Bitcoin (BTC) starts a new week in a solid position above $30,000 after its latest rapid gains.

BTC price action continues to deliver on bulls’ expectations after weeks of sideways trading offered little relief. Can it continue?

That is the question on every trader’s mind this week — $30,000 held into the weekly close and beyond, but in a volatile crypto market, anything can and does happen.

The macroeconomic climate is somewhat “standard” for the final week of June, offering some potential risk asset price catalysts but avoiding several major data releases at once.

The weekend’s news out of Russia appears to have had little impact on market performance elsewhere, having mostly concluded before the start of the week’s trading.

Turning to Bitcoin itself, a phase of taking stock appears to be here, with fundamentals conversely primed to shift down from all-time highs.

Sentiment is volatile too with $30,000, in particular, a pivotal level.

Cointelegraph takes a look at these factors and more in the weekly rundown of what is moving BTC price action in the short term.

Bitcoin bulls protect $30,000 at weekly close

Bitcoin drifted lower through the final part of the weekend after briefly touching $31,000.

Despite a lack of momentum, bulls managed to defend the $30,000 mark overnight, and at the time of writing on June 26, $30,500 was back as a focus, per data from Cointelegraph Markets Pro and TradingView.

In total, BTC/USD gained 15.6% last week, making it its third best weekly performance of 2023, according to data from monitoring resource CoinGlass.

“This week is all about flipping that resistance zone / supply zone at $31,000 into support,” popular trader Crypto Tony told Twitter followers.

“That is all i care about, but i do remain long while we consolidate below this level. Any harsh drops and i will be closing in profit and looking for a re entry.”

He added that both Bitcoin and Ether (ETH), the largest altcoin by market cap, were at resistance, the latter facing a battle for $2,000.

“Certainly going to be an important week for us all,” he commented.

Fellow trader Jelle agreed, predicting fresh gains on the horizon once $30,000 was dealt with for good.

The #Bitcoin weekly closed right at resistance.

Clear $30k in the coming weeks, and we’ll see much higher prices.

Until then, I continue buying dips. pic.twitter.com/r4jlRlm4xo

— Jelle (@CryptoJelleNL) June 26, 2023

Trader and analyst Rekt Capital described the wider Bitcoin price correction as “over,” while noting renewed flows into altcoins.

“Already we are seeing some Money Flow into Altcoins as BTC stays stable,” part of the weekend’s analysis stated, adding that the total crypto market cap had performed an impressive support retest.

Total #Crypto Market Cap performs a fantastic retest attempt

Once an area of resistance (red), this area has been successfully retested as new support

This retest has sent the entire market into an uptrend

If you like my content – you might enjoy my newsletter

This is where I… pic.twitter.com/hPZV1nUXf1

— Rekt Capital (@rektcapital) June 25, 2023

The total crypto market was also on the radar for Michaël van de Poppe, founder and CEO of trading firm Eight, who eyed its potential reclaim of the 200-week moving average.

The total market capitalization for #Crypto is looking at a reclaim of the 200-Week MA and continuation towards $1.6T. pic.twitter.com/GlmjBjuifU

— Michaël van de Poppe (@CryptoMichNL) June 25, 2023

Fed’s Powell, PCE data headline “huge” macro week

The week is set to be dominated by two key events from the wider economy, notably United States data prints, which will follow commentary by Jerome Powell, Chair of the Federal Reserve.

Powell will hold “discussions” on the economy over two days on June 28-29, while June 30 will see the release of the latest U.S. Personal Consumption Expenditures (PCE) Index figures.

These, Powell has previously said, are the Fed’s preferred yardstick for measuring inflation trends, with a better-than-expected number thus potentially impacting its next decision on interest rate adjustments.

“Huge week with a ‘Fed pivot’ in question,” financial commentary resource The Kobeissi Letter summarized in part of Twitter coverage.

Kobeissi referred to the possibility of the Fed abandoning its rate hike cycle for good, while Powell previously hinted that hikes may continue after being left unchanged in June.

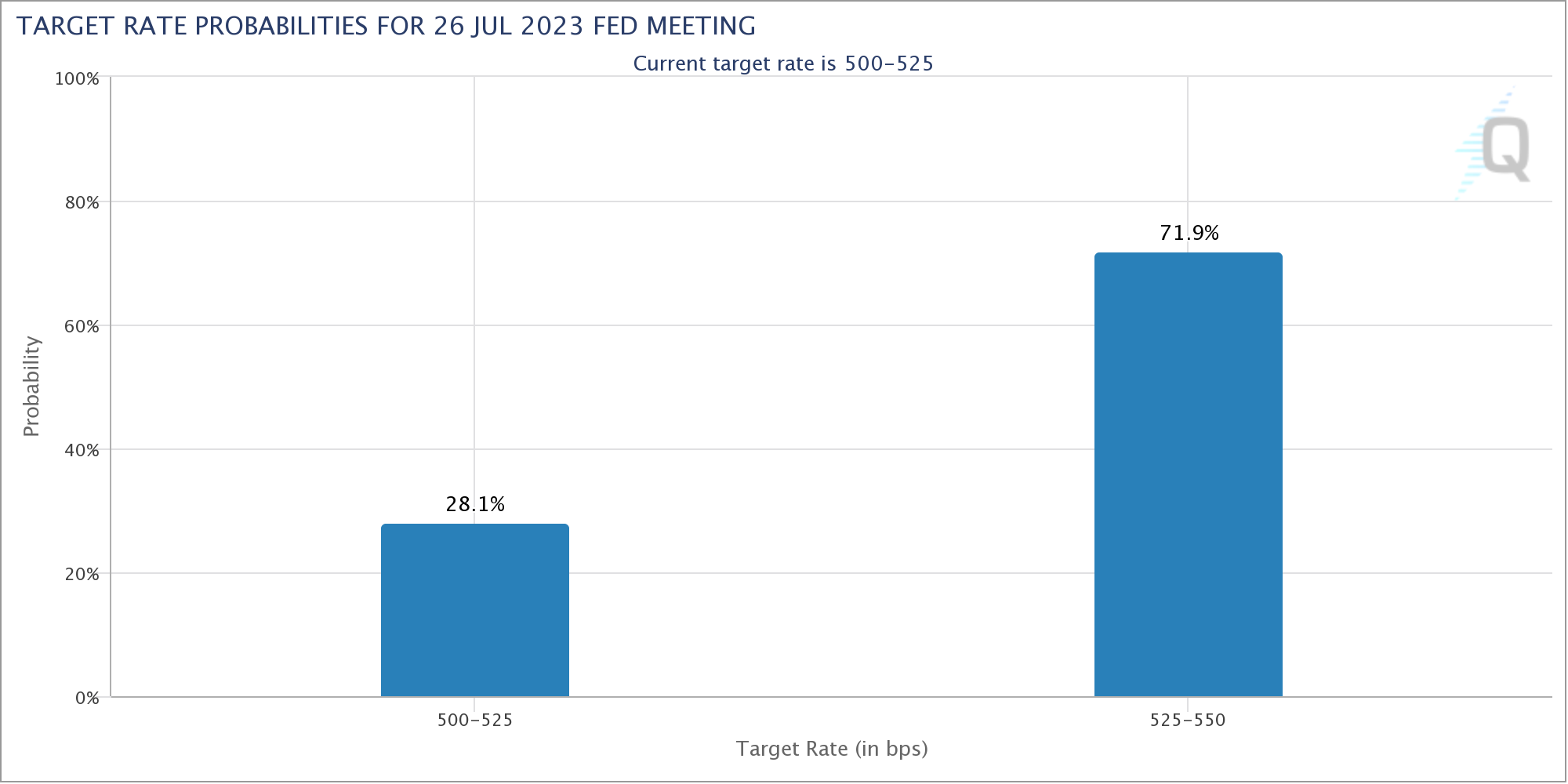

The latest data from CME Group’s FedWatch Tool meanwhile put the odds of a July hike at over 70% as of June 26.

Mining difficulty due to drop despite BTC price gains

In an interesting, if likely temporary, counterpoint to BTC price strength, Bitcoin network fundamentals are cooling their own gains.

According to the latest estimates from BTC.com, Bitcoin network difficulty is due to decrease at its upcoming readjustment on June 29.

This will mark the first downward readjustment since early May, but is currently forecast to be the second-largest of 2023 at around -2.5%.

Overall, however, the change is modest within historical context, and reacting, mining firm Simple Mining described the combination of accelerating spot price and declining difficulty as “miners’ two favorite things.”

Meanwhile, James McAvity, CEO of Texas-based Bitcoin energy firm Cormint, suggested that local events were responsible for the difficulty blip.

Bitcoin mining difficulty is adjusting down in response to the Texas heat wave prompting increased curtailment and underclocking from miners. As late stage proof of work rolls in, we will continue to see difficulty move inversely to seasonal grid demand. pic.twitter.com/EOUmkF0gcZ

— James McAvity (@jamesmcavity) June 23, 2023

Hash rate — an estimated measure of the computing power dedicated to mining — displayed similar behavior on the day, having declined from all-time highs through the week prior, as per data from data resource Blockchain.com.

Bitcoin RHODL Ratio points to “new breakout”

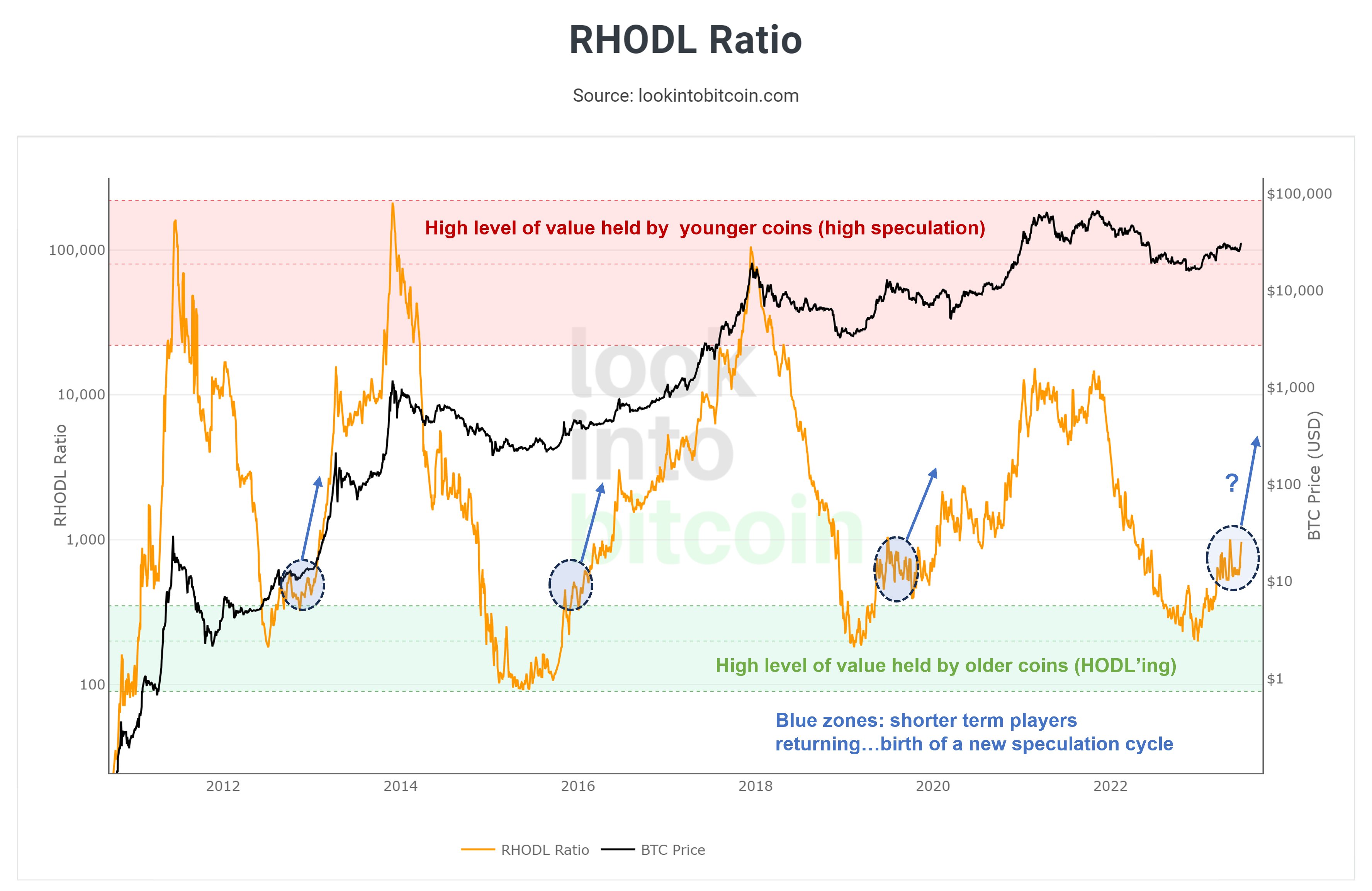

Bitcoin is at the dawn of a “new speculation cycle,” popular analyst Philip Swift believes.

In his latest research into Bitcoin’s RHODL Ratio metric, the LookIntoBitcoin founder argued that the BTC supply is beginning its move from hodler-based to speculative instrument.

Swift’s RHODL looks at the realized value of coins in specific age bands — their value at the time that they last moved. The RHODL Ratio looks at the 1-week band versus the 1-2 years band.

“It also calibrates for increased hodl’ing over time and for lost coins by multiplying the ratio by the age of the market in number of days. When the 1-week value is significantly higher than the 1-2yr it is a signal that the market is becoming overheated,” Swift explains in his introduction on LookIntoBitcoin.

While complex on paper, RHODL Ratio acts as a useful tool for Bitcoin price cycles, and is currently repeating classic behavior common at the start of bull markets.

While the property of long-term hodlers at the end of 2022, opportunistic traders are now stepping in again, the metric suggests, indicative of a transition to broader mainstream trading interest.

“As new players begin to enter the market and younger coins hold greater value, the RHODL Ratio is looking primed for a new breakout,” Swift commented.

Sentiment could “swing the other way”

Crypto market sentiment appears to care significantly about the fate of $30,000 for BTC price.

Related: Bitcoin ‘parabolic advance’ means BTC price all-time high in 2023 — Trader

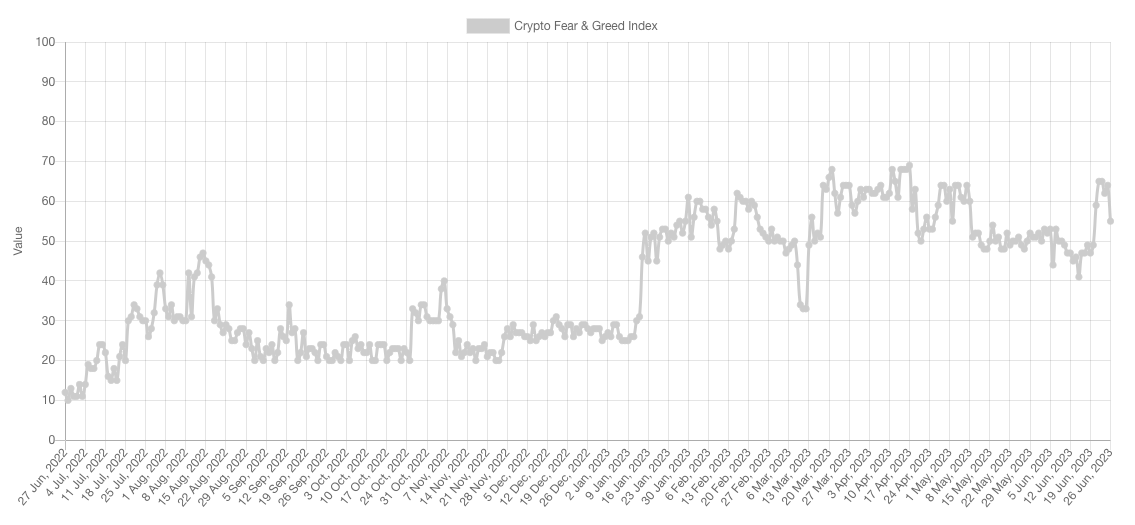

The Crypto Fear & Greed Index, which measures market mood composition, has fluctuated considerably in recent days as BTC/USD attempts to create new support.

After highs of 65/100 on June 22, the Index has shed 10 points, trending toward “neutral” territory as spot price momentum itself cools.

Fear & Greed is a lagging indicator, yet shows how sensitive the market is to current price action — and not just BTC, with ETH attempting to flip $2,000 to support.

Based on sentiment data, meanwhile, popular trader warned against longing until clearer signals were given.

“Sentiment could be about to swing the other way,” he said.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.