After rumors surfaced suggesting that BlackRock, the largest asset management firm, is poised to acquire Voyager Digital, crypto.news confirmed that the deal was fabricated.

When crypto.news reached out to BlackRock to confirm the veracity of the alleged buyout, Carolyn Vadino, the firm’s managing director of corporate communication, categorically confirmed that the press release was false.

According to Chinese crypto reporter Colin Wu, these rumors propagated as ‘news’ were likely intended to artificially inflate Voyager’s native token (VGX), a tactic known as ‘pumping.’

This misinformation was published as paid content on the reputable Associated Press (AP) website, emphasizing the far-reaching implications of such deceptive practices.

Wu traced the origin of the misleading press release to a Chinese social media account with a solitary follower, further highlighting the dubious nature of these claims.

The news story elaborated that BlackRock had concluded its preliminary due diligence on Voyager Digital, a platform already reeling under bankruptcy proceedings. It went on to state that negotiations were underway regarding the purchase of assets and shares from the bankrupt firm and that both parties had reached a tentative agreement for the acquisition.

Voyager boost

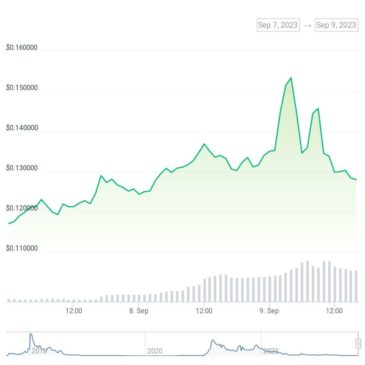

In the wake of the false report, Voyager Digital’s token, VGX, saw an 8% increase within a 24-hour time frame, showcasing the influence of fake news on the cryptocurrency markets.

At the time of going to press, VGX had lost 2.8% of its value. However, it was still 17.7% higher over seven days, and 18% over two weeks, per data from CoinGecko.

BlackRock, which oversees $9.4 trillion in assets, has made no secret of its growing interest in crypto. The firm recently applied to the U.S. Securities and Exchange Commission (SEC) for a Bitcoin (BTC) exchange-traded fund (ETF). However, the SEC has delayed its decision on the application until Oct. 17, alongside those of Wisdom Tree, Bitwise, Invesco, Ark Invest and VanEck.