Sits Above Cost for Average Investor’s Purchase Price