Key points:

-

Mixed results for US jobless claims fail to dent risk-asset enthusiasm.

-

Despite concerns over the bond market, Bitcoin and stocks enjoy stability at the start of the Wall Street trading session.

-

BTC price expectations remain lofty amid low volatility and a curious lack of profit-taking.

Bitcoin (BTC) focused on $111,000 around the May 22 Wall Street open as record highs met mixed US unemployment data.

Bitcoin, stocks brush off jobs uncertainty

Data from Cointelegraph Markets Pro and TradingView showed BTC price volatility cooling in line with stocks.

The latest US macroeconomic data painted a conflicting picture of labor market resilience to inflation trends.

Initial jobless claims came in below expectations at 227,000, while continuing claims exceeded their target by 13,000.

Far from a wary reaction, however, risk assets maintained prior levels, leading analysis to bullish conclusions over market sentiment.

“Initial Jobless Claims came in cooler than expected. Continuing Claims came in hotter than expected,” Blacknox, cofounders of trading resource Material Indicators, reacted on X.

“BTC is in price discovery, and the market wants to celebrate the good news and ignore the bad news.”

Fellow co-founder Keith Alan described the jobless numbers as “a bit more fuel for BTC momentum.”

“Keep watching Bitcoin and Gold,” trading resource The Kobeissi Letter continued.

Kobessi added that it expected some form of government intervention in the bond market after stocks’ volatility kicked in the day prior.

On today’s episode of the bond market:

The US 30Y Bond yield just hit 5.15% for the first time since October 2023.

Other than October 2023, 30Y Yields have not been this high since July 2007.

We expect attempted intervention by Trump and Bessent as the Fed refuses to cut… https://t.co/GUptlBLyCK pic.twitter.com/0DONKceum6

— The Kobeissi Letter (@KobeissiLetter) May 22, 2025

Bitcoin due “bigger move” amid low profit-taking

Comparing the latest all-time highs to previous cycles, meanwhile, Bitcoin market participants revealed surprising behavior.

Related: Bitcoin ‘looks exhausted’ as next bear market yields $69K target

Volatility and mass profit-taking, they noted, were both conspicuously lacking at $111,000.

“Can’t recall a time in history where $BTC just casually traded around in a 1% range at all time highs,” popular trader Daan Crypto Trades told X followers.

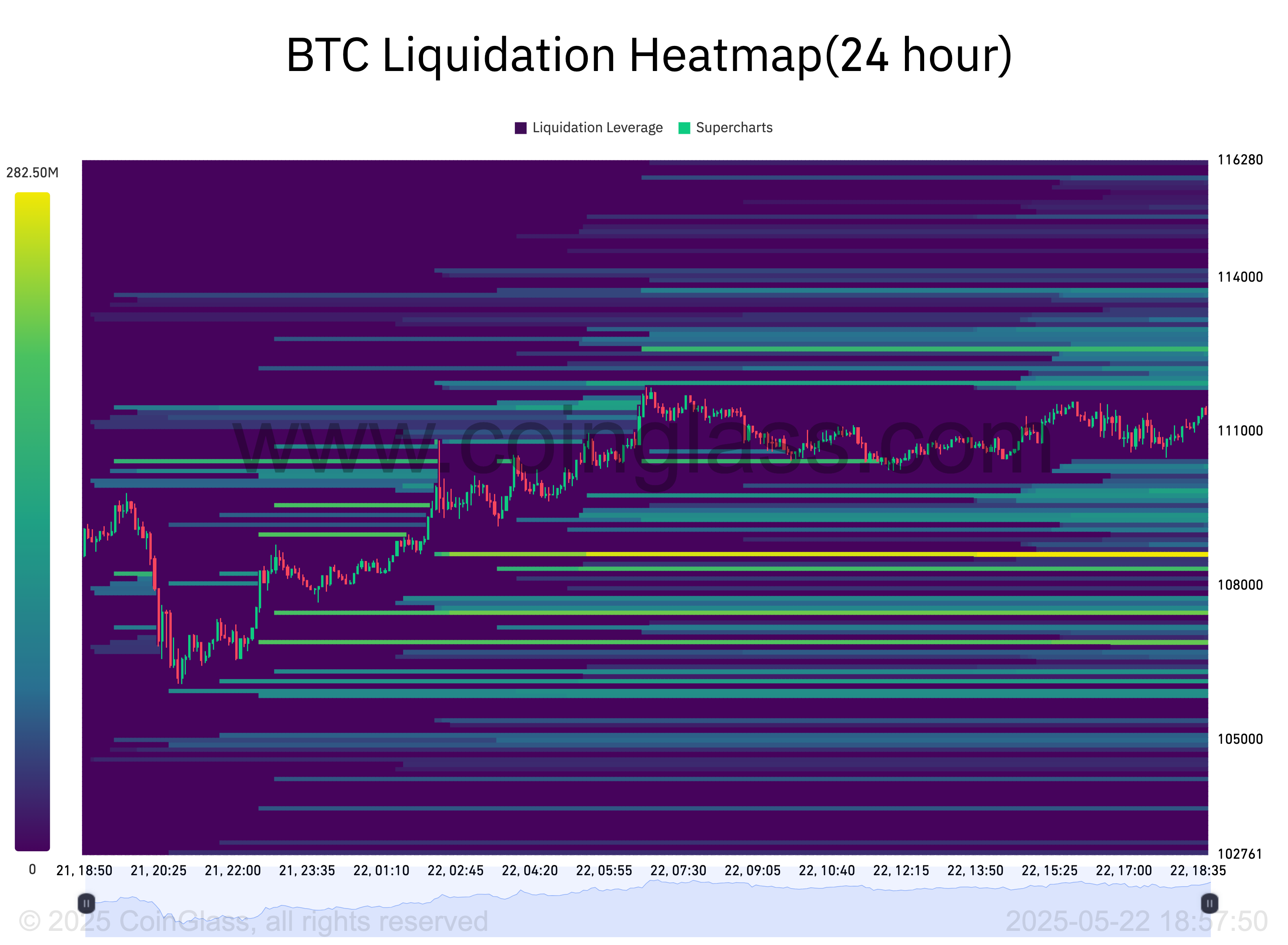

“Bigger move following once it breaks this local tiny range. Quite a lot of positions being build up on both sides.”

Order book liquidity data from monitoring resource CoinGlass thickening bids and asks around spot price.

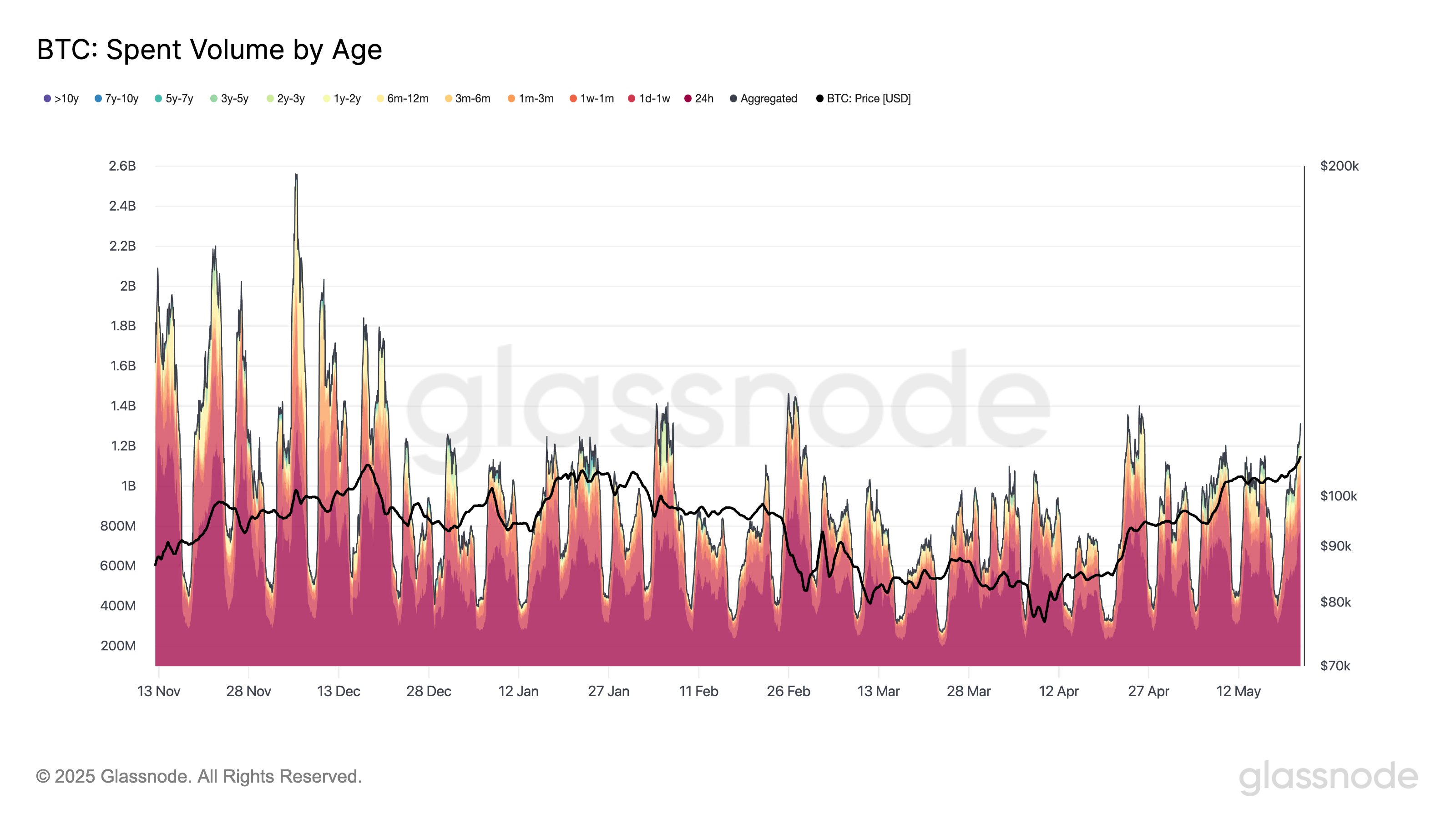

Elsewhere, onchain analytics platform Glassnode flagged steadfast resolve among hodlers despite 100% supply profitability.

“When $BTC hit all-time high yesterday, total profit-taking volume was around $1.00B – less than half the amount realized when Bitcoin first crossed $100K last December, which hit $2.10B,” it noted on the day.

“Despite a higher price, profit realization was far more muted.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.