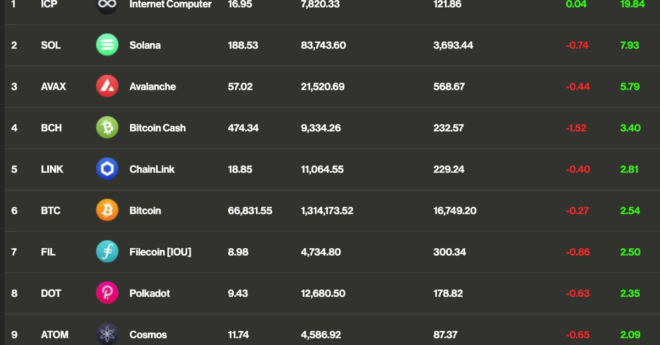

The crypto market began the week in the green as traders cheered BlackRock’s foray into asset tokenization and the beginning of the global central bank easing cycle. Bitcoin (BTC), the world’s largest digital asset, traded at $67,000, up 3% on a 24-hour basis, and ether traded 2.3% higher above $3,400. The CoinDesk 20 (CD20), a measure of the most liquid cryptocurrencies, was up around 3.2% at press time. Bradley Park, an analyst at CryptoQuant, attributes the gains to the market digesting BlackRock’s fund targeting tokenized products (BUIDL) on Ethereum. Other tokens gaining on Monday were Internet Computer (ICP), which added 20%, Ondo Finance’s ONDO, rising 15%, and Near protocol (NEAR), also about 15% higher over 24 hours.

BTC, ETH Back in the Green