Cardano (ADA) has been experiencing a persistent downside trend since the start of 2023; the selling pressure has increased in the past week. However, network development continues to grow and could hint at a reversal for the cryptocurrency.

Cardano (ADA) trades at $0.24 with sideways movement on its weekend price action as of this writing. In the previous seven days, the cryptocurrency recorded a 4%, with the potential for further losses if the price of Bitcoin continues on its current trajectory.

Cardano Price Bound For A Change In Trajectory?

Data shared by Cardano’s leading developer, Input Output Global (IOG), and seen on the chart below, shows that while ADA has been trending to the downside, network activity is on the rise, with 75.3 million transactions processed, 79,182 token policies, and over 1,250 projects currently building on the network.

As seen above, 144 projects have been launched on Cardano with over 8.8 million tokens. This network has been one of the fastest growing in development activity in 2022 and 2023 upon implementing smart contract capabilities via the Hard Fork Combinator event dubbed “Alonzo.”

Currently, IOG is working to launch other core improvements to Cardano, including a fix for its consensus algorithm set to improve performance and scalability. In addition, the IOG team has continued to work on its smart contract platform, Plutus, and in the native crypto wallet, Lace.

Two of the most significant upcoming events for the blockchain are the introduction of Hydra to improve scalability and Mithril. IOG stated the following about the recent developments for these projects:

(…) the team made progress working on the aggregator performance bottleneck that occurs with high client traffic and started creating a new distribution.

The above, and the data provided by IOG, could have an impact on ADA. However, additional data provided by TokenTerminal paints a different picture.

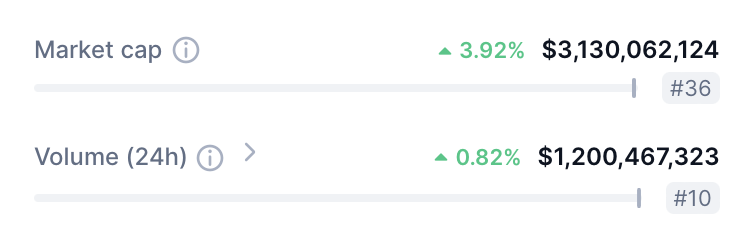

The crypto analytics firm indicates that Cardano experienced a 6% decrease in its circulating market cap and a 35% loss in its annualized fees. Moreover, while the number of developers working on the network has increased by about 6%, the number of core commits is down 29% in 30 days.

As the chart below shows, the correlation between the number of commits to the project and the price of ADA has been decreasing. Yet, the token has seen some positive price action following an uptick in the former metric.

Cover image from Unsplash, chart from Tradingview