Belarus has begun blocking access to several of the world’s largest cryptocurrency exchanges, including Bybit, OKX, BingX, and Bitget, according to data from BelGIE, the country’s central internet-filtering authority. The measure, carried out “based on a decision of the Ministry of Information,” disconnects Belarusian users from platforms that have historically served both retail traders and cross-border payment flows. Finance Magnates reached out to the affected exchanges for comment; no replies were received by the time of publication. What Happened in Belarus Belarusian users with domestic IP addresses report that platform…

Category: Exchanges

BTCC Exchange Integrates with TradingView, Bringing Professional Trading Tools to its 10 Million Global Users

December 9th, 2025 – VILNIUS, Lithuania BTCC, the world’s longest-serving cryptocurrency exchange, today announced the integration of its perpetual futures pairs on TradingView, a charting platform with over 100 million users globally. The integration enables traders to access BTCC’s 400+ futures pairs directly through TradingView’s charting and trading platform. The partnership addresses our users’ growing demand for seamless trading experiences that combine execution capabilities with advanced market analysis. TradingView, which is recognized for its comprehensive and powerful market analysis features, provides traders with professional charting tools, customizable indicators, and real-time…

Japan Moves to Mandate Liability Reserves for Crypto Exchanges

Introduction of stricter rules for crypto exchanges in Japan Japan is in the process of introducing significant changes to cryptocurrency regulation following renewed attention to Mt. Gox-related repayment activity in 2024. The Financial Services Agency (FSA) plans to introduce new rules requiring cryptocurrency exchanges to maintain special “liability reserves” to protect customers if their assets are lost due to hacks or unauthorized transfers. The measures aim to bring the cryptocurrency sector closer to the strict standards applied to traditional financial institutions in Japan, one of the world’s most heavily regulated…

TrustLinq Seeks to Solve Cryptocurrency’s Multi-Billion Dollar Usability Problem

December 9th, 2025 – Zug, Switzerland TrustLinq, a Swiss-regulated payments company, is addressing one of the most widely recognised problems in cryptocurrency: large amounts of crypto are held globally but cannot be used easily within the traditional financial system. The lack of a reliable and compliant path from crypto into global bank networks has left billions effectively inactive. TrustLinq provides a regulated infrastructure layer that enables cryptocurrency holdings to fund fiat-denominated transactions in more than 70 currencies through established settlement channels without the need of having a bank account. According…

Financial Giant BlackRock Files for Staked Ethereum Exchange-Traded Fund

The financial giant BlackRock wants to launch a new staked Ethereum (ETH) exchange-traded fund. The world’s largest asset manager has filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for the new “iShares Staked Ethereum Trust ETF,” which, if approved, would trade under the ticker “ETHB.” BlackRock says in the filing that it plans to stake 70-90% of the trust’s available Ethereum under normal market circumstances. “The trust’s staking program seeks to maximize the portion of the Trust’s ether available for staking while controlling for liquidity…

Top Crypto Exchanges in December 2025 – Year-End Rally and Record Volumes

Disclosure: This article contains affiliate links. If you click a link and make a purchase or sign up for a service, Bitcoin.com may receive a commission. Our editorial content is independent and based on objective analysis. As traders prepare for 2026, the top crypto exchanges 2025 continue to define what transparency, innovation, and security mean […] Source

Kraken Crypto Exchange Launches Elite Service Program for Wealthy Digital Asset Investors

Kraken introduces invitation-only VIP platform targeting ultra high net worth individuals with comprehensive premium crypto services. Kraken announced the public launch of its VIP program on December 4, 2025, designed for sophisticated traders and strategic capital allocators. The invitation-only service requires members to have either a $10 million average platform balance or $80 million in […] Source

Bitget Hints at ‘Wall Street’ Expansion, Moving Beyond Cryptocurrency Roots

Bitget, a Seychelles-based cryptocurrency exchange, has announced that it will expand its operations to include tokenized shares and commodities, such as gold. Bitget’s CMO, Ignacio Aguirre Franco, stated that the goal of this move was to attract customers who want to trade these assets without the constraints of traditional markets. Bitget to Debut Tokenized Stock […] Source

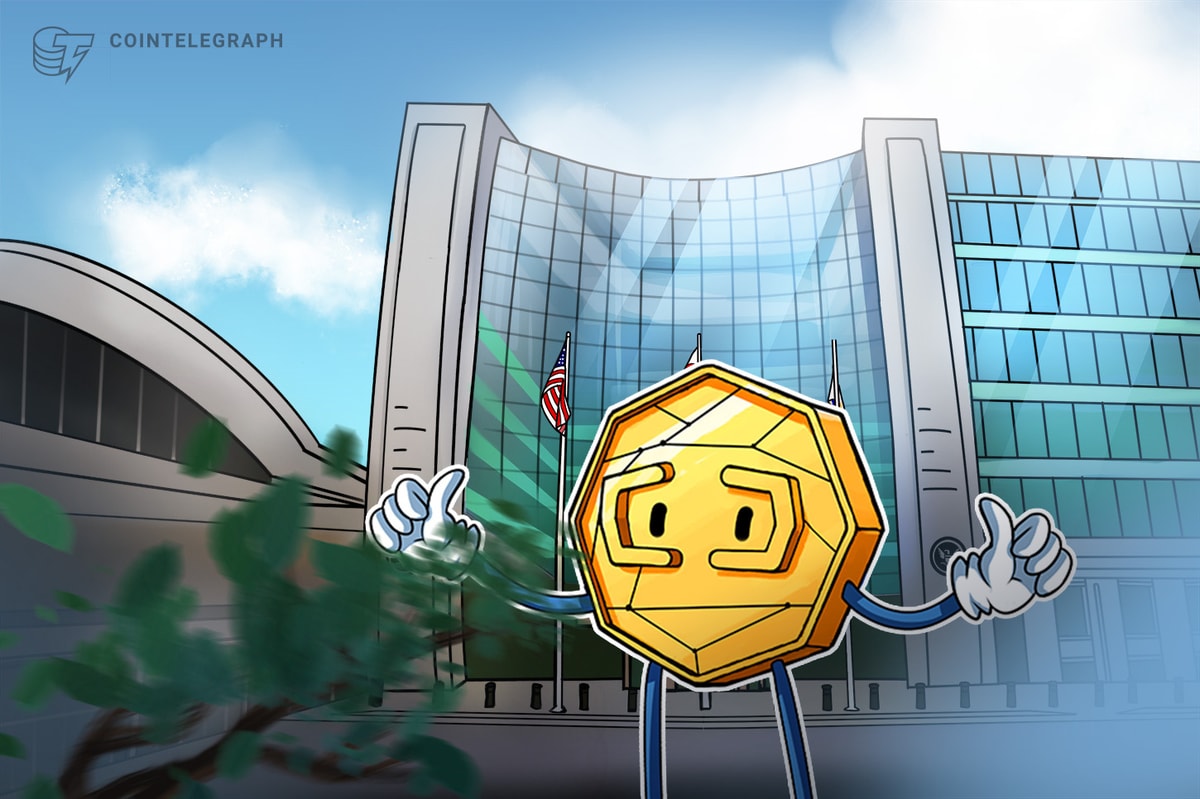

First-Ever Spot Crypto Trading Goes Live on a CFTC-Registered Exchange

Bitnomial has become the first U.S. exchange cleared to offer regulator-approved spot cryptocurrency products, marking a pivotal regulatory shift and a political tone change under President Trump’s crypto-friendly administration. CFTC Hails ‘Golden Age’ as Bitnomial Lists First Regulated Spot Crypto Products Bitnomial has officially entered the history books as the first U.S. exchange to list […] Source

CFTC Greenlights Spot Crypto Trading on US Exchanges

The US Commodity Futures Trading Commission has given approval for spot cryptocurrency products to trade on federally regulated futures exchanges. In a Thursday notice, Acting CFTC Chair Caroline Pham said the move was in response to policy directives from US President Donald Trump. She added that the approval followed recommendations by the President’s Working Group on Digital Asset Markets, engagement with the US Securities and Exchange Commission and consultations from the CFTC’s “Crypto Sprint” initiative. “[F]or the first time ever, spot crypto can trade on CFTC-registered exchanges that have been…