The Banking, Housing, and Urban Affairs Committee has been under the chairmanship of Sherrod Brown, the Ohio Democrat that the cryptocurrency industry spent tens of millions of dollars on defeating in this month’s elections. In his tenure, Brown allowed no significant legislative debate on digital assets legislation, though even as he ran the committee, Massachusetts Democrat Warren often managed to be the more prominent naysayer on crypto matters. Now that the Republicans won the Senate majority and will take the gavel, Warren confirmed she’ll step up as the ranking Democrat…

Category: ICO

Pro-Crypto President-Elect Donald Trump Paves Way for Innovation-Driven Regulations in the U.S.

Trump 2.0 and the bipartisan, pro-crypto Congress will usher in a brave new world for the crypto industry. A regulatory environment that encourages innovation, rather than stifles it, will finally give the institutions the confidence to enter the market. And entrepreneurs, no longer shackled by the threat of regulatory sanction or personal liability, will be free to focus on building. The future could not be brighter. Source

Bitcoin (BTC) Traders Make $100K Price Bets Through CME Options: CF Benchmarks

“Traders appear to be snapping up bitcoin call options at the $100k strike price. Per CF Benchmarks’ data, the 30-day constant maturity 25 delta skew has now breached the 5 vol threshold, a near YTD high, which implies that there is much greater demand for upside exposure,” Thomas Erdösi, head of product at CF Benchmarks, told CoinDesk in an email. Source

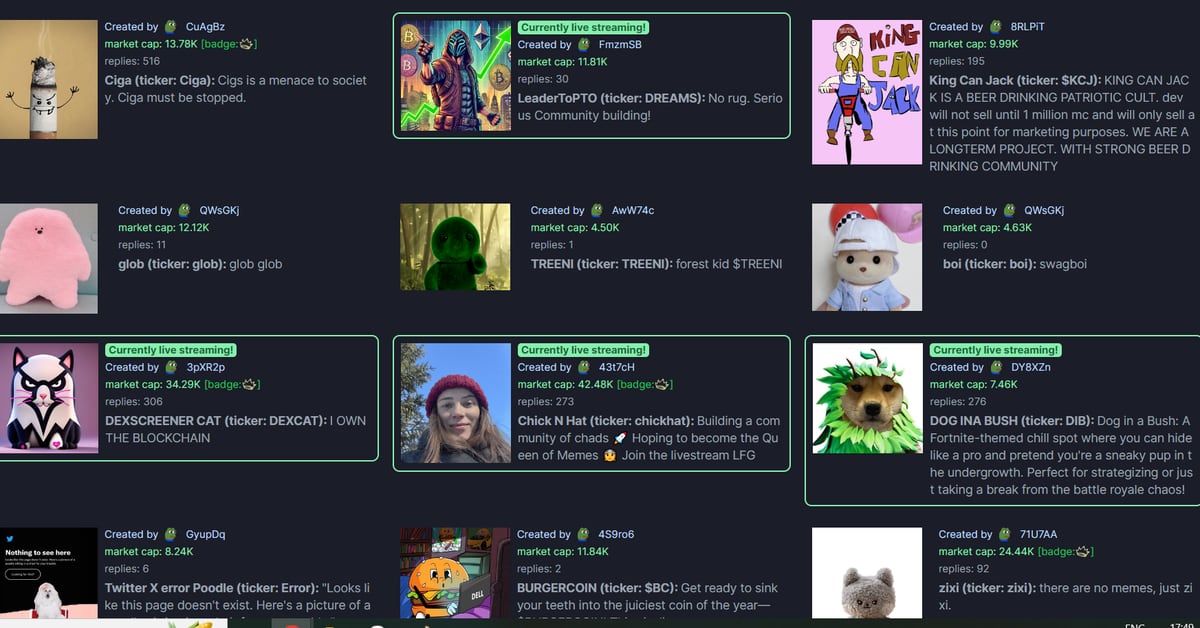

Profiting in A New Altcoin World

As the saying goes, “there’s a million ways to make a million dollars.” In altcoin trading, there are dozens or maybe hundreds of ways to approach the markets to make juicy returns. You can be a scalper, swing trader, yield farmer, airdrop hunter, new-launch sniper; the list goes on. Each of these approaches is getting tougher, though, for two overarching reasons: Source

BlackRock Expands Tokenized RWA Fund Beyond Ethereum to Aptos, Arbitrum, Avalanche, OP Mainnet, Polygon

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL), issued in partnership with tokenization platform Securitize, is now accessible on the Aptos, Arbitrum, Avalanche, Optimism’s OP Mainnet and Polygon networks, the company said on Wednesday. Source

Robinhood Adds SOL, PEPE, ADA, XRP Following Trump Victory

Robinhood adds SOL, PEPE, ADA, XRP, Coinbase adds PEPE Source

CoinDesk 20 Performance Update: HBAR Falls 11.4%, Leading Index Lower From Tuesday

Aptos and NEAR Protocol were the only gainers, each rising 1.7%. Source

Copper to Offer Custody Services For Tokenized Money Market Funds Such as BlackRock’s (BLK) BUIDL

Tokenized Treasuries are digital representations of U.S. government bonds and are at the forefront of the representation of real-world assets on blockchains, allowing them to be traded as tokens on networks such as Ethereum, Stellar, Solana and Mantle. Digital asset firms and TradFi heavyweights have been racing to put financial instruments such as government bonds, private credit and money market funds on blockchain rails, to achieve operational efficiencies and faster settlements. Source

Zero Gravity Labs Raises $40M for Decentralized AI Operating System

The seed round included contributions from Hack VC, Delphi Digital, OKX Ventures, Polygon and Animoca Brands. Source

Ether ETFs in the Black for the First Time After 5 Days of Inflows

After that, the ether ETFs did not enjoy the same response as their bitcoin equivalents had done in January. Grayscale’s Ethereum Trust (ETHE), which already had over $8 billion in assets at the time of listing, began experiencing outflows that were not offset by flows into the other funds. Source