Bitcoin (BTC), the flagship cryptocurrency, finally breached the $30,000 level last week after ten months of anticipation, thanks to the increasing optimism that the US Federal Reserve will soon end its aggressive monetary tightening campaign.

As of April 17, BTC was trading at $29,883, down 3.62% from its 90-day high of $31,005, achieved on April 14.

Let’s explore the factors driving bitcoin’s price action, the role of the Federal Reserve, and the evolving market landscape.

The Federal Reserve’s role in bitcoin’s resurgence

The recent surge in bitcoin’s price has been fueled by a shift in the US Federal Reserve’s monetary policy.

Investors believe a more stable and predictable environment will emerge as the central bank eases its rate hikes to alleviate stress on the banking sector.

This optimism stems from the turmoil experienced by the banking sector in March, which led to increased expectations of the Fed’s leniency.

Friday’s closely watched US nonfarm payrolls (NFP) report showed that employers maintained a strong pace of hiring in March, pointing to a still-resilient economy.

Market factors and future predictions

Several factors could influence bitcoin’s price trajectory as the market evolves.

Some experts, like DonAlt, a technical analyst who predicted the 2023 bull market, believe that bitcoin is primed for a run-up to the $50,000 level.

However, a likelihood of a correction in the asset soon cannot be ruled out.

Meanwhile, Miners’ profitability and the state of miners in the network are critical to bitcoin’s price movement.

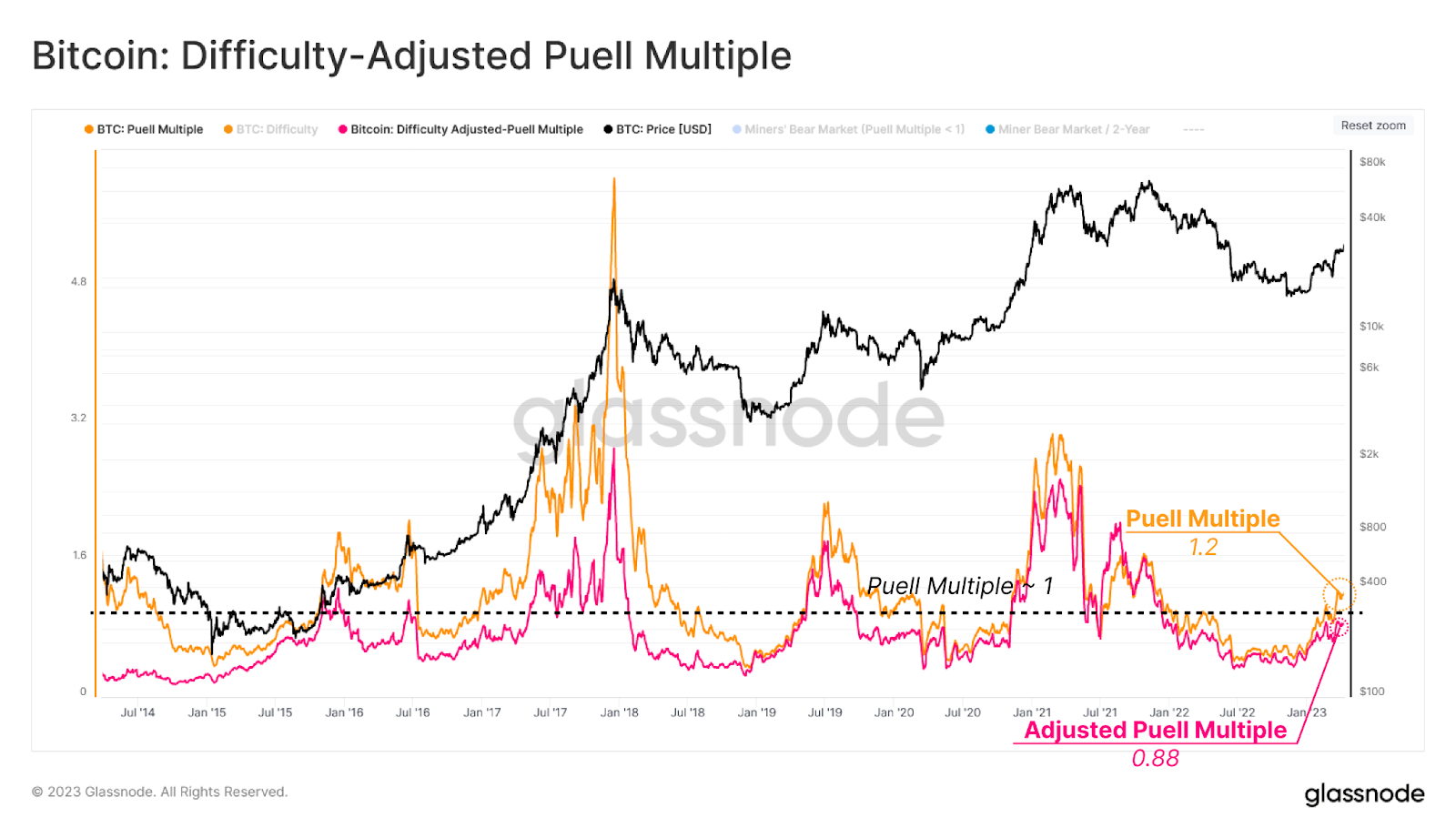

The difficulty-adjusted Puell multiple, a metric that measures miners’ profitability while considering the difficulty of mining Bitcoin, currently stands at 0.88.

A value below 1 indicates that miners still need to be profitable, which could affect the asset’s price.

In addition to on-chain metrics and technical indicators, the sentiment among traders plays a vital role in bitcoin’s price rally.

Some experts note that the recent run-up to $30,000 lacks the “crypto mania” seen in previous bull runs, suggesting that a potential correction could be on the horizon.

With 700k wallets snapping up 390k BTC at a bargain ($29,330-$30,200), we’ve got a rock-solid support level to watch. Conversely, 770k wallets loaded on 360K BTC ($30,270-$32,200), signaling a tough resistance zone.

Meanwhile, the recent upswing in the fees-to-rewards ratio signals the onset of a new accumulation cycle in the bitcoin market, reminiscent of the patterns observed in 2019 and 2020.

This development hints at a possible price surge in anticipation of the 2024 Bitcoin halving, setting the stage for a potentially fiery market performance.

Amid this, CoinCodex expects BTC to maintain its bullish momentum and reach $32,729 by May 14, implying a 10% upside from current price levels.

The road ahead

In conclusion, as cryptocurrency continues to evolve rapidly, all eyes are on the forthcoming bitcoin halving event in 2024.

The current market indicators, such as the fees-to-rewards ratio, suggest a new accumulation cycle is underway, mirroring the patterns seen in previous years.