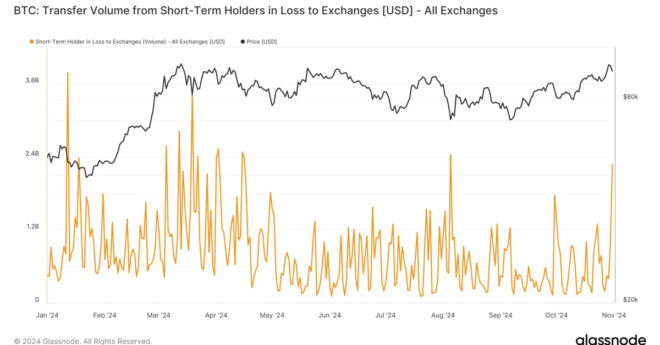

The panic selling was the most since Aug. 5’s yen carry trade unwind. Short-term holders — investors who have held bitcoin for less than 155 days — tend to panic and sell when the price drops, and buy when there is euphoria or greed in the market. In total, they sent over 54,000 BTC to exchanges on Thursday, the highest amount since Mar. 27.

Bitcoin’s Drop on Thursday Spurred Short-Term Holders to Sell BTC at a Loss: Van Straten