The disclosure comes nearly a year after CoinDesk broke the news that Kraken was considering its own layer-2 network, following the runaway success enjoyed by Base after it launched in mid-2023. Source

Category: ICO

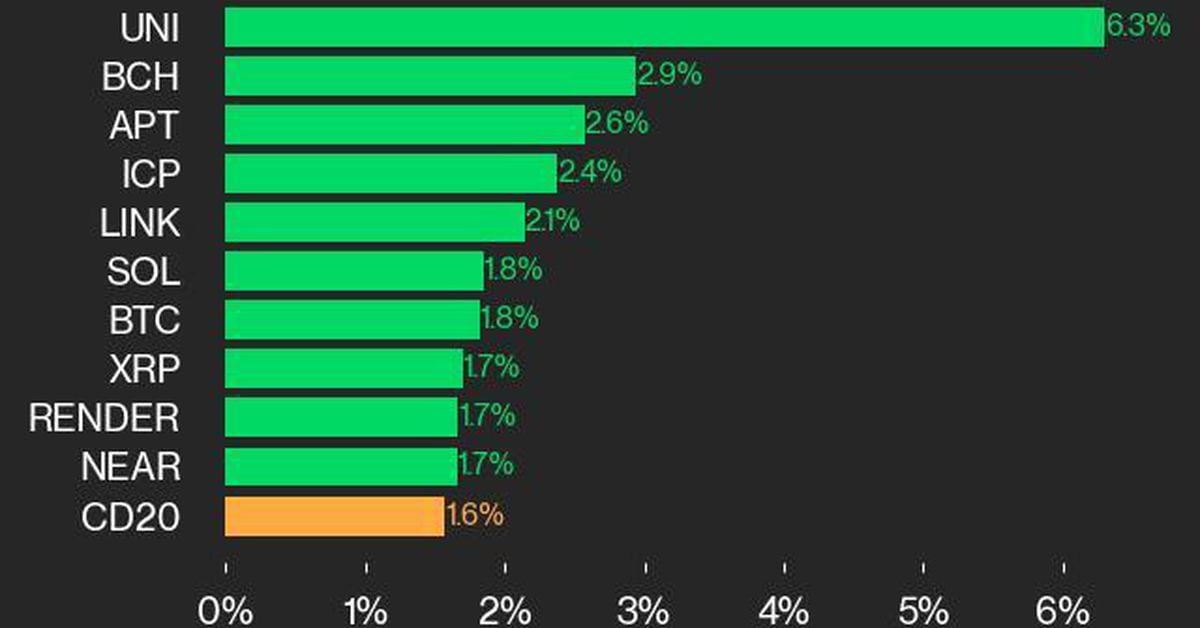

CoinDesk 20 Performance Update: UNI Gains 6.3% as Nearly All Index Constituents Trade Higher

Bitcoin Cash was also among the top performers, gaining 2.9% since Wednesday. Source

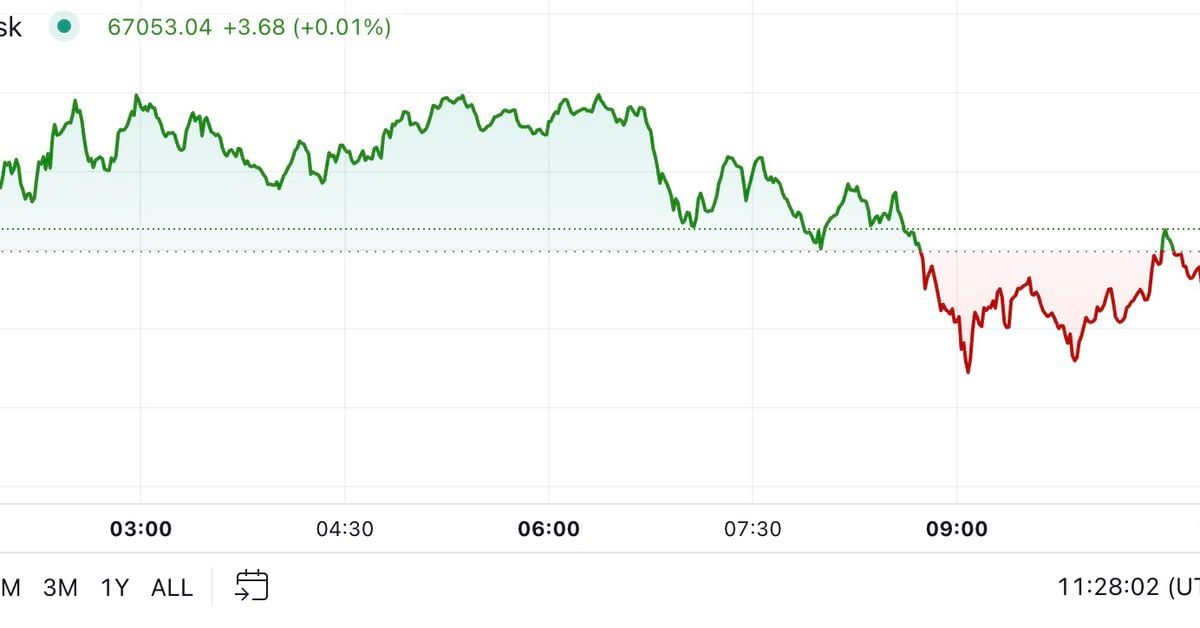

BTC Rebounds to $67K After Subdued U.S. Economic Data Reading

The number of so-called whales or network entities owning at least 1,000 BTC jumped to 1,678 early this week, reaching the highest since January 2021, according to data tracked by Glassnode and Bitwise. The growing accumulation by large holders alongside solid uptake for alternative vehicles, especially the U.S.-listed spot ETFs, suggests increasing confidence in bitcoin’s price prospects. Meanwhile, retail investor accumulation has slowed, with the cryptocurrency’s price nearing $70,000, according to analytics firm CryptoQuant.”Retail holdings have risen by just 1K Bitcoin in the last thirty days, a historically slow pace,”…

Solana (SOL) Looks Overbought Against Ethereum (ETH); BTC-Gold (XAU) Ratio Stuck in a Downtrend

Some savvy traders see an overbought RSI, especially on longer duration charts, as a sign of bullish solid momentum or evidence of the path of least resistance being on the higher side. As the adage goes, the RSI can stay overbought longer than bears can stay solvent. Source

Prosecutors Defend Nishad Singh Saying He Provided ‘Substantial Assistance’ in FTX Investigation

“Singh also brought to the Government’s attention criminal conduct that the Government was not aware of and, in some cases, may have never discovered but for Singh’s cooperation. That included information about Bankman-Fried and [Ryan] Salame engaging in one of the largest-ever campaign finance schemes, and instances when Bankman-Fried manipulated FTX’s financials to make its revenue appear greater,” it stated. Source

Swiss Crypto Trading Firm Portofino Sees Staff Exodus After Exec Firings

Both Portofino’s chief operating officer and co-founder, Alex Casimo, and chief financial officer, Jae Park, were fired in July. This then triggered the resignations of Vincent Prieur, the head of strategy and operations, and Shane O’Callaghan, the global head of business development, as well as a significant number of the firm’s staff. Source

Trader Warns of Correction as BTC Dominance Reaches 2021 Levels

“Ethereum continues to lose market share to bitcoin and other altcoins. As a result, BTC’s share of all cryptocurrency capitalization has risen to 57.3%, the highest since April 2021,” Alex Kuptsikevich, senior market analyst at FxPro told CoinDesk in an email. “But that doesn’t necessarily mean an upward trend for the top cryptocurrency, which has pulled back below $67K, losing 1% in the last day and nearly 4% from its peak on 21 October. Source

Statement in response to the introduction of the Data Use and Access Bill in the House of Lords

John Edwards, Information Commissioner said: “We welcome the introduction of the Data Use and Access Bill in the House of Lords and look forward to seeing it progress through parliament to Royal Assent. This is an important piece of legislation which will allow my office to continue to operate as a trusted, fair and independent regulator and provide certainty for all organisations as they innovate and promote the UK economy. “Our response to the bill will be published in due course.” Source

On Derive’s Options Market, Institution Takes $25M Hedge Bet on BTC Price Action Spurred by U.S. Election

“This $25 million options trade marks a watershed moment for onchain options trading, and it’s one that could have significant implications post-election. The institution has strategically positioned a unique structure with sold puts, bought calls, and eBTC collateral, potentially standing to make $1,020,000 on the structure if BTC hits $80,000 by November 29 – excluding any gains from the eBTC collateral,” Nick Forster, co-founder of Derive told CoinDesk in an email. Source

I’ve Personally Been Debanked Because of My Crypto Ties

“They said, ‘You have five days to move your money,” he said. “They were actually super honest. They’re like, ‘Look, you are a notable person in crypto, and having notable people in crypto, and banking the crypto industry means more scrutiny from federal regulators.” Source