Bitcoin vs. Ethereum: read our exploration of the key differences, features, performances, and prospects.

Cryptocurrency has changed the financial landscape, with Bitcoin (BTC) and Ethereum (ETH) emerging as two leading players in the space. In this comprehensive comparison, we will delve into the key differences between Bitcoin and Ethereum, exploring their features, recent performances, and prospects.

Understanding the nuances of these cryptocurrencies is crucial for investors, developers, and enthusiasts alike, given their significant impact on the digital economy.

Understanding Bitcoin and Ethereum

In the world of crypto, BTC vs ETH has become a never-ending debate. The dynamic duo have common characteristics but also bear significant differences.

Users can store both in virtual wallets and identify them by unique alphanumeric addresses. While the two can be bought and sold on various online exchanges, neither of them is controlled or regulated by financial institutions or central banks. Instead, their operations are distributed among numerous computers, referred to as nodes, each running duplicates of their networks to avoid manipulation.

Despite these similarities, Bitcoin and Ethereum serve distinct purposes: Bitcoin is often used as a store of value, while Ethereum is predominantly used to interact with decentralized apps (dapps) developed on its blockchain.

Many investors also use BTC as a sort of safety net, preserving value during market dips, while they use ETH to get access to decentralized financial (defi) services.

Bitcoin basics

Cryptocurrencies officially became a thing in 2009 when a mysterious person or group of people working under the name Satoshi Nakamoto introduced Bitcoin to the world.

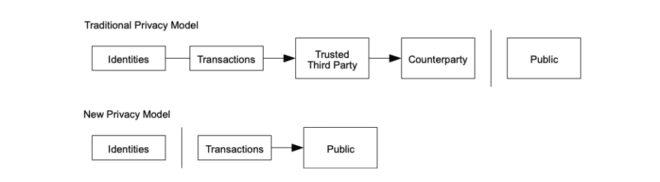

Satoshi aimed to create a decentralized, peer-to-peer (P2P) digital currency that would free people from the shackles of government oversight and the control of traditional financial bodies.

Bitcoin’s underlying technology, the blockchain, serves as an unchangeable ledger, recording every transaction across a distributed network of nodes while leveraging cryptographic techniques to ensure its security and integrity.

Miners on the Bitcoin blockchain create and share blocks through a proof-of-work (PoW) process, where machines utilize extensive computing power to perform hashing functions.

Bitcoin’s mining—the decentralized way of issuing new Bitcoins and validating transactions—and consensus mechanisms protect the network from malicious attacks intending to alter user balances or double-spend funds, making it resilient with virtually zero downtime.

In its early days, Bitcoin faced skepticism and was often associated with the dark web and illicit activities. However, as its potential as “digital gold” became apparent, it started to gain traction among technologists, libertarians, and forward-thinking investors.

Bitcoin’s decentralized nature, combined with its fixed supply, capped at 21 million coins, positioned it as a hedge against inflation and an alternative store of value. It also added to its allure and, coupled with the process of mining, has, over time, turned BTC into a deflationary asset.

The cryptocurrency is set for its next halving event in April 2024, a significant event that reduces the rewards given to miners for each block of transactions added to the blockchain.

Historically, such halving events have served as bullish catalysts for Bitcoin prices.

Ethereum basics

Four years after the introduction of Bitcoin, a 19-year-old Russian-Canadian computer programmer named Vitalik Buterin proposed Ethereum alongside other notable figures such as Gavin Wood, Charles Hoskinson, Anthony Di Iorio, and Mihai Alisie.

The concept of Ethereum was brought into the public eye in early 2014 at a Bitcoin conference in Miami, Florida. The blockchain itself officially launched in July 2015 with its first live release, known as Frontier.

While Bitcoin pioneered decentralized P2P transactions, Ethereum sought to extend the capabilities of blockchain technology, becoming a platform for decentralized applications and smart contracts.

Innovation on Ethereum is on the rise, with dapps providing financial services and non-fungible tokens (NFTs) representing one of the many possibilities that smart contracts offer developers.

Transactions, smart contracts creation, and dapps all require payment in Ether, the network’s native cryptocurrency. As Ether’s value increased, it also began to be seen as a store of value.

Dapps on Ethereum allow users to utilize ETH and other crypto assets in various ways, including as collateral for loans or to earn interest when lent to borrowers on defi protocols.

To grow its utility and keep its services on the cutting edge, Ethereum has undergone several upgrades over the years aimed at improving its scalability, security, and sustainability.

The latest upgrade, known as Dencun, is slated for the first quarter of 2024. It is part of an ambitious set of improvements planned for Ethereum that developers hope will transform the network into a fully scaled, maximally resilient platform.

Following Dencun, Ethereum is also expected to undergo three other upgrades: the Verge, the Purge, and the Splurge.

BTC vs ETH: unpacking the differences

While both Bitcoin and Ethereum rely on distributed ledgers and cryptography, they differ in many technical aspects. The differences between Ethereum and Bitcoin are numerous. Here are a few:

Transaction types: On the Ethereum network, transactions may contain executable code, while Bitcoin network transactions only carry information to record the transactions.

Transaction fees: While Ethereum transactions are typically faster than Bitcoin transactions, they come with higher transaction fees, known as gas fees. Ethereum is currently working on solutions to increase scalability and reduce gas fees.

Primary purpose: While both BTC and ETH are digital currencies, Ether’s primary purpose is not to serve as a monetary system alternative but to facilitate and monetize the operation of the Ethereum network’s smart contracts, dApps, and other potential blockchain solutions.

Block time: Some Ethereum transactions are confirmed within seconds, making them significantly faster than Bitcoin transactions, which can take minutes.

Scalability: Both Bitcoin and Ethereum face scalability issues. Bitcoin handles an average of seven transactions per second, while Ethereum handles around 30 transactions per second. Both are working on solutions to increase their transactional capacities.

Ethereum plans to use sharding to increase its base blockchain’s capacity and reduce network congestion. Sharding creates new blockchains, or “shards,” to help distribute the computing resources necessary to run Ethereum across 64 networks.

Bitcoin, on the other hand, has implemented the Segregated Witness (SegWit) upgrade and is developing a layer-two scaling solution called the Lightning Network. These solutions aim to use the limited Bitcoin block space more efficiently and handle up to 15 million transactions per second.

Consensus mechanisms: The biggest difference between Ethereum and Bitcoin is consensus mechanisms. Bitcoin employs a PoW system, whereas Ethereum moved to a proof-of-stake (PoS) mechanism in September 2022.

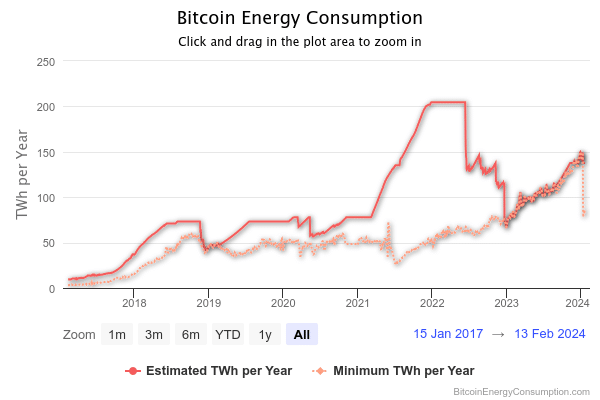

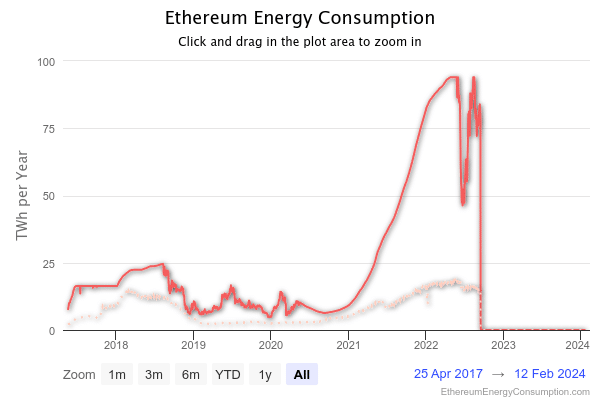

Energy consumption: One major criticism of the PoW system used by Bitcoin is its high energy consumption due to the computational power required.

Ethereum’s transition to the PoS system has made it significantly less energy-intensive, replacing miners with validators who stake their crypto holdings to gain the ability to create new blocks.

Market capitalization and transaction volume: Despite having more coins in circulation, Ethereum’s market capitalization is significantly lower than Bitcoin’s. Bitcoin processes around 500,000 transactions per day, while Ethereum processes about 1.2 million. Ethereum’s greater block count and smaller block size are due to its faster block addition time.

Recent market performance

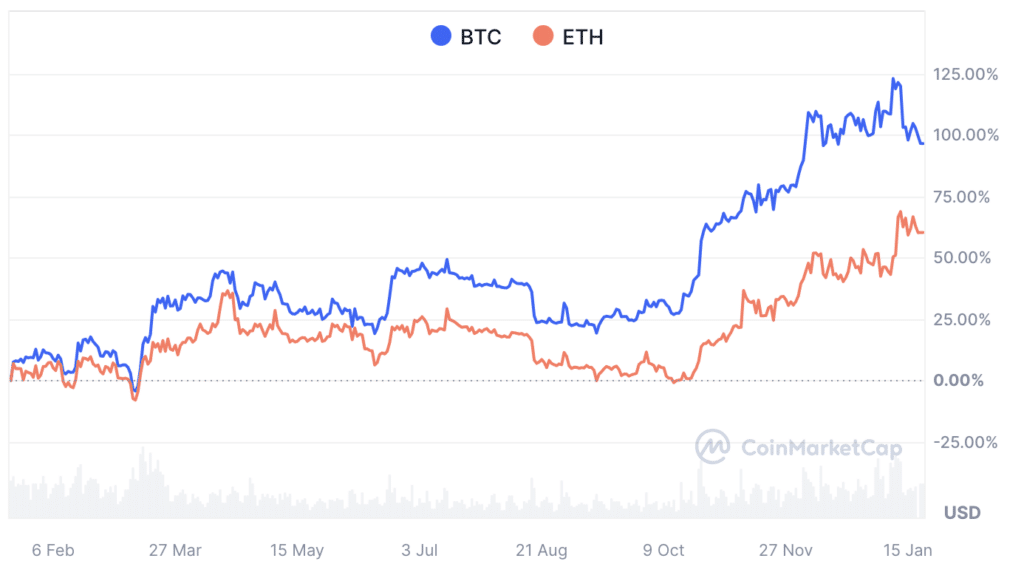

In 2023, the crypto market demonstrated significant resilience, bouncing back from 2022’s downturn yet still falling short of the peak seen in 2021. Bitcoin saw a robust year, with its market capitalization soaring to a high of +172%. Others, including Ethereum, also experienced a vibrant year, boasting a +90% increase in their market caps.

Bitcoin’s price climbed steadily from less than $17,000 at the start of 2023 to $43,550 by year’s end despite intermittent periods of minor volatility. Nevertheless, the market leader’s share, which hovered around 50%, was still below its 2021 peak when it exceeded $65,000.

On the stability front, both have maintained relative stability in the last 12 months. However, bitcoin concluded 2023 with a monthly gain of 12.6% and an annual gain of 156%, the highest since 2020. Ethereum prices rose by 15.7% in December, ending the year at $2,353, representing a 91% gain for the year.

Bitcoin also surpassed Ethereum in several indicators. As of December 2022, BTC held a market dominance of 40.1%, while ETH’s share was 18.4%. Currently, BTC’s market share has surged to just under 50% of the total crypto market value, while ETH’s is around 18%.

Final thoughts

As we continue to consider Bitcoin vs. Ethereum, it’s undeniable that both cryptocurrencies bring unique value propositions to the digital economy. Their market performances make the choice to buy Bitcoin or Ethereum quite tough for investors because they both present strong cases.

Bitcoin has solidified its position as a store of value and deflationary asset, offering an alternative to traditional financial systems and acting as a hedge against inflation.

Ethereum, on the other hand, with its focus on smart contracts and decentralized applications, has become a hotbed for innovation, giving rise to trends such as defi and NFTs.

Looking to the future, both are poised to maintain their positions in the crypto space. Bitcoin’s upcoming halving event in 2024 could likely serve as a bullish catalyst for its price, while Ethereum’s ongoing upgrades aim to improve its scalability, security, and sustainability, holding the potential to boost its utility and performance.

However, as crypto enthusiasts discuss and consider an Ethereum vs. Bitcoin investment, they should remember that the two are not without risks. As the crypto landscape evolves, it will be essential for investors to stay informed and make educated decisions.

Is Ethereum better than Bitcoin?

The comparison between Ethereum and Bitcoin isn’t necessarily about which is “better,” but rather which is more suited to certain uses or investment strategies. Bitcoin, as the first cryptocurrency, is often viewed as digital gold due to its limited supply and is primarily used as a store of value. It’s widely recognized and has high liquidity, making it a stable choice for many investors. On the other hand, Ethereum goes beyond being a digital currency – it also enables smart contracts. It hosts a multitude of decentralized applications (dapps), making it highly versatile and a driving factor behind the Decentralized Finance (defi) movement.

What is the difference between Bitcoin and Ethereum?

There are several differences between Bitcoin and Ethereum because they serve different purposes and have unique technical foundations. Bitcoin was designed as a digital alternative to traditional fiat currencies, with its primary purpose being a decentralized form of digital cash that enables peer-to-peer transactions. Ethereum is an open-source platform that enables developers to build and deploy smart contracts and decentralized applications (dapps).

Should I buy Bitcoin or Ethereum?

The decision to buy Bitcoin or Ethereum depends on your individual financial goals, risk tolerance, and understanding of each cryptocurrency’s underlying technology. Both have shown significant growth potential, but they also come with risks, as the crypto market is known for its volatility, so it’s imperative for you to DYOR (do your own research) before making any purchases in the financial world.