Bitcoin (BTC) stayed steady at $39,000 into March 14’s Wall Street close as stocks took the opportunity to reclaim some losses.

Bulls need “miracle” $40,600 reclaim

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD unmoved at the opening bell on March 14.

The pair had rebounded from a last-minute comedown into March 13’s weekly close to avoid a deeper retracement.

The week was set to bring many potential challenges for bulls, however, beginning with a European vote on outlawing proof-of-work algorithm cryptocurrencies March 14.

March 13, however, was the main focus, this being the day that the United States Federal Reserve was due to announce a key interest rate hike of a rumored 25 basis points.

Geopolitical tensions surrounding Russia’s invasion of Ukraine, along with a resurgence of COVID-19 in China, meanwhile, added to the list of hurdles.

Traders were thus lackluster on the immediate prospects, given what the market had to navigate. For Crypto Ed, the 0.618 Fibonacci level at around $40,400 was to form a local top before a deeper retracement took hold.

Only a “miracle” reclaim of $40,600, he said, could produce a bullish outcome.

#BTC

Looking for a retrace to the .618fib which lines up with taking out latest top (stop hunt)

Pic 1: take out the low TF range high

Pic 2: lines up with my S/R at 40.6kGoing short when sweep of the highs in a SFP.

Long when a miracle happens and clear reclaim of $40.6k pic.twitter.com/Ic3uNTxGGH— Ed_NL (@Crypto_Ed_NL) March 14, 2022

Fellow trader and analyst Anbessa meanwhile highlighted a cut-off point of $37,600 for bulls to defend.

On live order book charts, on-chain monitoring resource Materail Indicators further flagged increased sell pressure appearing at $40,000 on March 14.

“New BTC/USDT ask liquidity that just appeared seems to be trying to push [the] price down to the ladder of bids below. Expecting it to get pulled if bids gets filled,” the account commented on a chart showing the changes on the Binance order book.

Bloomberg analyst: Bitcoin “cold” against oil

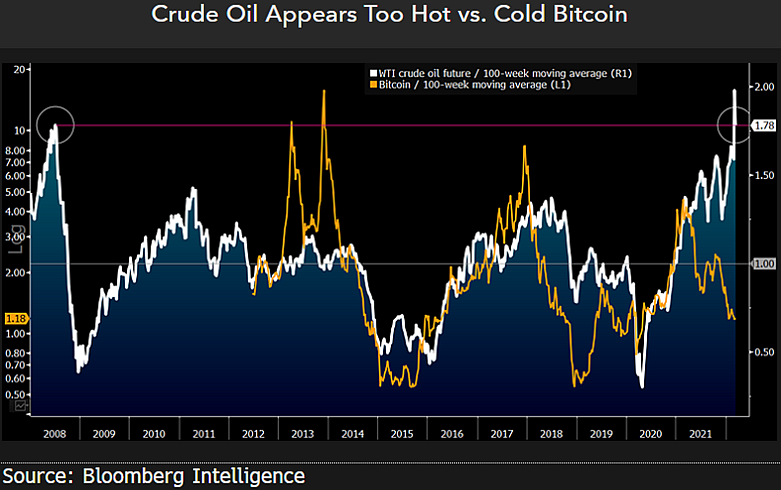

Turning to longer timeframes, Bloomberg Intelligence chief strategist Mike McGlone doubled down on his opinion that Bitcoin would ultimately emerge stronger from the current turbulence.

Related: Two years since the COVID-19 crash: 5 things to know in Bitcoin this week

Bitcoin, he noted on the day, was defying an “ebbing tide” in risk asset demand by protecting most of its support.

“The fact that one of the best performing and most volatile assets since the financial crisis — Bitcoin — is showing relative buoyancy in an ebbing tide for risk assets in 1Q may portend the crypto’s maturation toward digital collateral, in a world going that way,” he argued alongside a chart comparing WTI oil to BTC.

Commodities remained the hottest movers as the week began while oil futures nonetheless began to cool.