Summary:

- Crypto exchange BitMex alerted users to an unscheduled trading engine downtime on Wednesday.

- The platform said trading facilities were suspended due to technical issues and assured users that all funds and assets are safe.

- Today’s downtime comes amid a rally in crypto prices and massive short liquidation events across Bitcoin, Ether, and other virtual currencies.

On Wednesday, cryptocurrency exchange Bitmex informed users of suspended trading on the platform due to technical issues. Bitmex assured users that “all funds are safe” regardless of the unscheduled trading engine downtime.

According to the update, trading halted on the platform around 14:51 UTC.

Crypto Sentiment Green Alongside Bitcoin Rally And BitMex Pause

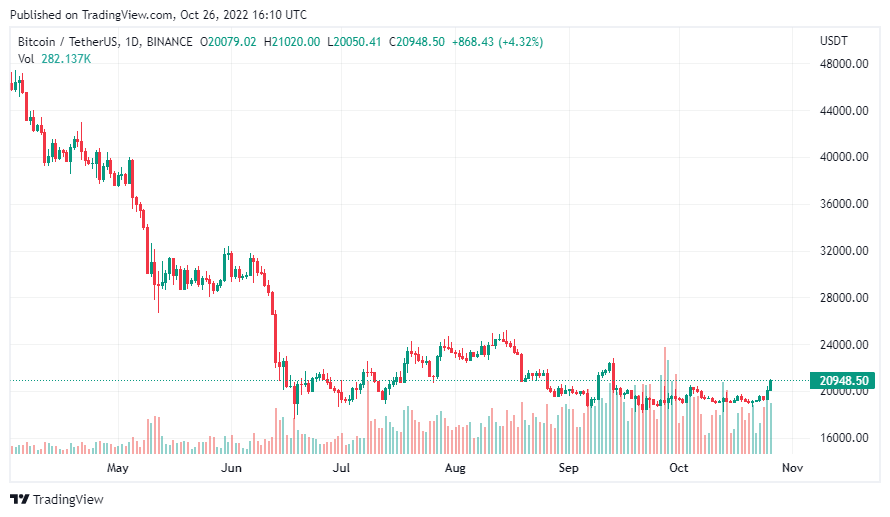

Today’s BitMex trading engine downtime comes amid a rally in the crypto market. Bitcoin (BTC) broke above $21,000 per data from TradingView. Altcoin leader Ethereum recorded double-digit gains as the broader crypto market experienced relief.

Wednesday’s rally also preceded record short liquidation events across major exchanges. Coinglass data reported over $1.4 billion in liquidations and 87% of the positions wiped out were short traders.

$700 million in liquidation happened on FTX, setting a new record for the crypto exchange for the biggest liquidation event in a single day.

Amid seemingly positive sentiment in the market, crypto users on Twitter noted that BitMex pausing its trading engine might hold some significance. One user said that the last time the exchange published this alert, Bitcoin nearly doubled in value.

However, pseudonymous BTC technical analyst Pentoshi surmised that today’s pump could be another bear market rally fueled by hopium that the feds might ease off the gas on their interest rate hike strategy.

Speculations broke out that the federal reserve could follow the Bank of Canada and explore less aggressive monetary policies as world governments battle rising inflation.