“Chain unification is inevitable — like ACH or SWIFT for crypto,” said Sean Li, CEO of Magic Labs, in a press release shared with CoinDesk. “Developers can build user experiences that eliminate barriers. Users should only care about transaction cost and speed, not the chain. Eliminating UX barriers will unlock the best use cases.” Source

Category: ICO

Bitcoin Spikes to a New Record High, While Ether and Solana Rally Ahead of FOMC

“Beyond … bitcoin pushing to a fresh record high, the market should perhaps be paying attention to what could be a more bullish development,” Joel Kruger, market strategist at LMAX Group, said in a Thursday market update. “The crypto market is looking for a resurgence in the decentralized finance space, with Ethereum playing an important part in this initiative.” Source

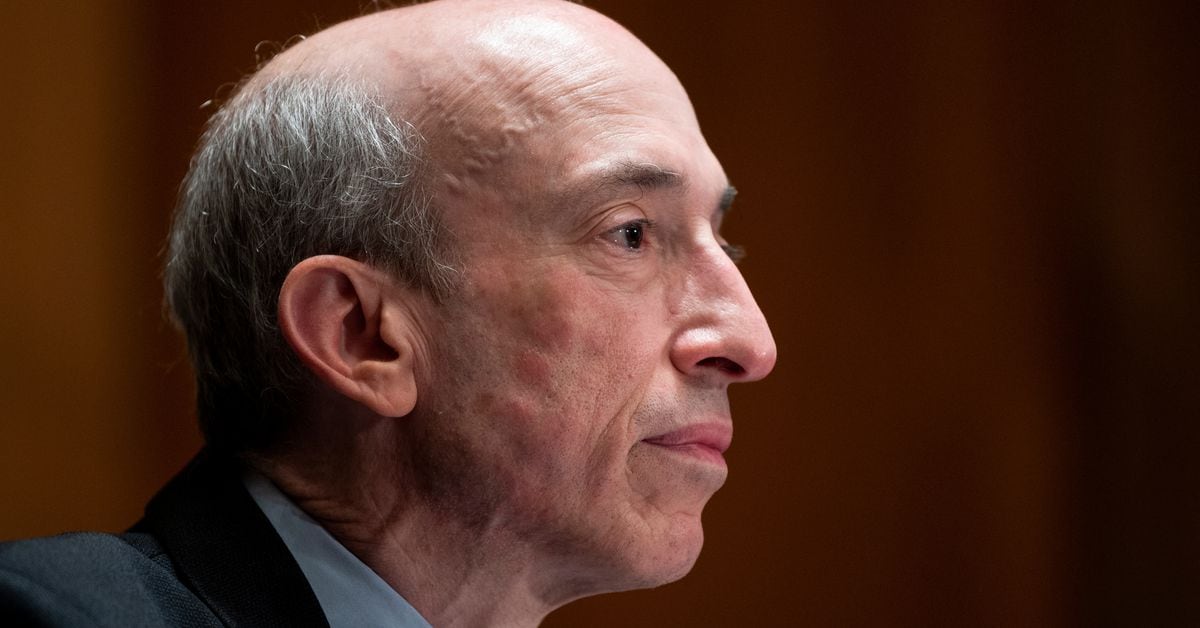

Here’s How Quickly Gary Gensler Could Lose His SEC Chair Gig Under Trump

Gensler has been on the forefront of those actions, being openly skeptical of cryptocurrencies. Just last month, he reiterated his views haven’t changed. Speaking at NYU’s School of Law in Manhattan in October, he said: “With all respect, the leading lights of this field in 202[4] are either in jail or awaiting extradition right now.” Source

We’ve Been Thinking About Blockchains Wrong. They’re About Time, Not Money

The good news is it’s not too late. We need to look past the allure of financialization and remember that blockchains, as universal timekeepers, can do so much more. The possibilities are almost unlimited. We can enable strangers on different continents to share information and ideas securely, transparently, trustlessly. We can use our favorite apps that have become essential to our lives – but without the anxiety that we might be tracked and listened to. We can chat with strangers on the Internet and enjoy online news with full certainty…

French Regulator Says It’s ‘Examining’ Polymarket

The scrutiny comes after a French national, known only by his first name, Theo, profited handsomely on Polymarket by placing large, and ultimately correct, bets that Donald Trump would win the U.S. presidential election, despite polls that indicated the contest with Kamala Harris would be a toss-up. According to the Wall Street Journal, Theo is set to make $50 million on his trades. Source

Market Impact and Policy Shifts

On election night, Nov. 5, bitcoin surged to an all-time high, breaking past $75,000 as Trump claimed victory. With a Republican sweep across Congress, this outcome is seen by the crypto community as the most favorable result for digital assets. Trump’s vocal support for crypto, along with his criticism of the SEC’s restrictive stance, has fueled expectations for a regulatory landscape that encourages innovation and growth. The market’s swift reaction, even before the race was called, underscores crypto’s role as a 24/7 barometer of major events. Source

The Fed Is Set to Cut Rates, Boosting the Outlook for Crypto

In March 2022, the Fed started raising interest rates due to the economic distortions it saw. We looked at the same aberrations above in labor, inflation, and economic output. However, now, all those measures have returned back to normal. Yet, monetary policy has not. So, like I said at the start, don’t be surprised when policymakers cut rates later this week and even more moving forward. And as this happens, it should support more stability in economic growth and underpin a steady rally in crypto investments like bitcoin and ether.…

Former FTX CTO Gary Wang Asks Court for No Jail Time

“Unlike Singh, [Wang] did not engage in money laundering or participate in the straw donor scheme. Unlike Singh, [Wang] did not generate false revenue, code a fake insurance fund, try to persuade Bankman-Fried to fraudulently conceal his loans, or otherwise participate in affirmatively deceptive conduct. And, unlike Singh, [Wang] did not receive cash bonuses or spend FTX proceeds on real estate or other extravagant goods,” Wang’s lawyers wrote. “All of these factors combine to make him meaningfully less culpable than Singh.” Source

Trump Family-Backed Crypto Project Makes $1M in ETH Profit Following Tame WLFI Token Sale

But it’s not all doom and gloom for World Liberty Financial as ether (ETH) has risen by more than 16% since 01:00 UTC on Wednesday, turning the paltry $15.3 million it has raised, into $16.25 million. Etherscan shows that the token sale wallet has not liquidated any tokens and that it currently holds 4,234 ETH and $4.2 million worth of stablecoins. Source

UK Lords Echo Support for Digital Assets Property Bill

“It supports our efforts to ensure that our jurisdiction remains at the forefront globally, providing a flexible legal framework that can react to the dynamic nature of digital assets and other emerging technologies,” Lord Frederick Ponsonby of Shulbrede said during the debate. Source