Internet Computer was the only gainer, rising 2.3% from Tuesday. Source

Category: ICO

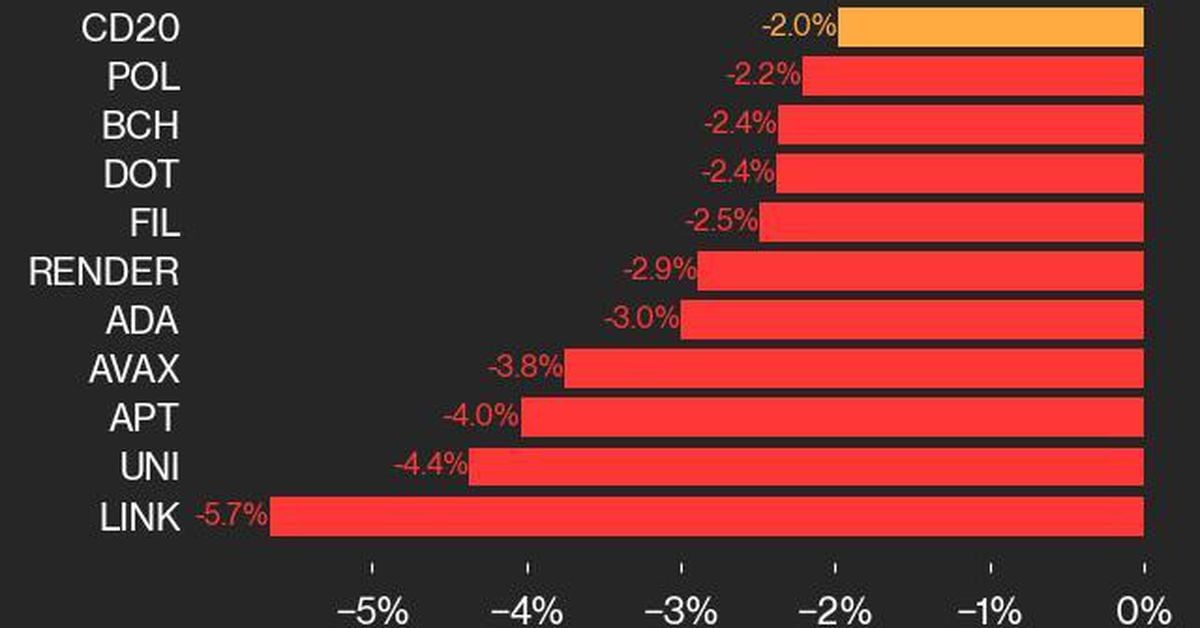

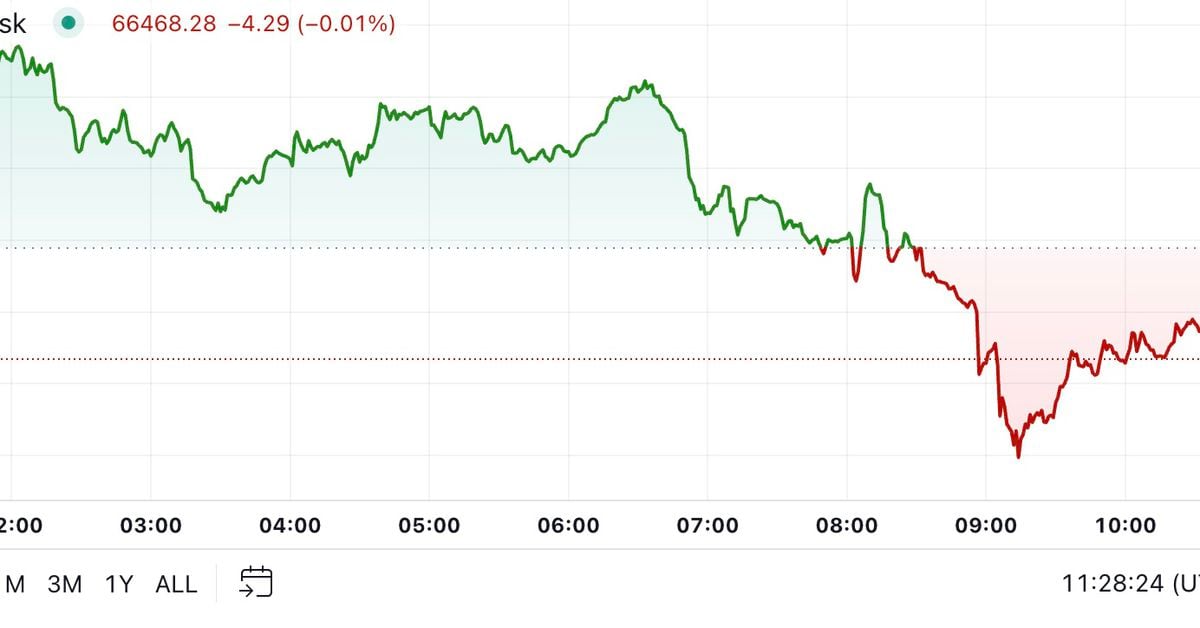

BTC’s Fall Below $67K Prompts Broad Market Dip

Bitcoin slid below $67,000, prompting a broad decline across the major cryptocurrencies. BTC dropped under $66,500 during the late European morning, around 1.3% lower in the last 24 hours. The broader digital asset market, as measured by the CoinDesk 20 Index, has fallen just over 1.5%. Bitcoin ETFs snapped a seven-day winning streak on Tuesday, losing nearly $80 million. DOGE led the losses among major tokens, falling 3.8%, while ETH and XRP both lost around 1.5%. DOGE had led gains in the previous seven days following a recent endorsement by…

Binance’s Gambaryan Free to Leave Nigeria for Medical Treatment After Money Laundering Charges Dropped: Reports

During his time in prison Gambaryan, a U.S. citizen, developed malaria, pneumonia and tonsillitis.But he was also suffering from complications tied to a herniated disc in his back which left him in need of a wheelchair – though in a video from his last court appearance, Gambaryan did not have a wheelchair and instead had to struggle on a single crutch, CoinDesk reported earlier. Source

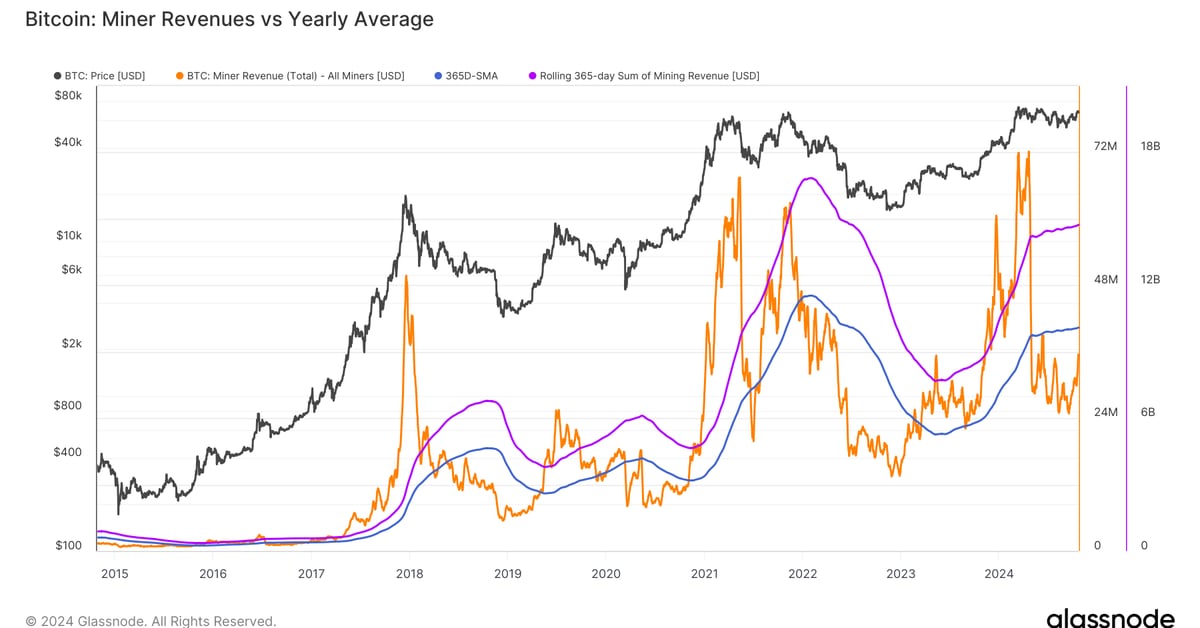

Bitcoin (BTC) Mining Difficulty Hits All-Time High as Hashrate Surges

From November 2023 to July 2024, we saw over 30,000 bitcoin leave miner wallets, one of the longest distribution periods from miners on record. However, we can now observe that since July, miner balances have been relatively flat and have shown signs of accumulation, telling us remaining miners on average can handle the new environment. Source

Why Partisia’s Blockchain May Be Uniquely Placed to Solve the Data Privacy Issue

“Partisia was founded to tackle a critical ‘real world’ challenge: enabling collaboration on sensitive data without compromising privacy,” Youngman said. “Our blockchain draws on decades of cryptographic expertise from pioneers like Ivan Damgård allowing us to build solutions that not only overcome barriers to real-world adoption but also create entirely new business models, giving individuals and enterprises unprecedented control over their data.” Source

Who's Afraid of Gary Gensler? Not Don Wilson, the Trader Who Beat the Regulator Once Before

Gensler’s SEC has been vague about how crypto firms can register to legally trade digital assets in the U.S. Chicago-based markets giant Don Wilson thinks that’s a strategy, not an accident. Source

Bitcoin’s (BTC) Impending Golden Cross and Overhyped Concerns of Rising U.S. Treasury Yields

“Central banks think policy is tight and want to cut gradually. If employment cracks, they will cut fast. If employment bounces, they will cut less. Two months ago, bonds were pricing a strong possibility of falling behind the curve. Now the recession skew is gone, yields are up. That is not bearish risk assets and it doesn’t mean the Fed has screwed up,” Dario Perkins, managing direction, global macro at TS Lombard, said in a note to clients on Oct. 17. Source

MakerDAO Contemplates Dropping SKY as Community Debates

Christensen wrote that three proposals are being considered to address community concerns: continue with Sky as the core brand to build on its recent momentum, recenter the Maker brand with its original identity and reinstate MKR as the sole governance token, or bring Maker back with a refreshed brand that aligns with the current ecosystem while maintaining its established trust and stability. Source

Andy Barr’s ‘Vision’ for House Financial Services

“We have serious people working in financial innovation that can create a lot of jobs, generate wealth, cement America even more as the world’s financial juggernaut,” he said. “But there are pitfalls, and there are things to watch out for, and regulators and lawmakers need to make sure we’re building a foundation, but not an overly prescriptive set of rules. So I think it’s hard to sit here and not get excited about some of the innovation that’s happening, but at the same time, how are we going to regulate…

Tether (USDT) CEO Ardoino Says He Expects U.S. Will Catch Up in Crypto Regulation

“There is no place like the U.S.,” he said via video link at DC Fintech Week in Washington. “I think it’s very, very important that sensible crypto regulations and stablecoin regulations will come to fruition in a way that will protect the end users,” he said, predicting that would happen in the U.S. Source