Bitcoin (BTC) starts the second week of August with barely a sound as rangebound BTC price behavior continues.

After one of its least volatile weekly closes, BTC/USD remains stuck at $29,000 — but can the coming seven days provide what is needed to break the deadlock?

Headlining the list of potential volatility catalysts is United States inflation data in the form of the Consumer Price Index (CPI) — a key readout on the way to the next interest rate decision in September.

However, with Bitcoin famously stubborn this quarter, it may take more than that to rediscover a trend.

Elsewhere, on-chain data is pointing to an accumulation phase for whales and other larger investors. Network fundamentals are due to inch higher, while the number of new wallets is defying price action and continuing to grow.

Cointelegraph takes a look at the main topics of interest to keep in mind this week when it comes to BTC price action.

Bitcoin price predictions trend lower after silent weekly close

Bitcoin closed the week without a sound, keeping its narrow trading range firmly in place and offering nothing by way of last-minute surprises.

Data shows BTC/USD acting in a $200 corridor overnight — a status quo still in play at the time of writing.

For popular traders, this risks lower levels entering next, as bulls lack the momentum to beat out selling pressure below the key resistance levels of $29,250, $29,500 and $30,000.

“BTC continues to reject at ~$29250. As long as that continues, bias favours to lower prices,” trader and analyst Rekt Capital summarized.

Eyeing a possible support zone immediately below spot price, fellow trader Credible Crypto argued that volatility could pick up simply as a result of the working week returning.

“In any case, want to see some strength here soon or else we might still have one more local low to go (which would be fine),” he told Twitter followers in part of recent analysis.

A pretty muted reaction off of our green zone thus far, but it’s also a weekend so might see some strength once the week starts.

In any case, want to see some strength here soon or else we might still have one more local low to go (which would be fine). $BTC https://t.co/Lm4lqxqUFZ pic.twitter.com/3kQ38dbjnb

— CrediBULL Crypto (@CredibleCrypto) August 7, 2023

Continuing, Michaël van de Poppe, founder and CEO of trading firm Eight, suggested that Monday could provide a local low for Bitcoin to act upon through the week.

“Monday coming up, usually a day that Bitcoin makes it’s standard drop. In that case, targeting $28K to bid,” he said.

“If we do not drop to that region, then I clearly want to see a break above $29.7K to add on my longs.”

Querying the return of BTC volatility

Overall, however, Bitcoin is suffering from a clear case of suppressed volume, leading volatility to head back to its lowest-ever levels.

On weekly timeframes, popular trader Skew noted, volume was all but absent. An accompanying volume profile chart showed the background behind Bitcoin’s current multi-month trading range between $26,000 and $32,000.

$BTC 1W Volume Profile (range Nov 2020 – Current)

Pretty useful when it comes to key levels / market inflection pointsKey points for volume profile:

HVN – High Volume Node

LVN – Low Volume Node

POC – Point of control

VA – Value AreaJust used the total volume profile here so… pic.twitter.com/49mKz4rV9h

— Skew Δ (@52kskew) August 7, 2023

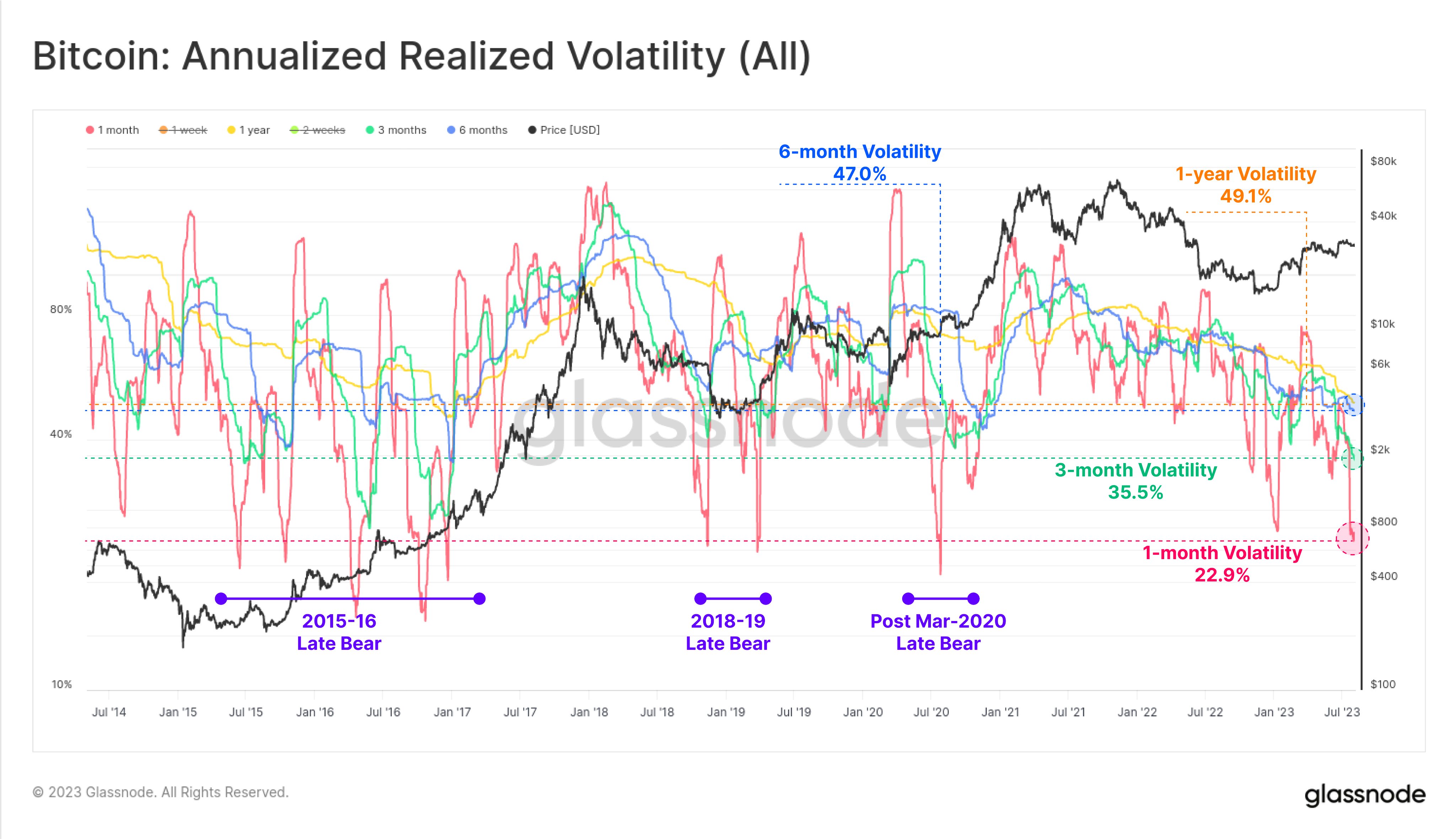

“Realized volatility for Bitcoin has collapsed to historical lows,” Checkmate, lead on-chain analyst at Glassnode, continued at the weekend.

Uploading a chart of Bitcoin’s annualized realized volatility, Checkmate revealed that such flat behavior was last seen over three years ago in the months after the March 2020 COVID-19 cross-market crash.

“Across 1-month to 1yr timeframes, this is the quietest we have seen the corn since after March 2020,” he added.

“Historically, such low volatility aligns with the post-bear-market hangover periods (re-accumulation phase).”

“Reaccumulation” becomes Bitcoin buzzword

The term “reaccumulation” is one appearing frequently in current market conditions.

As Cointelegraph reported, attention is on Bitcoin whales in particular, as these slowly maneuver into what could be the next run to all-time highs.

Reaccumulation has characterized the landscape after every BTC price cycle bear market, and analysts are hoping that this time is no different.

“Retail sold this last bear market, whales didn’t flinch,” popular technical analyst CryptoCon argued last week.

“The wind is at our backs this cycle, this is big.”

With whales holding back from selling compared to previous bear markets, while still entering reaccumulation, the bullish case for what comes next is strengthening.

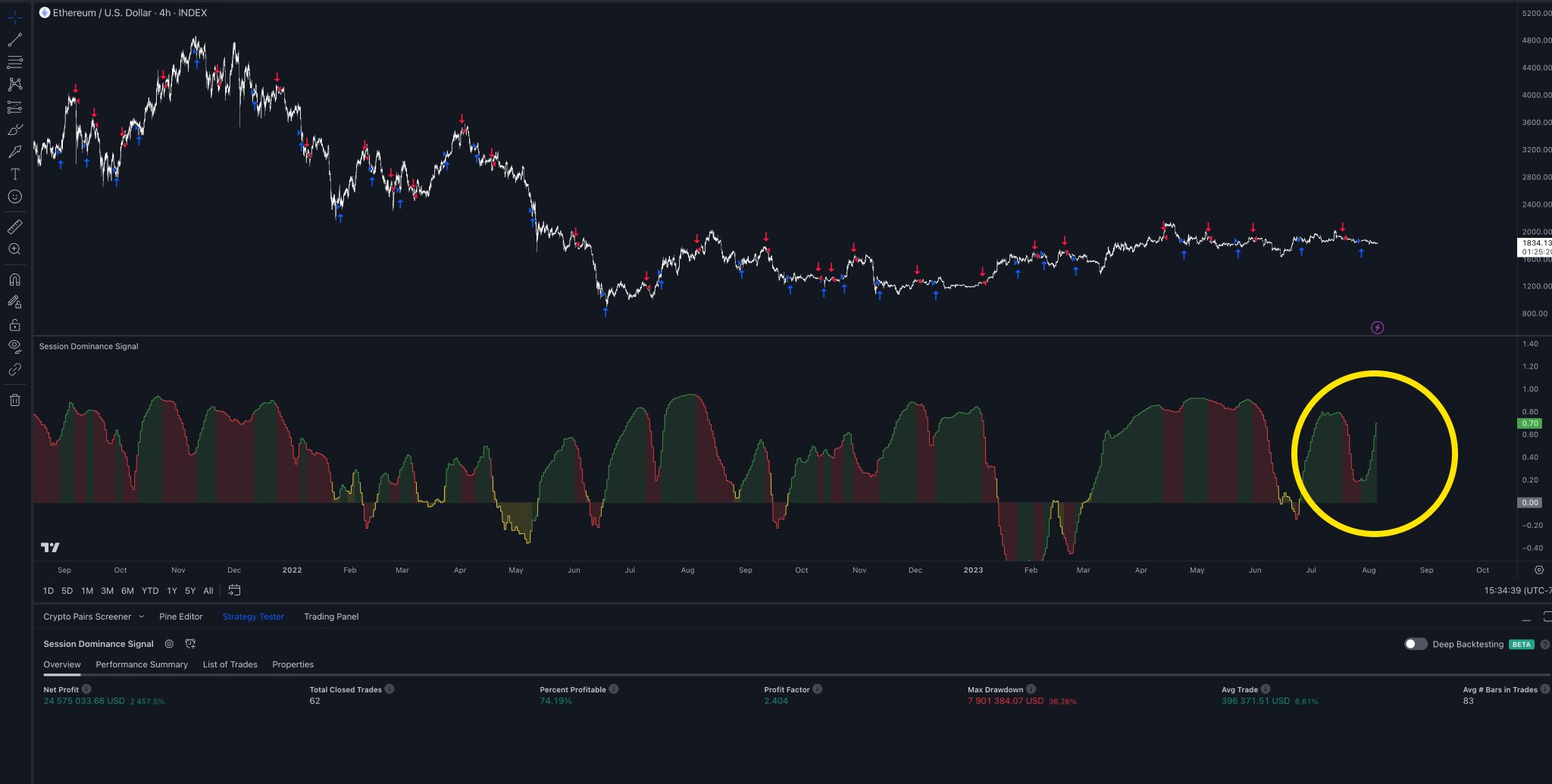

It is not just whales — day traders are giving market cyclist Cole Garner cause for optimism as well.

Asian buyers continue to dominate the day-to-day trading landscape, and this is just as important an indicator that BTC price upside lies ahead, not behind the market.

“When buyers dominate the Asian session, BTC & ETH prices goes up. As a general trend, almost always,” he reasoned in part of a Twitter thread at the weekend.

“When Asia starts selling: usually near a local top.”

Garner described the Asian buying dynamic as “potent alpha nobody talks about.”

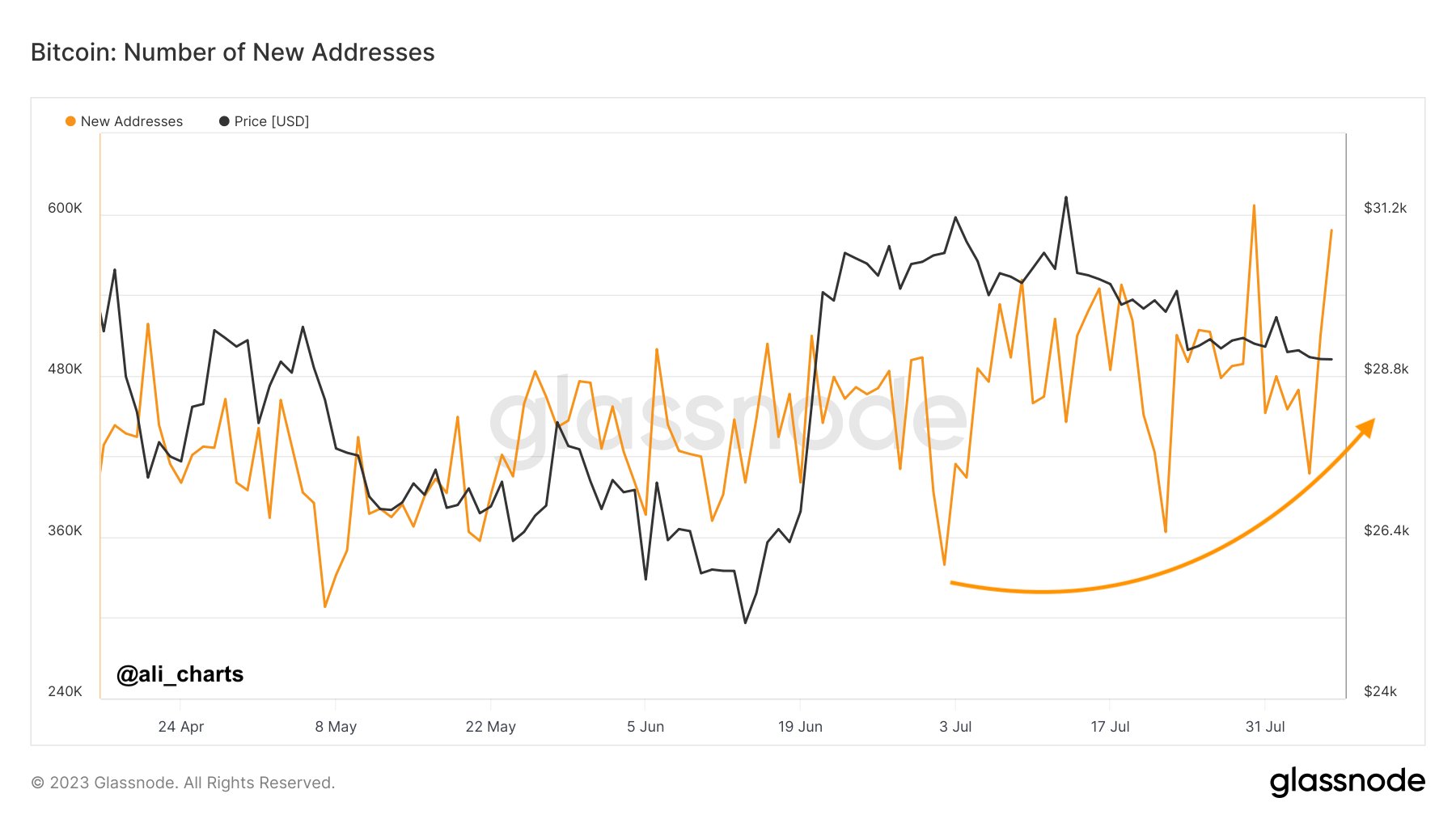

To add to the accumulation argument, Bitcoin wallet numbers have preserved their own uptrend despite BTC price returning below $30,000 after local highs.

“This bullish divergence between price and network growth hints at a stable long-term BTC uptrend,” popular analyst Ali responded alongside Glassnode data.

“Buy the dip!”

Fundamentals show signs of recovery

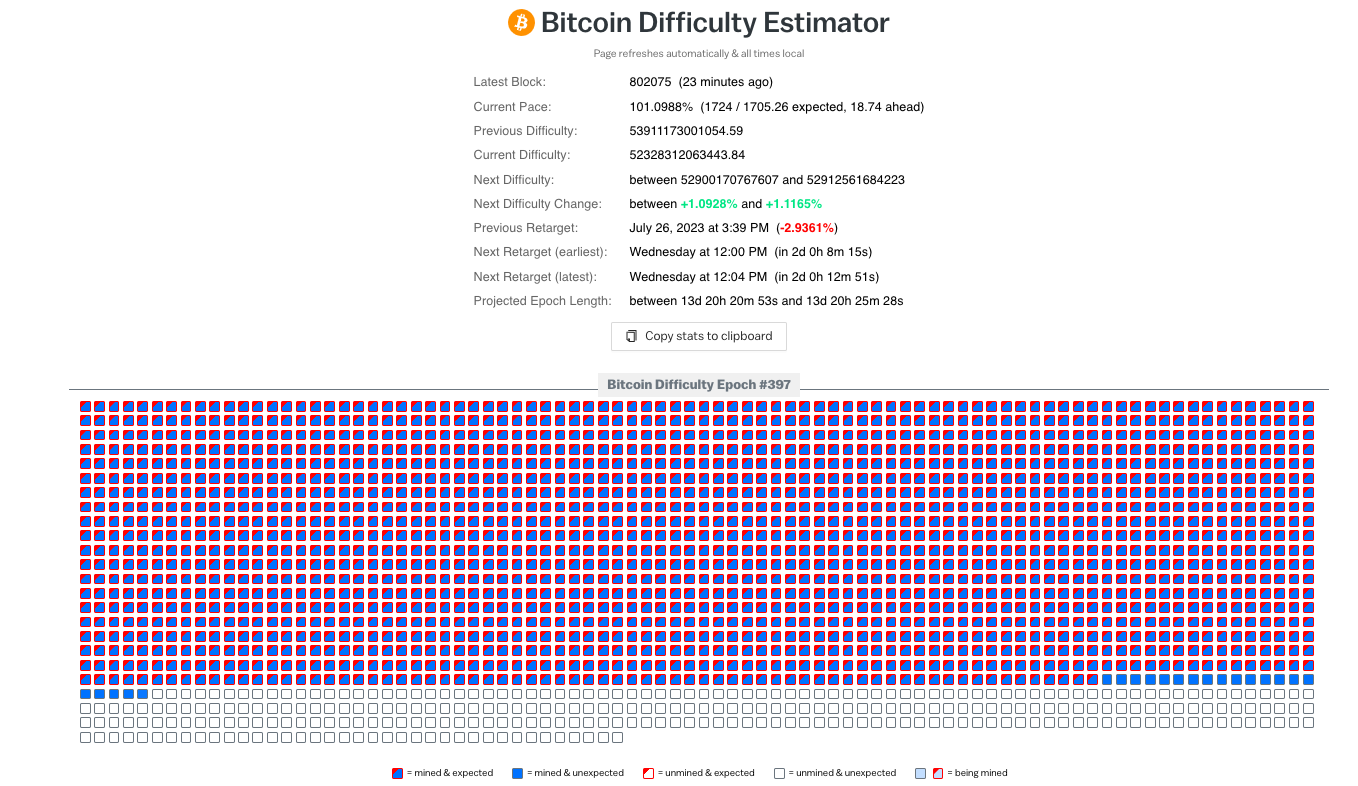

Bitcoin network fundamentals are in two minds this week, echoing a seriously indecisive market mood.

After dropping by just over 3% at its previous automated readjustment two weeks ago, Bitcoin network difficulty is due to recoup some of those losses.

According to estimates from Bitcoin education resource Bitrawr, difficulty should increase by around 1.2% to come within inches of new all-time highs.

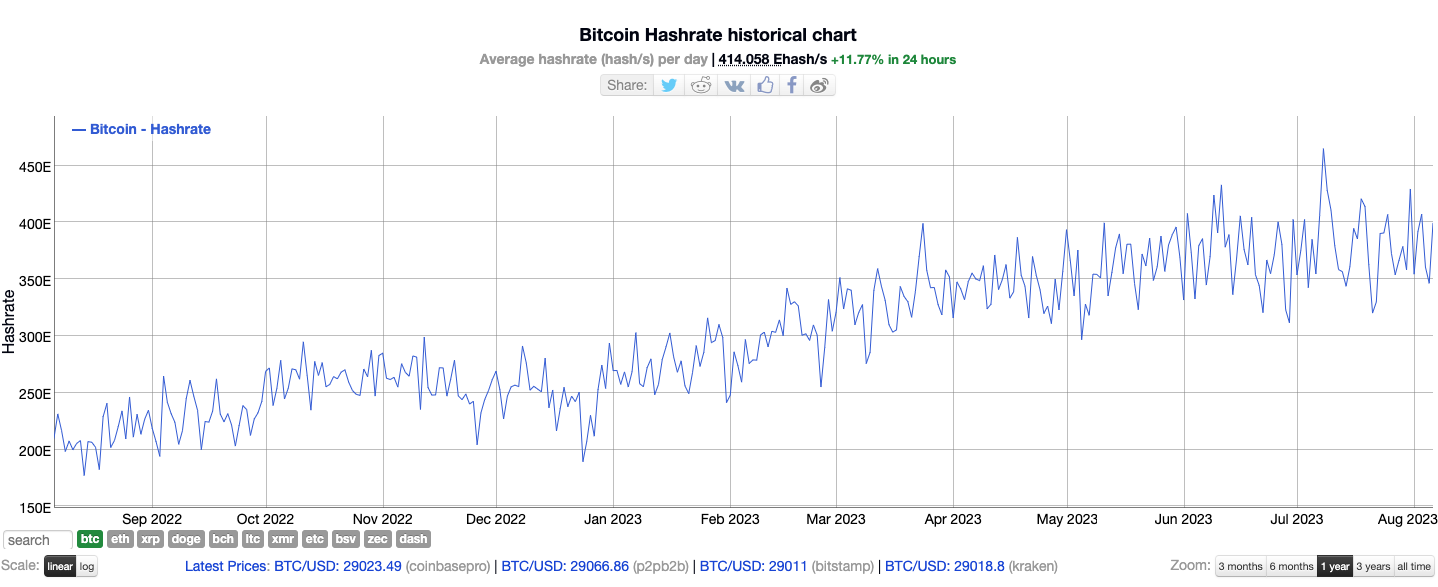

Turning to hash rate, a consolidation phase within a broader uptrend is what arguably characterizes the current setup.

Hash rate values vary considerably by estimate, but after recent all-time highs, spikes in activity have cooled in recent weeks.

CPI looms ahead of September Fed rate move

Outside Bitcoin, talk is all about the week’s key macro data release in the form of the U.S. CPI print for July.

Related: BTC price upside ‘yet to come’ at $29K after Bitcoin RSI reset — Trader

Coming as inflation indicators almost unanimously point downward, CPI is a classic volatility catalyst, making Aug. 10 a day full of potential trading opportunities.

“Inflation data this week should give more color as to what the Fed will do in September,” financial commentary resource The Kobeissi Letter forecast, ahead of what it called “another busy week.”

Other macro data due in the coming days includes the July Producer Price Index (PPI) print on Aug, 11, as well as S&P 500 firm earnings throughout the week.

Key Events This Week:

1. July CPI Inflation data – Thursday

2. Jobless Claims data – Thursday

3. July PPI Inflation data – Friday

4. Consumer Sentiment data – Friday

5. Total of 3 Fed members speak

6. ~15% of S&P 500 companies reporting earnings

Another busy week ahead.

— The Kobeissi Letter (@KobeissiLetter) August 6, 2023

While Bitcoin has shown increasingly muted reactions to CPI prints in recent months, zooming out, the picture for some market participants remains unequivocally tied to inflation.

“Amazing how if you shift Bitcoins price forward 9 months it literally tracks the rate of change in inflation exactly. It’s almost like it could see the future,” Steven Lubka, Managing Director and Head of Private Clients and Family Offices at Bitcoin investment firm Swan wrote in part of recent social media commentary.

‘#Bitcoin didn’t hedge inflation’

‘#Bitcoin had no relationship with CPI’Amazing how if you shift Bitcoins price forward 9 months it literally tracks the rate of change in inflation exactly

It’s almost like it could see the future pic.twitter.com/BfPyJH7jm6

— Steven Lubka (@DzambhalaHODL) July 30, 2023

Magazine: Experts want to give AI human ‘souls’ so they don’t kill us all

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.