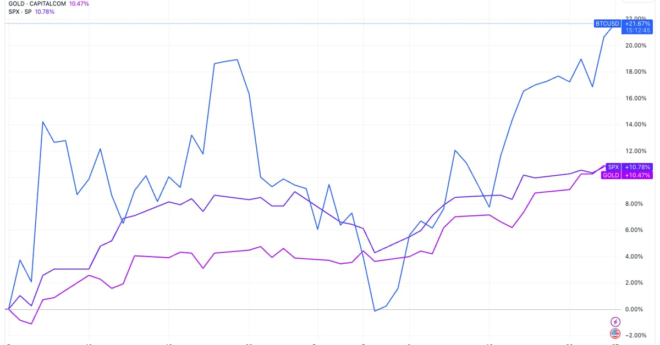

Second, bitcoin’s high volatility can be perceived as a “risky” asset, which contributes to the discussion that whether it is a “risk-on” or “risk-off” asset. The token could be considered a flight-to-safety option because it is scarce, non-sovereign, and decentralized. Lastly, BlackRock pointed out that the long-term adoption of bitcoin may come from global instability.

BlackRock Highlights Bitcoin’s Risk-Off Status in the Long Term