Bitcoin miner Cango said it closed a previously announced $10.5 million equity investment from Enduring Wealth Capital Limited and entered into agreements for an additional $65 million in equity financing from entities owned by Cango chairman Xin Jin and Chang-Wei Chiu, a director of the company.

According to Thursday’s announcement, the $10.5 million investment was completed through the issuance of seven million Class B shares priced at $1.50 each. The shares carry 20 votes per share, increasing Enduring Wealth Capital’s voting power to 49.7% from 36.7%, while its economic ownership remains below 5% of outstanding shares.

The additional $65 million would be raised through the issuance of about 49 million Class A shares, which carry one vote per share, at $1.32 each. The investments are being made through entities wholly owned by Jin and Chiu and remain subject to customary closing conditions, including approval from the New York Stock Exchange. The company said it expects the transactions to close this month.

If completed, Chiu would hold about 12% of total outstanding shares and about 6.7% of voting power, while Jin would hold about 4.7% of shares and 2.6% of voting power.

The financing follows Cango’s Feb. 9 sale of 4,451 Bitcoin (BTC) for about $305 million, proceeds of which were used to partially repay a Bitcoin-backed loan and reduce leverage.

The company said the divestment is part of a broader shift toward AI and high-performance computing, with plans to repurpose its global, grid-connected mining infrastructure to provide distributed compute capacity for the AI industry.

Cango’s stock price was down about 7.7% at time of writing, according to data from Yahoo Finance. Sector-tracker CoinShares Bitcoin Mining ETF was down 3.8%.

Related: The real ‘supercycle’ isn’t crypto, it’s AI infrastructure: Analyst

Earnings misses and BTC volatility pressure mining sector

Cango’s capital raise follows sharp declines in publicly traded Bitcoin miners last week. CleanSpark fell about 19% during regular trading on Feb. 5 and dropped another 8.6% after hours after missing quarterly estimates, while IREN slid about 11.5% and another 18.5% after hours after reporting revenue below expectations and a quarterly net loss.

RIOT Platforms and MARA Holdings also declined about 15% and 19%, respectively.

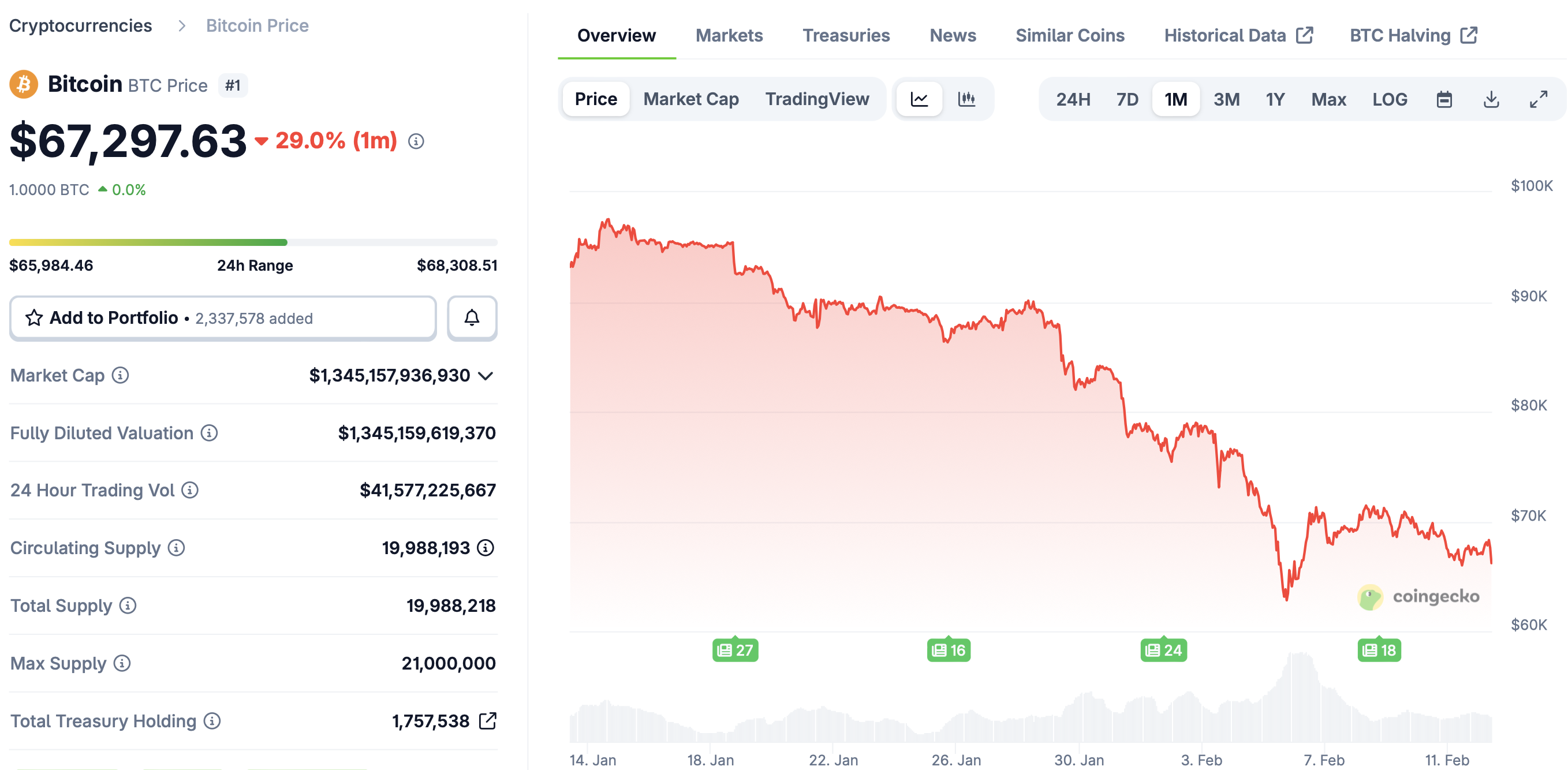

The sell-off in mining stocks coincided with a sharp decline in the price of Bitcoin, which dropped about 12% the same day, sliding from about $71,426 to $62,822, according to CoinGecko data.

Large Bitcoin transfers were also recorded during the period. On Feb. 5, miner-linked wallets transferred 28,605 BTC, worth about $1.8 billion, one of the largest single-day outflows since November 2024, according to CryptoQuant data. Another 20,169 BTC moved the following day.

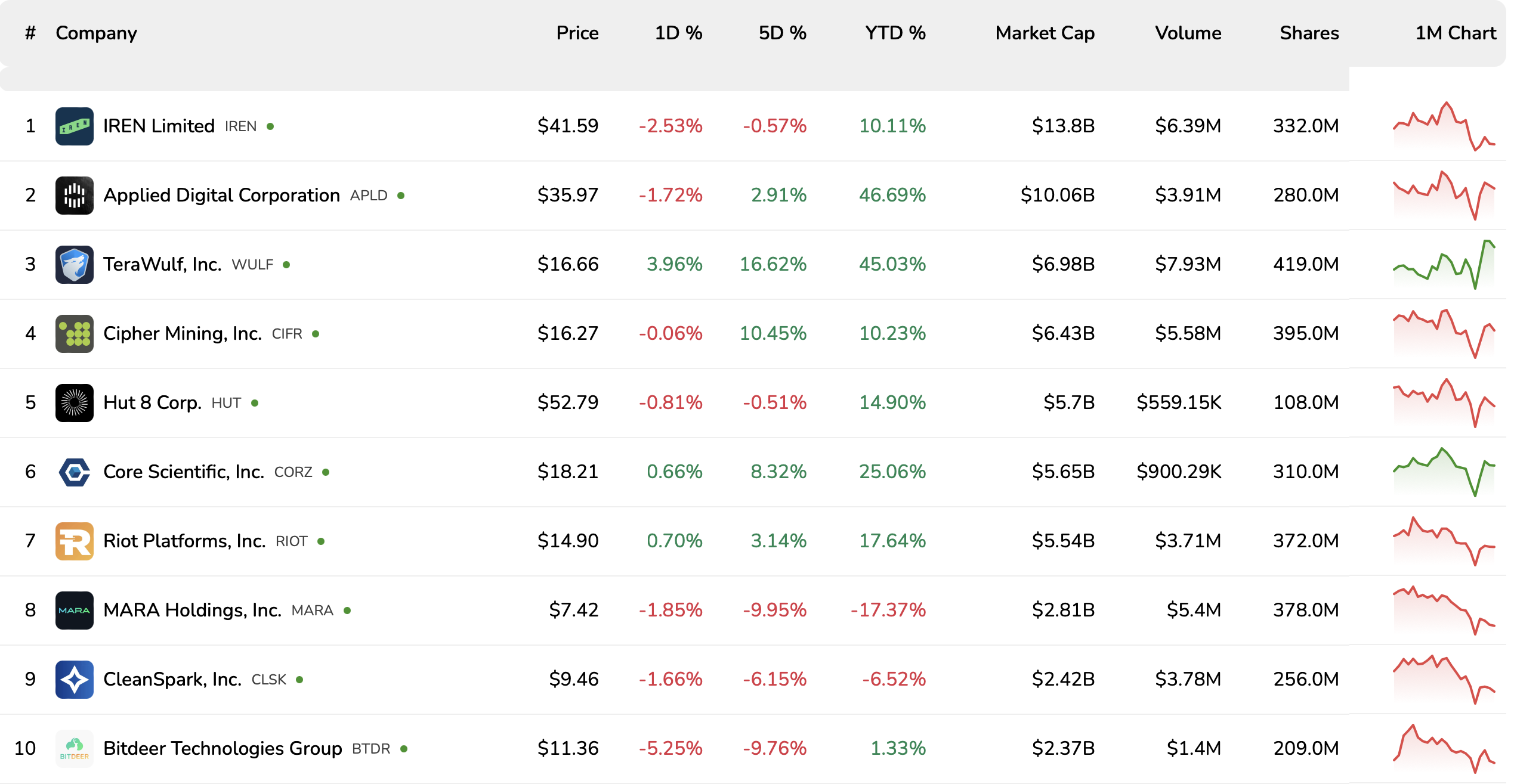

Though several Bitcoin miners were deep in the red last week, many stocks remain up on the year. IREN, the top Bitcoin miner by market cap, is up about 10% year-to-date.

Applied Digital and TeraWulf are the strongest performers, each up about 45% year-to-date, while Core Scientific has gained about 25% and Riot Platforms is up about 17%. Hut 8 has risen nearly 15% over the same period.

Of the top 10 Bitcoin mining stocks by market cap, MARA Holdings and CleanSpark are the only two trading in negative territory year-to-date. MARA is down about 17% on the year, while CleanSpark has declined about 6.5%, according to data from BitcoinMiningStock.io.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye