ETH price has outperformed BTC since the Spot ETF approval on Jan. 11, but on-chain data suggest the gap could further widen in the days ahead.

Ethereum price continues to consolidate its lead over Bitcoin this week closing above the $2,500 mark in each of the last 4 trading days from Jan. 15.

2 vital trading indicators highlight how the ETH bulls could further assert dominance in the days ahead.

Investors have shifted ETH Worth $1 billion from exchange-hosted wallets into long-term storage

As Ethereum price raced up the charts last week, there was widespread speculation that investors could book profits at the milestone $2,500 territory. But interestingly, at the time of writing on Jan. 18, ETH price has closed each of the last 3 trading days above $2,500 suggesting that the bulls are, instead, holding out for more gains.

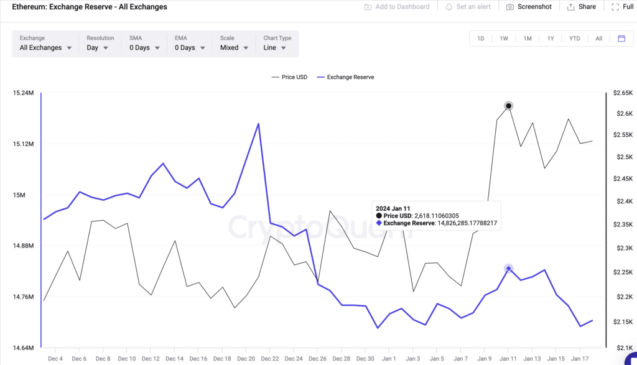

Looking beyond the price charts, the recent shift in ETH exchange reserves better projects the bulls holding stance. Cryptoquant’s exchange reserves data provides a real time snapshot of the total units of a cryptocurrency that is currently held in wallets hosted on exchanges and trading platforms.

As of Jan. 11, investors held a total of 14.8 million ETH coins in exchange-hosted wallets. Interestingly, the figure is now down to 14.7 million ETH as of Jan 18.

As depicted above, investors have now shifted 133,271 ETH coins from exchange wallets into long-term storage in the last 7 days. exchange-hosted wallets into long-term, dispelling concerns of potential widespread profit-taking at the $2,500 milestone.

Typically, a drop in exchange reserves is often bullish for a cryptocurrency’s short-term price action. It essentially means that investors are moving their coins from trading wallets into long-term storage.

Preference for long-term storage during a price rally signals investor confidence and intent to hold out for more gains. With the exchange supply in decline over the past week, it’s unsurprising that ETH price has consolidated above the $2,500 support since Jan 15.

Importantly, the historical trends show that periods of rapid decline in ETH exchange reserves have often been followed by a price uptrend. If the pattern recurs, Ethereum holders can anticipate an upswing toward $2,600 in the days ahead.

While exchange supply drops, ETH is attracting more demand

Secondly, as Ethereum exchange supply declined over the past week, the total number of active ETH sell orders has now dropped far below market demand. This current Ethereum spot market dynamics is another vital on-chain indicator pointing towards ETH stretching its lead over BTC in the days ahead.

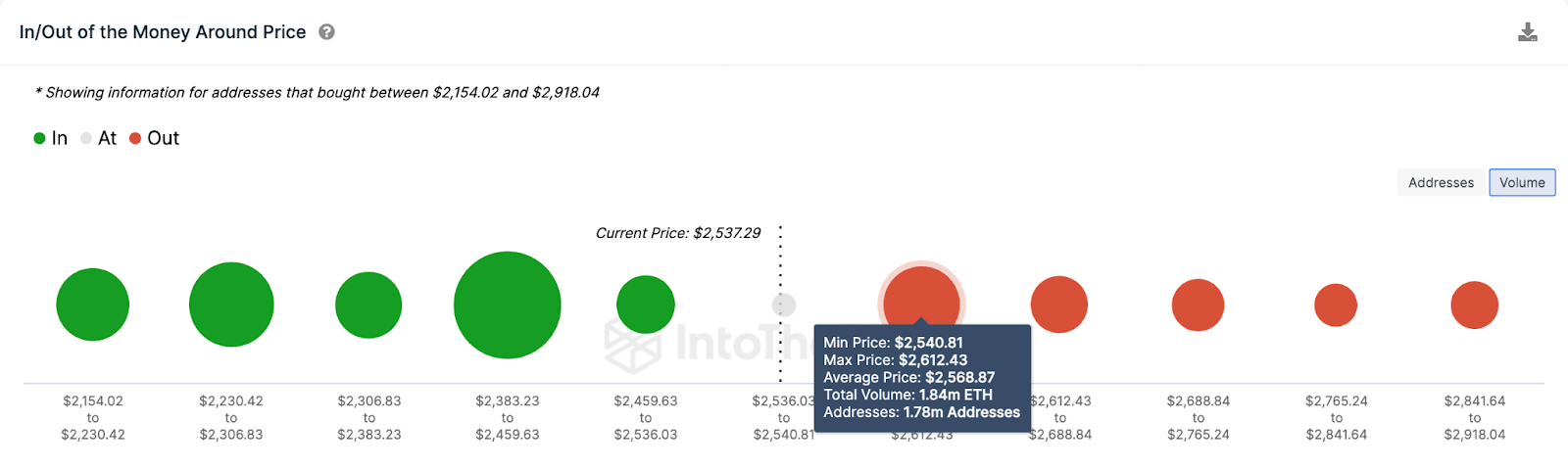

IntoTheBlock’s aggregate exchange order books chart captures a cryptocurrency’s total active buy/sell orders across multiple exchanges.

Currently, there are active purchase orders for 357,490 ETH listed across 20 crypto exchanges including Binance and Coinbase. Meanwhile, the bears have put sell orders for only 250,750 ETH.

The chart above depicts that the market supply for Ethereum has fallen short of demand by 106,740 ETH. Intuitively, when the demand for an asset outpaces supply by such a large margin, it signals a dominant bullish sentiment within the ecosystem.

In summary, the prolonged decline in ETH exchange reserves has now led to excess demand in the spot markets. These two vital short-term indicators could accelerate Ethereum price rally and further widen its lead over BTC.

ETH Price Forecast: $2,700 Could be the next target

Based on the 2 critical on-chain data points analyzed above, Ethereum price looks set to remain in upward trajectory towards $2,700 in the short-term.

But for the bulls to validate this bullish forecast, they must first scale the $44,000 resistance level. IntoTheBlock In/Out of the money data, which groups current Ethereum holders by their historical entry prices. also affirms this forecast.

It shows that 1.78 million existing investors had acquired 1.84 million ETH at the maximum price of $2,612. If those holders look to sell as ETH approaches their break-even point, it could inadvertently trigger a reversal.

But if the bulls can smash through the sell-wall at $2,612, the $2,700 area could be the next target for Ethereum price.

On the downside if things take a bearish turn, the bulls can rely on the historically significant buy wall at $2,400 for initial support.

The chart above shows that 853,920 addresses acquired 4.5 million ETH at the average price of $2,414. If those holders make frantic efforts to cover their positions, Ethereum price can stage an instant rebound from that territory.