Ether may be about to shine after underperforming against the wider crypto market this year, according to a new report by Steno Research. ETH has gained around 8% this year, compared with BTC’s 40%. However, ether’s performance during the last bull market could provide some clues as to what to expect now. ETH surged thanks to greater onchain activity from DeFi, stablecoin issuance and NFTs. The Federal Reserve interest-rate cut earlier this week will result in increased onchain activity, which will strongly benefit Ethereum, Steno said. “Ethereum’s active addresses remain strong, particularly when factoring in the growing adoption of rollups,” analyst Mads Eberhardt wrote, adding that the network’s transactional revenue looks to have bottomed in August.

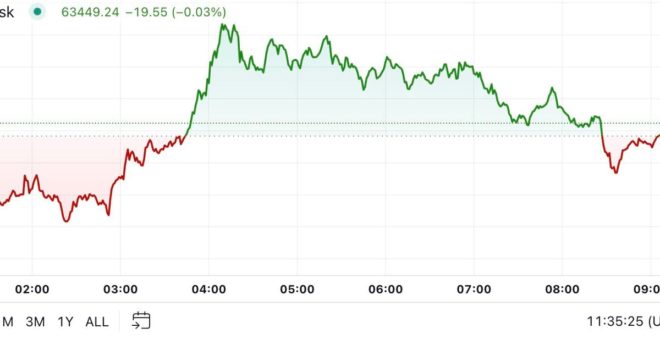

Bitcoin Tests $64K as BoJ Pauses Rate Hikes