- The total crypto market cap is down over 13% in the past 24 hours

- Bitcoin fell as low as $26,000 for the first time since December 2020

- Tether slightly depegged amid the ongoing market crash and UST debacle

- Over $300 Billion was wiped out from the crypto market over the past two days alone

The massive slump in the cryptocurrency market continued on Thursday as the leading digital token by trading volume Bitcoin dipped below $28,500.

Data from the daily charts on TradingView also showed that BTC touched a 2-year low after falling to around $26,700 for the first time since December 2022. Over the past 24 hours, the top coin is down more than 9% and currently trades around $28,200.

Historically, the market cap of a crypto token moves in correlation with significant changes in the coin’s price. The same fundamental theory proved true this week as BTC’s market capitalization fell to just over half a billion.

According to data from technical analysis, the leading coin lost more than $400 billion in market cap from its 2022 high of $910 billion back in March.

As EthereumWorldNews previously reported, Dylan LeClair, Head of Market Research at Bitcoin Magazine, said BTC could go as low as $24,700. LeClair cited average on-chain cost basis and bear market cycle patterns in his analysis thread on May 9, 2022.

Over $1 Billion in Liquidations As Bitcoin Bleeds

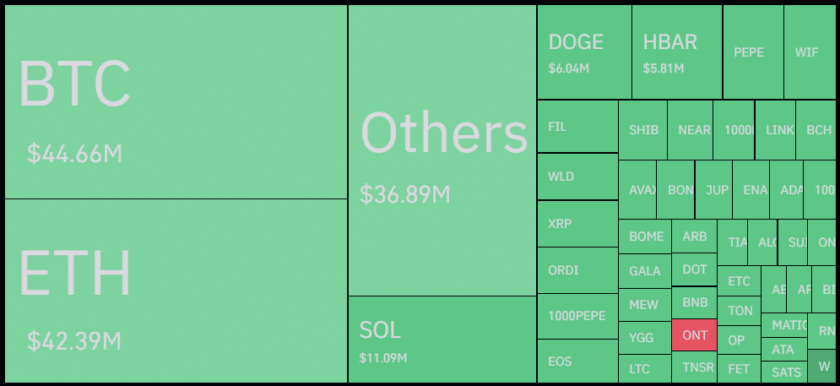

More than 305,000 traders lost their long positions as the market crash continues. According to CoinGlass, liquidation calls amounted to more than $1.2 billion on Thursday. Also, BTC, ETH, and LUNA accounted for the top three liquidated tokens.

Tether’s USDT Depeggs Slightly Amid UST Stablecoin Crash

USDT, the largest stablecoin in the world issued by Tether, depegged in the early hours of Thursday. However, the deviation from its $1 peg was minimal and the stablecoin only fell a few a cents to around $0.98.

The slight depeg supposedly caught attention given the huge dip in UST prices over the past few days.

Unlike algorithmic stablecoin such as UST, USDT is backed by a fiat reserve that boasts $1 for every USDT in circulation, per comments from Tether officials.