Bitcoin whales seem bullish with increased accumulation as the release of the U.S. Consumer Price Index data gets closer.

According to data provided by IntoTheBlock, the number of whale transactions consisting of at least $100,000 worth of Bitcoin (BTC) surged from 12,560 to 16,240 between Sept. 7 and 9.

The increased whale activity around BTC came after its price plunged below the $54,000 mark amid an increased selloff.

Per ITB data, Bitcoin whales have moved over $70 billion worth of the asset in the past seven days.

It’s important to note that increased whale activity could usually lead to high price fluctuations, but in this case, large holders seem to be accumulating Bitcoin due to increased inflows.

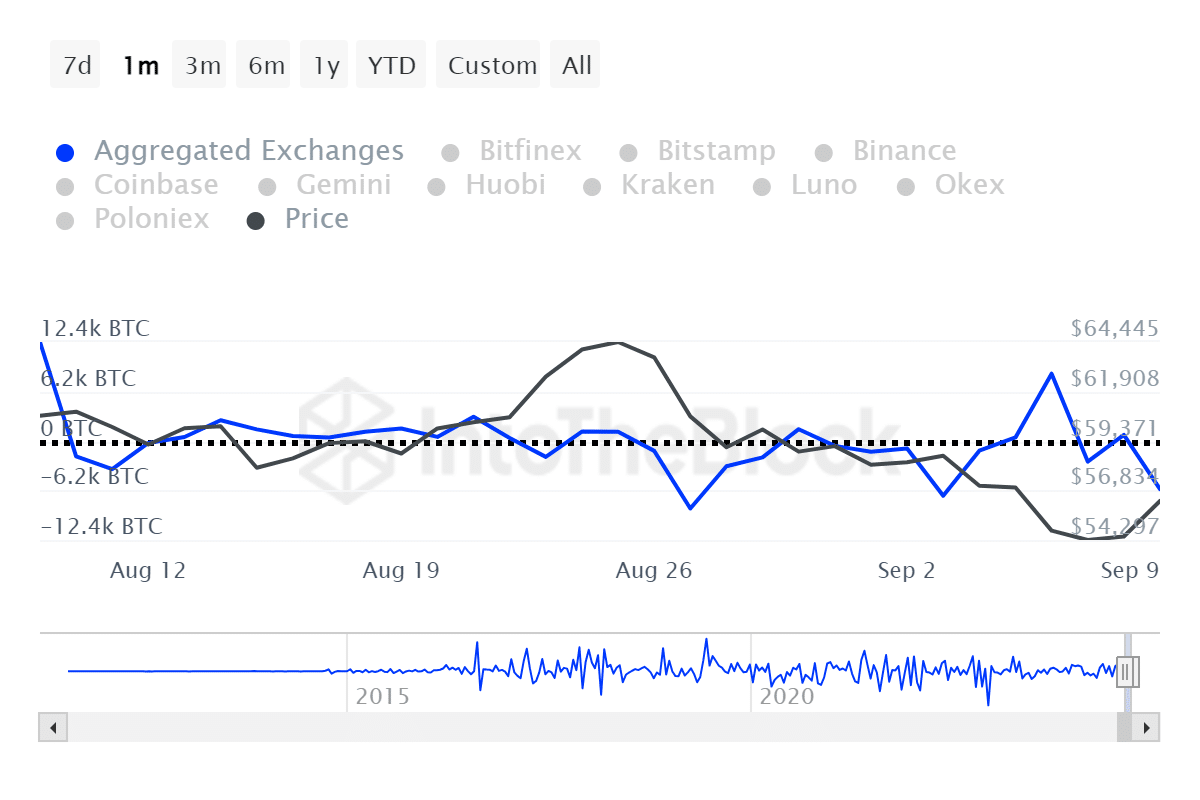

The large holders’ inflow plunged from 11,570 to 1,100 BTC on Sept. 7 and declined even further to 469 BTC a day later, suggesting a massive selloff, according to data from ITB. However, the Bitcoin whale inflow recorded a notable increase to 1,580 BTC on Sept. 9.

The indicator shows that the whale selloff might have come to an end.

Not only whales, but also retail holders seem to be accumulating Bitcoin. According to ITB, Bitcoin saw an exchange net outflow of over 6,000 BTC yesterday.

Bitcoin is now up 3.5% and is trading at $56,950. The flagship cryptocurrency briefly touched a local high of $58,000 earlier today and has been consolidating close to the $57,000 zone.

At this point, investors are looking bullish as the U.S. CPI data, which shows the inflation rate in the country, is expected to come at 2.6%.

If the inflation rate for August comes at or lower than the expected percentage, economists believe a 50 basis point interest rate cut would be most likely this week.

The rate cut could, consequently, form a bullish momentum for financial markets such as crypto and stocks.