A big selling point of bitcoin exchange-trade funds was their potential to reduce bitcoin’s notorious volatility over time. But what’s happened so far is that big swings are back in the world of cryptocurrency. Just look at last week. Bitcoin climbed to an all-time high —its first record in more than two years — only to quickly fall by as much as 10% before bouncing back up to yet another new record. The bitcoin 30-day historical volatility index has been sitting at its highest levels in 11 months as leverage…

Category: Bitcoin Analysis

Why recent rallies in bitcoin, gold may be related

The bitcoin rally was catalyzed by microeconomic factors at the end of 2023, but may have recently fused into the more macroeconomic-fueled gold rally, according to Wolfe Research. The yellow metal is up 5.7% in March, which accounts for most of its 6% gain over the past month. On Friday, it hit record highs for a fourth consecutive session. Bitcoin has also been trading at record highs this week, after hitting new all-time highs on both Tuesday and Friday. It’s up 8% in March. Bitcoin’s positive price performance initially was…

Bitcoin is set to make another run at the record and could rally to $98,000, according to chart analyst

Bitcoin charged to new highs on Tuesday, but then retreated about 14%, sending a scare into the market. Since then the price has stabilized. I think the two most important questions are will bitcoin retest the $69,000 high and ultimately blast through? And if so, what are the catalysts to justify the outlook for higher prices? I’ve been following the bitcoin story for 10 years now, opened my first Coinbase account back in 2014 and bought bitcoin at $330. No, I don’t still have them. I’ve followed and traded it since…

These crypto trades are having big years as bitcoin hits a record high

Bitcoin’s push to a record high on Tuesday has been part of a broader rally in 2024, with other cryptocurrencies and investment vehicles tied to bitcoin surging along with it. Start with the arrival of bitcoin exchange-traded funds, which is often pointed to as one of the sparks of the crypto rebound. The price of bitcoin has climbed about 48% since Jan. 11, when the ETFs first launched, according to Coin Metrics. The ETFs have seen similar gains. IBIT 1M mountain Bitcoin ETFs, like iShares’ IBIT, have surged over the…

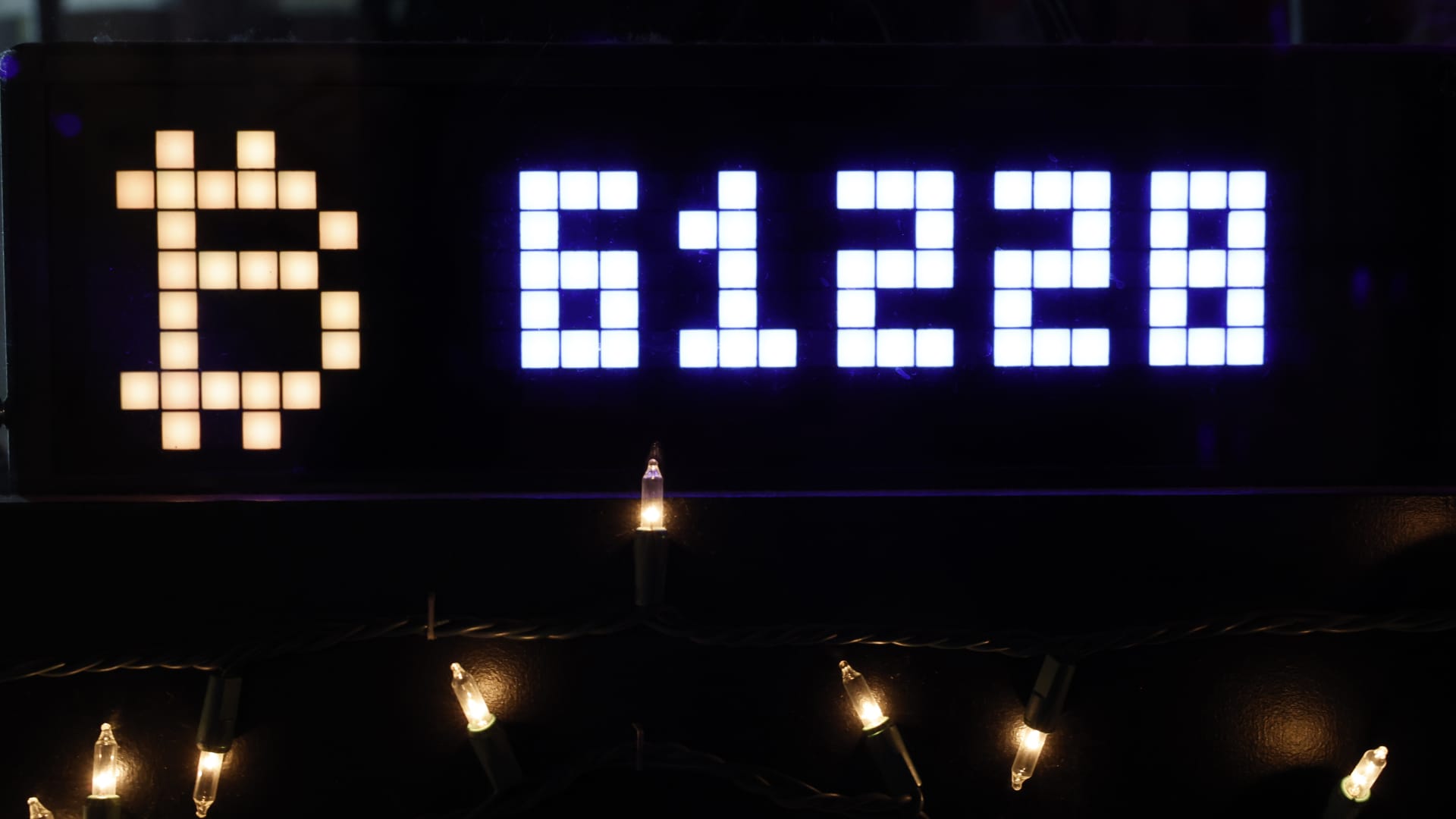

Bitcoin tops $65,000 as it nears 2021 all-time high

Jaap Arriens | NurPhoto | Getty Images The price of bitcoin rose to start the week, edging even closer to its all-time high after the rally took a breather over the weekend. The flagship cryptocurrency was last higher by 3.7% at $65,127.00, according to Coin Metrics. Earlier, it rose to as much as $65,606.17, its highest level since November 2021. Ether advanced 1% to $3,508.24. Both coins are coming off their best week in almost a year (bitcoin gained about 21% and ether 16%) but paused their run over the…

Investors should tread carefully in March after bitcoin’s rally to $60,000

With bitcoin on a hot streak this past week, investors should brace themselves for a cooling in March. The flagship cryptocurrency exploded in the final week of February, which ended as the best month since 2020 . It started the week around $50,000 on Monday and leapt above $62,000 by the end of the week —just 10% below its November 2021 all-time high of $68,982.20. “The recent price action seems too quick and too big to sustain over the next month,” said Yuya Hasegawa, crypto market analyst at Japanese bitcoin…

Bitcoin ETFs see record-high trading volumes

Retail traders appear to be using a new tool during this huge rally for bitcoin — exchange-traded funds. The funds, which launched last month, have seen their trading volume surge this week as bitcoin continues to climb. For example, the iShares Bitcoin Trust (IBIT) had already seen more than 61 million shares change hands by early afternoon on Wednesday, according to FactSet. That is well above its previous record high of roughly 43 million shares, which came on Tuesday. Another multibillion dollar fund, the Fidelity Wise Origin Bitcoin Fund (FBTC),…

Bitcoin’s all-time high is in view after it breached $57,000: Analysts

Bitcoin’s all-time high is in clear sight after the cryptocurrency surpassed $57,000 on Tuesday. The flagship crypto is now roughly 20% off its November 2021 all-time high of $68,982.20, and it just cleared a key resistance level, according to Fairlead Strategies. “The main thing to highlight is the confirmed breakout above $48,000, which targets final resistance [of about] $64,900,” said Will Tamplin, senior analyst at Fairlead. BTC.CM= 5D mountain Bitcoin this week confirmed a breakout above $48,000 Oppenheimer chart analyst Ari Wald confirmed that outlook. “Positive momentum for the price…

Here’s what bitcoin’s chart says about its next moves after it breached $50,000 this week

Bitcoin broke through $50,000 to start the week and although a stubbornly high inflation reading has pulled it lower since, the cryptocurrency is still in safe territory, according to chart analysts. On Monday, the cryptocurrency finished above $50,000 – at one point rising to $50,334.00, its highest level since December 2021. Technical analysts had expected this breakthrough last month , when bitcoin kicked off the new year with a rally that seemed to be heading toward $48,000. It’s retesting that level now, however, and it was due for the slight…

CleanSpark jumps on plans to buy 4 bitcoin mining facilities

An array of bitcoin mining units inside a container at a CleanSpark facility in College Park, Georgia, on April 22, 2022. Elijah Nouvelage | Bloomberg | Getty Images Bitcoin miner CleanSpark climbed on Tuesday after the company said it will acquire new mining facilities that will give it the power and infrastructure to potentially double its hashrate within the first half of the year. CleanSpark shares were last higher by nearly 9%. At one point, the stock rose as high as 10.8%, also helped by a midday rise in the…