“Arguments have been made that ETFs, as well as bitcoin exchanges, ignore what some believe is the single most important feature of bitcoin, the ability to control their funds without the need to place trust in a third-party to manage the asset,” said Jim Iourio, managing director of TJM Institutional Services and a veteran futures and options trader. “This flies in the face of Bitcoin’s entire point of existence.”

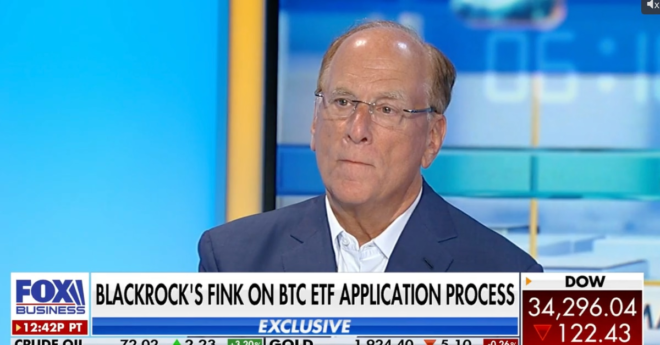

BlackRock CEO Larry Fink’s Turnabout on Bitcoin $BTC Elicits Cheers, Skepticism of Crypto Cred