Bitcoin (BTC) stayed on course for its highest weekly close in ten months on April 2 as $28,000 held.

BTC price analyst: “Massive” liquidations due at $30,000

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD stable over the weekend after closing out March at near $28,500.

A key point of resistance from earlier in its current halving cycle, the current trading zone represents a major hurdle for bulls to overcome. Should they manage it, price targets now extend beyond the $30,000 mark.

Not an expert on classical chart patterns but if we can fit the current structure in it, that gives a minimum price target of 35000$ for #Bitcoin

Also a nice confluence of a break above the high at 32,5K where a lot of stops are sitting to create a possible deviation above … pic.twitter.com/xTAz6yVgO7

— JACKIS (@i_am_jackis) March 30, 2023

“Bitcoin has been consolidating below the biggest resistance/support of the last 2+ years,” analyst Matthew Hyland summarized in his latest tweet on BTC.

“A whole new ballgame if BTC breaks it. NASDAQ & S&P went strong into weekly close. Still major pessimism and disbelief while major milestones are close to being made for Stocks/BTC.”

Popular Twitter account Byzantine General predicted that a breakthrough of resistance immediately above spot price would result in a sea of liquidations, leading to further upward momentum.

“It feels like some bear is very desperately trying to defend the 29k to 30k region,” a tweet stated on the day.

“I think that when this level breaks massive liqs will come in. And it does feel like a matter of ‘when’ not ‘if’ because there’s zero froth in the market, only some spot supply.”

Related: US enforcement agencies are turning up the heat on crypto-related crime

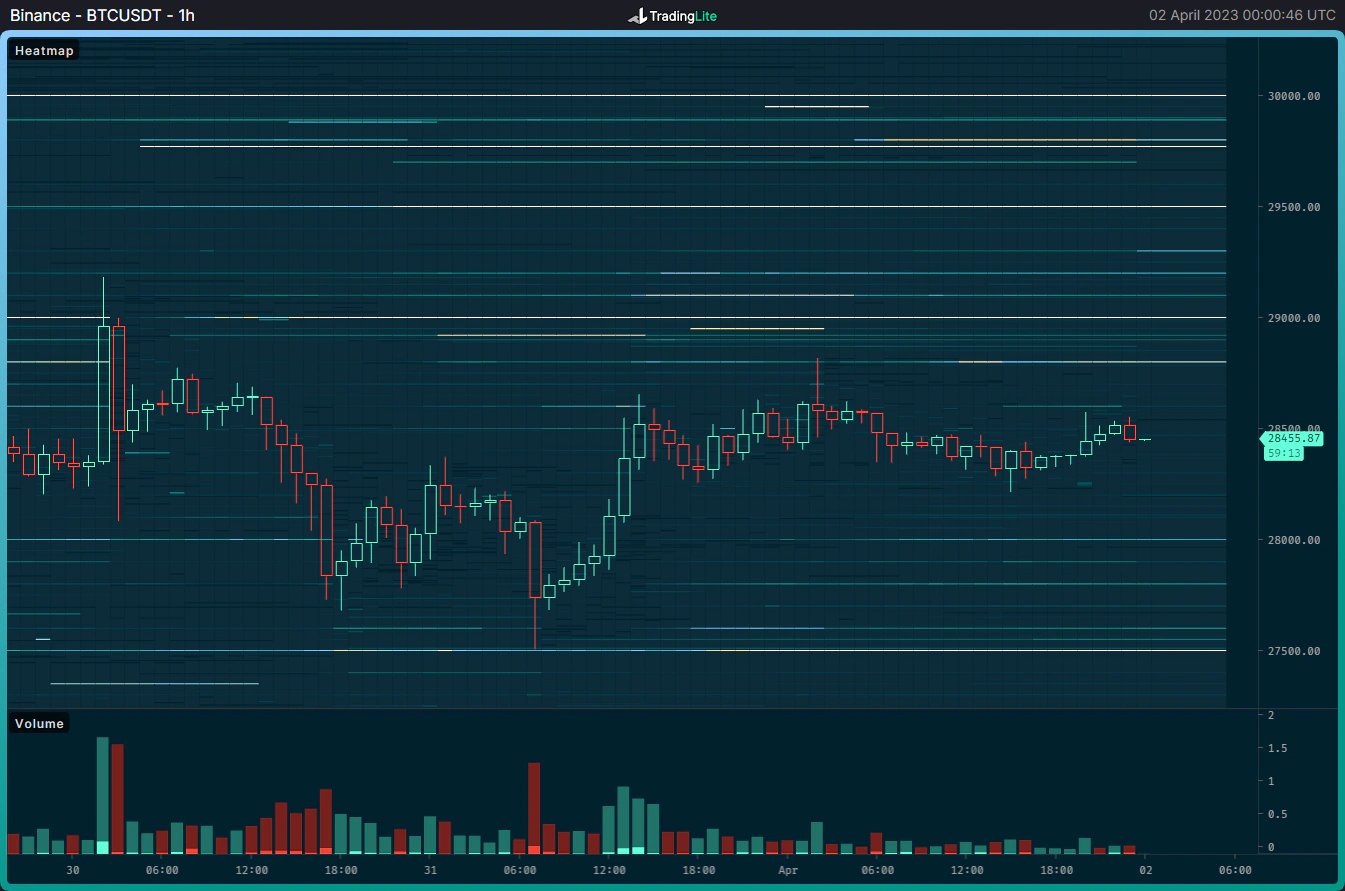

An accompanying chart showed the Binance BTC/USDT order book with bid and ask liquidity concentrations by price level.

On shorter timeframes, however, traders were content to wait for the weekly close to cement prior gains.

“Ranging this weekend it seems on the corn, and for continuation the bulls want to reclaim the range high at $28,750. Until the we chill,” Crypto Tony tweeted on the day.

Others were more pessimistic, among them trading resource Stockmoney Lizards, which described a correction as “very likely” before BTC/USD hits $30,000.

like in February, we now see a bearish divergence. Correction still very likely before we approach 30k. pic.twitter.com/atXM2aiBqa

— Stockmoney Lizards (@StockmoneyL) April 2, 2023

Bitcoin bulls add another 23% in March

Last month nonetheless managed to crown itself one of Bitcoin’s best March months.

Related: Bitcoin price hits $28.5K on PCE data as macro ‘accumulation zone’ ends

According to data from Coinglass, 23% gains for BTC/USD almost match its 2021 performance, with 2013 remaining its most volatile.

Bitcoin’s trajectory overall mimics both years, these seeing at least three months “in the green” before significant consolidation began.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.