Bitcoin’s price has been regaining momentum after a recent weeks of decline, climbing back above $85,000. This marks a 2.7% increase in the past week, slowly recovering from previous losses.

While the broader market remains cautious, investors appear to now be closely monitoring whether BTC can sustain its upward trend or if further corrections are on the horizon.

Bitcoin Bullish Indicators Emerges

Amid the ongoing Bitcoin price movement, CryptoQuant analyst Crypto Dan has provided insights into the current market structure. In a recent post titled “Past Bull Cycle vs. Current Market”, Dan examined the similarities between previous market cycles and the present conditions.

He highlighted that while bear market phases often feel like prolonged downturns, they also present key accumulation opportunities. Dan explained that in past market cycles, significant stop-loss movements signaled major sell-offs, leading to prolonged bearish sentiment.

However, in the current cycle, such massive liquidations have not occurred, and Bitcoin’s recent drop remains within the standard 30% correction range. He noted that while some fear the onset of a bear market, broader macroeconomic trends suggest that the bull cycle is still intact.

“과거 상승사이클과 현재 시장”

암호화폐 시장의 하락사이클에서는 첫번째 지표처럼 엄청난 크기의 손절의 움직임이 여러번 나옵니다.

누가봐도 하락사이클로 인식이 되고 시장이 망했다는 생각이 들 정도가 됩니다. 그리고 그 최악의 구간은 약 1년간 지속됩니다. 하지만 그 최악의 구간에서… pic.twitter.com/eQvd7yA2rn

— Crypto Dan (@DanCoinInvestor) March 20, 2025

The analyst further pointed out that short-term uncertainties, such as geopolitical tensions and trade disputes, may be influencing market sentiment. However, once these factors subside, the market could see a strong rally. The analyst noted:

Uncertainty in the market is an unavoidable element that will always accompany the investment landscape. Therefore, we analyze and respond to the market while managing risk.

Exchange Outflows Indicate Re-Accumulation

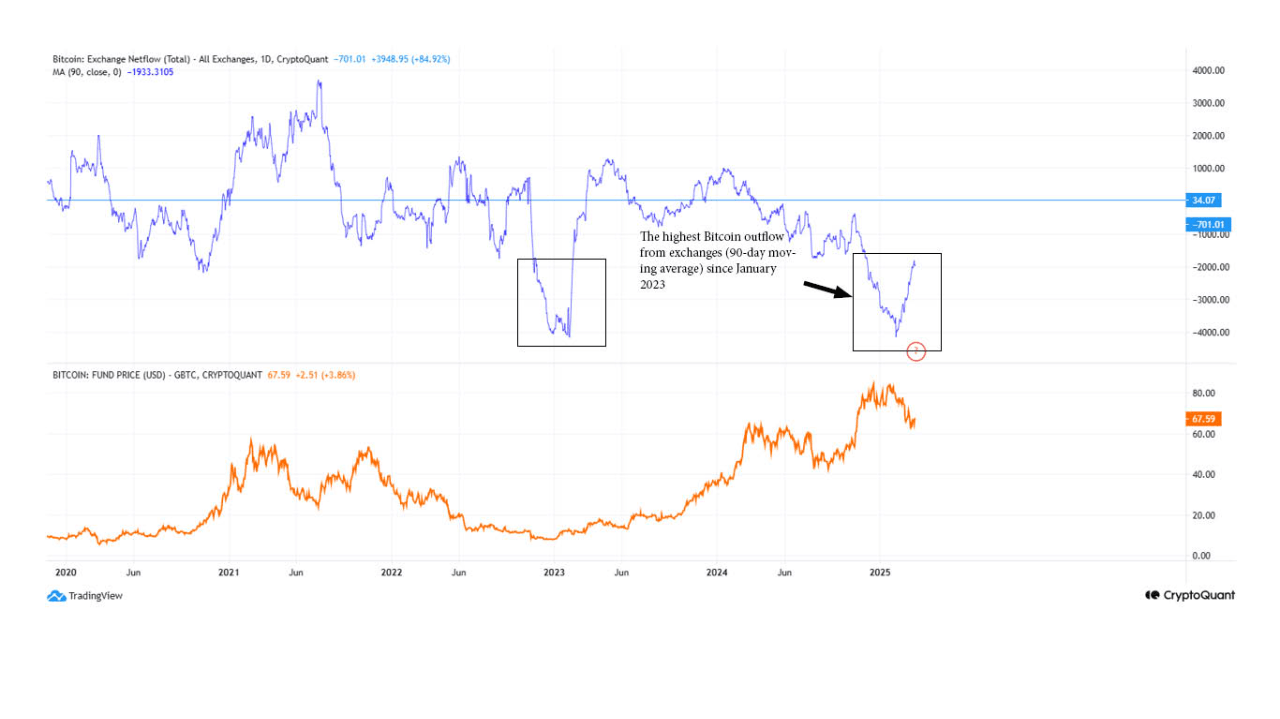

Another CryptoQuant analyst, CryptoOnCain, provided additional insight by highlighting Bitcoin’s highest exchange outflow on a 90-day moving average since January 2023.

This data suggests that Bitcoin is being withdrawn from exchanges at a rapid pace, a sign that investors could be accumulating BTC rather than preparing to sell. Historically, such significant outflows have preceded bullish moves, as reduced exchange supply tends to create upward pressure on price.

The analyst noted that a similar pattern was observed in early 2023 when Bitcoin hit its lowest price in that cycle before rallying. If this trend continues, it could indicate a shift toward stronger market confidence in BTC’s long-term potential.

Featured image created with DALL-E, Chart from TradingView