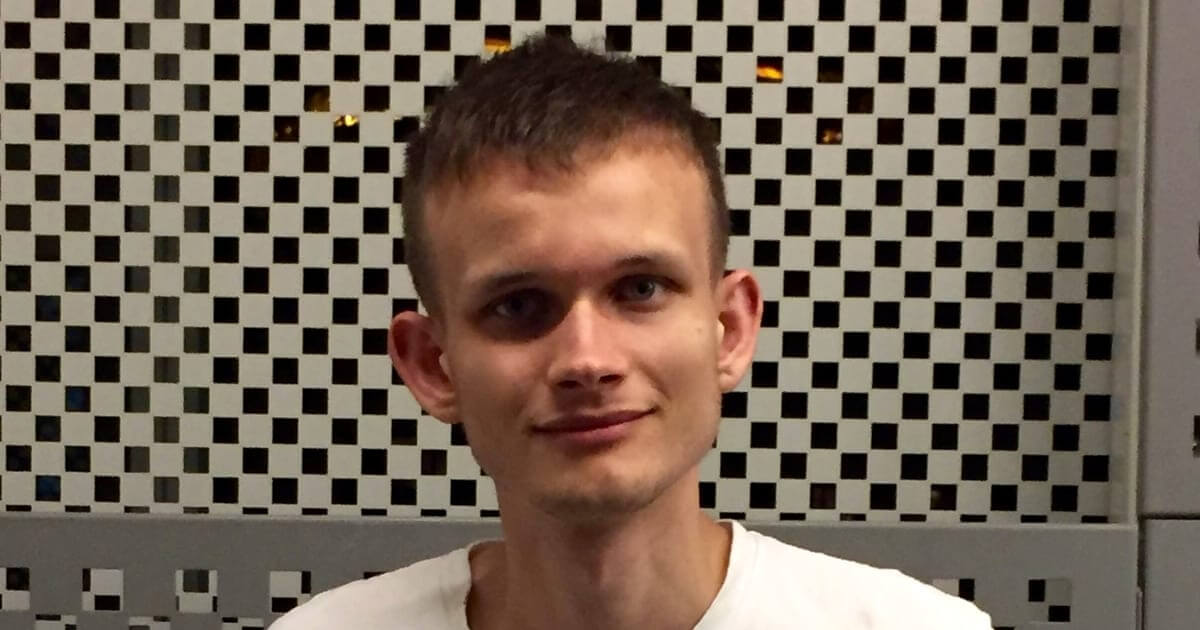

Ethereum’s Vitalik Buterin, along with researchers and privacy advocates, published a paper on September 6, 2023, titled “Blockchain Privacy and Regulatory Compliance: Towards a Practical Equilibrium.” The paper introduces “Privacy Pools,” a smart contract-based protocol designed to reconcile financial privacy with regulatory compliance. The news was shared to Blockchain.News by Ameen Soleimani. Key Details Authors: Vitalik Buterin (Ethereum Foundation), Jacob Illum (Chainalysis), Matthias Nadler (University of Basel), Fabian Schar (Center for Innovative Finance, University of Basel), Ameen Soleimani (Privacy Pools) Publication Date: September 6, 2023 Abstract: The paper focuses on “Privacy…

Category: Blockchain

What Is a Blockchain Sequencer? It Sits Between Ethereum and Layer-2 Networks Like Coinbase’s Base

A criticism of the setup is that today’s rollup sequencers are typically run by “centralized” entities, and thus represent single points of failure, potential vectors for transaction censorship, or possibly a choke point if authorities ever chose to shut it all down. Coinbase, for example, runs the sequencer for its new Base blockchain, a role that could produce an estimated $30 million of net revenue annually, based on estimates by the analysis firm FundStrat. Source link

New $20M fund eyes blockchain gaming and NFTs

A group of cryptocurrency venture investors has established a $20 million fund to invest in undervalued Web3 projects and companies focused on blockchain gaming and digital collectibles. Alpha Protocol Ventures (APV) will look to invest in a variety of projects across the Web3 ecosystem, its CEO and founder Vagelis Diamantis told Cointelegraph in an email interview. He said that gaming and collectibles will be a priority focus, while decentralized finance, layer-1 and layer-2 protocols will also fall within the scope of the fund’s capital allocation. “We will also explore projects…

SEC vs Service Provider Developments Keeps Market Volatility Up – Blockchain News, Opinion, TV and Jobs

By Matteo Greco, Research Analyst at the publicly listed digital asset and fintech investment business Fineqia International (CSE:FNQ). Bitcoin (BTC) closed last week around $26,000, a 0.5% decrease in price from its previous week’s closing price of $26,100. Last week was pretty hectic, following the lawsuit win for Grayscale against the SEC. The court said that the SEC’s decision to reject the Grayscale Bitcoin ETF application was arbitrary and capricious and did not offer adequate explanations for the rejection.The SEC will now evaluate the Grayscale Bitcoin ETF application again and give a new verdict…

Visa (V) Expands Blockchain Payment Capabilities by Expanding Circle’s USDC Settlements to Solana (SOL)

“By leveraging stablecoins like USDC and global blockchain networks like Solana and Ethereum, we’re helping to improve the speed of cross-border settlement and providing a modern option for our clients to easily send or receive funds from Visa’s treasury,” Cuy Sheffield, head of crypto at Visa, said in a statement. Source link

Making real-world blockchain solutions possible — Solana co-founder Raj Gokal

Raj Gokal, co-founder of blockchain protocol Solana and chief operations officer of Solana Labs, started his career in venture capital with a focus on high-growth tech business. For seven years, Gokal focused on health tech, first with wearable sensors using Bluetooth Low Energy as a wireless protocol, then leading product management at Omada Health. He aimed to address the fractured, challenging United States healthcare system but “encountered challenges with health plans and regulators, leading me to recognize the industry’s persistent issues,” he told Cointelegraph. After meeting Solana co-founder Anatoly Yakovenko…

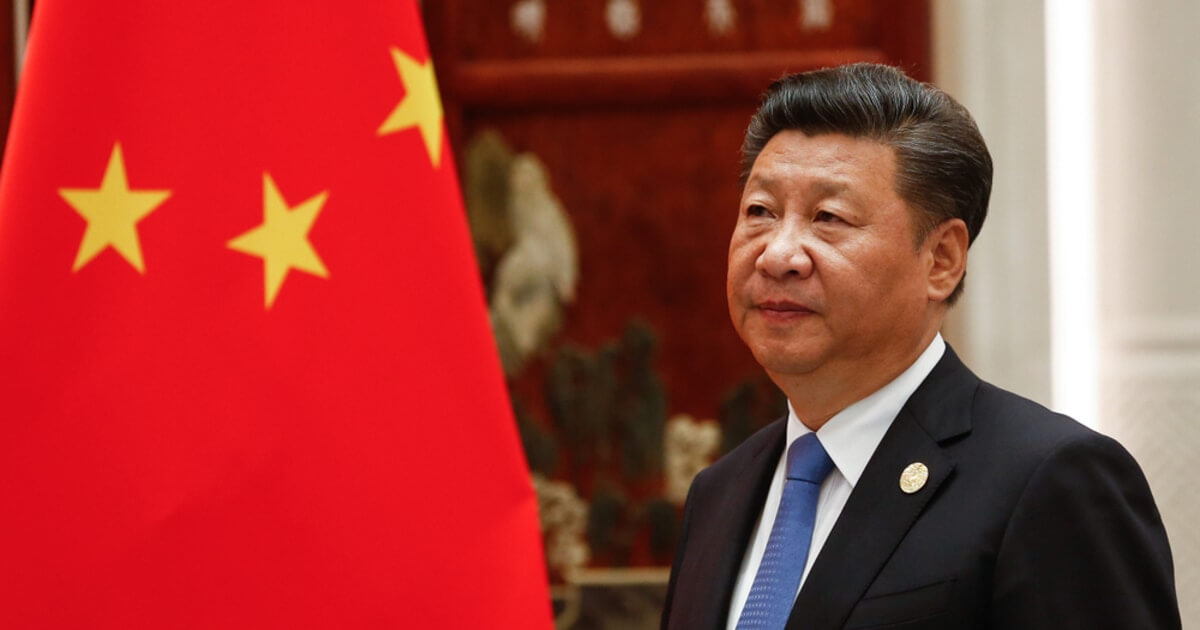

Chinese President Xi Jinping Highlights the Transformative Impact of Blockchain and AI on Global Industries

In a congratulatory message to the 2023 China International Intelligent Industry Expo, Chinese President Xi Jinping emphasized the profound changes that emerging technologies like the internet, big data, cloud computing, artificial intelligence (AI), and blockchain are bringing to global industries and lifestyles. Accelerating Digital Transformation According to a report from ChainCatcher, Xi Jinping’s message highlighted that these technologies are accelerating the digital, intelligent, and green transformation of industries. “The intelligent industry and digital economy are thriving, significantly altering the global allocation of resources, industrial development models, and people’s lifestyles,” Xi…

Indian central bank-backed NPCI begins blockchain recruitment

The National Payments Corporation Of India (NPCI) — an initiative led by the Reserve Bank of India (RBI) and 247 Indian banking companies — is on the lookout for a seasoned blockchain technologist to head and investigate opportunities for blockchain in current-day payment systems. NPCI owns and operates the Unified Payments Interface (UPI), India’s home-grown instant payment system that facilitates interbank peer-to-peer and person-to-merchant transactions. A recent LinkedIn job posting confirmed NPCI’s ongoing drive to hire a head of blockchain. NPCI’s job posting for a head of blockchain. Source: LinkedIn…

Swift says blockchain integration ‘more plausible’ than unifying CBDCs

Bank messaging network Swift has recently shared a report highlighting how Swift can connect with blockchains and solve the issue of interoperability between different blockchain networks. In a report titled “Connecting blockchains: Overcoming fragmentation in tokenised assets,” Swift concluded that a more incremental approach that interlinks existing systems to blockchains is “more plausible” for market development in the near term, compared to bringing together central bank digital currencies (CBDCs), tokenized deposits and assets in a single unified ledger. Diagram demonstrating how Swift can connect financial institutions with various blockchains. Source:…

Breaking: Swift, Chainlink, and Major Banks Achieve Multi-Blockchain Token Transfer

Swift, the global financial messaging service, announced on August 31, 2023, that it has successfully conducted a series of experiments to facilitate the transfer of tokenized assets across multiple blockchains. Collaborating with major financial institutions and Chainlink ($LINK), a Web3 services platform, Swift aims to solve the interoperability challenges that have been a barrier to the growth of tokenized asset markets. Major banks involved are: Australia and New Zealand Banking Group Limited (ANZ), BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange (SDX), The Depository Trust &…