Dogecoin (DOGE) and shiba inu (SHIB) led gains among majors with a price jump of as much as 30%, with DOGE flipping xrp (XRP) and stablecoin USDC late Sunday to become the sixth-largest token. DOGE has jumped on renewed endorsements by technology entrepreneur Elon Musk, pushing it 88% in the past 30 days. Source

Category: ICO

Solana (SOL) Price Hits Cycle High, Joins $100B Market Cap Club in Broad Crypto Rally

Solana achieved a remarkable comeback after the collapse of Sam Bankman-Fried’s FTX and Alameda Research in 2022, which was a key backer of the budding smart contract platform. The chain emerged as the go-to ecosystem for retail crypto users and a hotbed of this cycle’s memecoin craze, hosting for example the popular pump.fun protocol. Resurging decentralized finance (DeFi) activity also benefitted the network, making Solana’s on-chain trading ecosystem the third-most-profitable sector in crypto, a recent Coinbase report noted. The solana token was a standout among altcoins over the past year’s…

Dogecoin Flips XRP as Elon Musk-Linked Trade Keeps on Giving

DOGE prices zoomed a further 14% on Sunday, pushing the token above XRP to make it the seventh-largest by market capitalization. Source

ADA Rockets 35% as Charles Hoskinson Reveals Trump Crypto Policy Plans

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information have been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation.…

Bitcoin Smashes $79K in Bullish Weekend Pump, With $280M Bearish Bets Liquidated

Weekend pumps are considered bullish because they indicate broad interest and participation from smaller investors rather than just institutional players. Source

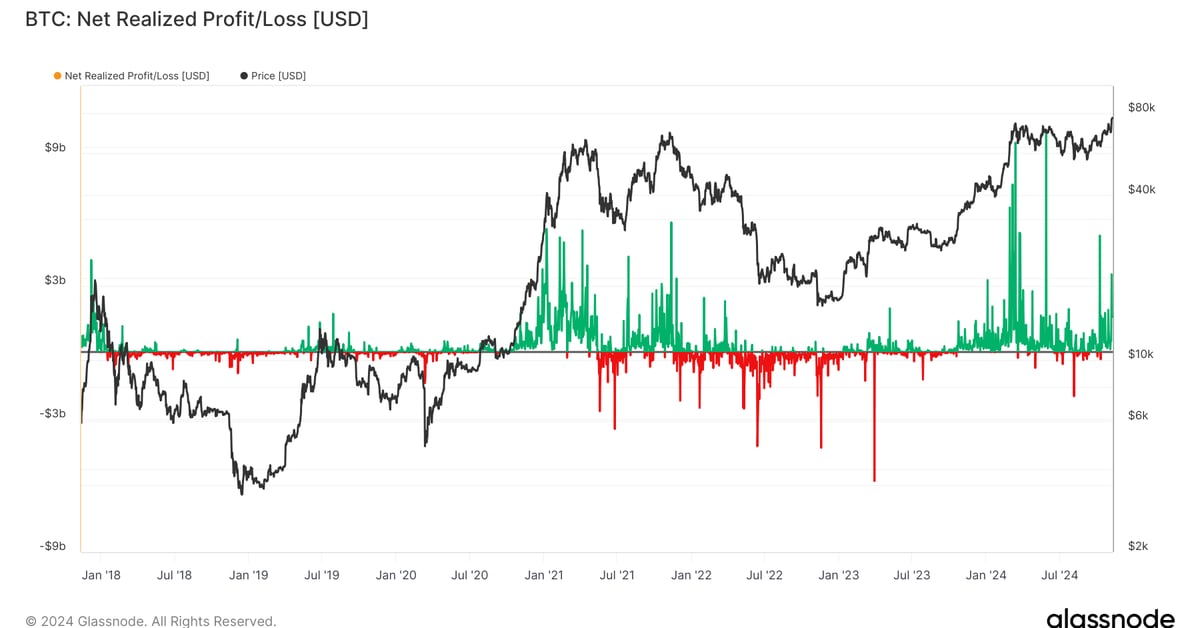

Why Bitcoin Will Soar Above Its Fresh Record: Van Straten

Even after breaking through $77,000 for the first time, bitcoin’s price looks very likely to keep soaring, CoinDesk senior analyst James Van Straten argues. Source

The Unique Way the Solana (SOL) Trading Ecosystem Is Making Bank

By the numbers: Tether’s USDT and Circle’s USDC stablecoins have produced $93 million and $28 million in revenue, respectively, in the last seven days, according to DefiLlama data, while the Ethereum, Tron and Solana networks saw $19 million, $11 million and $9.6 million. Solana-based protocols and trading bots, meanwhile, are right behind. Trading bot platform Photon and memecoin powerhouse pump.fun have both generated over $6 million in the last seven days, exceeding Ethereum-based decentralized finance, or DeFi, heavyweights such as Maker, Lido or Aave in terms of revenue. Source

Bitcoin (BTC) Price Tops $77K Record as Muted Funding Rates Suggest Crypto Rally Has More Room to Run

While crypto assets booked double-digit gains during this week, with BTC sitting at record highs, funding rates for perpetual swaps on crypto exchanges are much closer to neutral levels than the market top in early March, CoinGlass data shows. Funding rate refers to the amount long traders pay shorts to take the opposite side of a trade. When funding rates are negative, shorts pay the fee to longs, as this relationship often occurs during bearish periods. Source

Tether (USDT) Enters Oil Trade Finance by Financing $45M Middle Eastern Commodity Deal

“This transaction marks the beginning, as we look to support a broader range of commodities and industries,” Tether CEO Paolo Ardoino said in a statement. “With USDT, we’re bringing efficiency and speed to markets that have historically relied on slower, more costly payment structures.” Source

Ethereum Foundation's Treasury Shrunk 39% Over 2 1/2 Years to $970M

TKTK Source