Non-U.S. investors were subject to local regulations before being whitelisted, founders Zachary Folkman and Chase Herro said on the spaces call. Several notable crypto figures attended the spaces including Stani Kulechov, founder of Aave, Sandy Peng, co-founder layer-2 network Scroll and Luke Pearson, senior research cryptographer, Polychain Capital. Source

Category: ICO

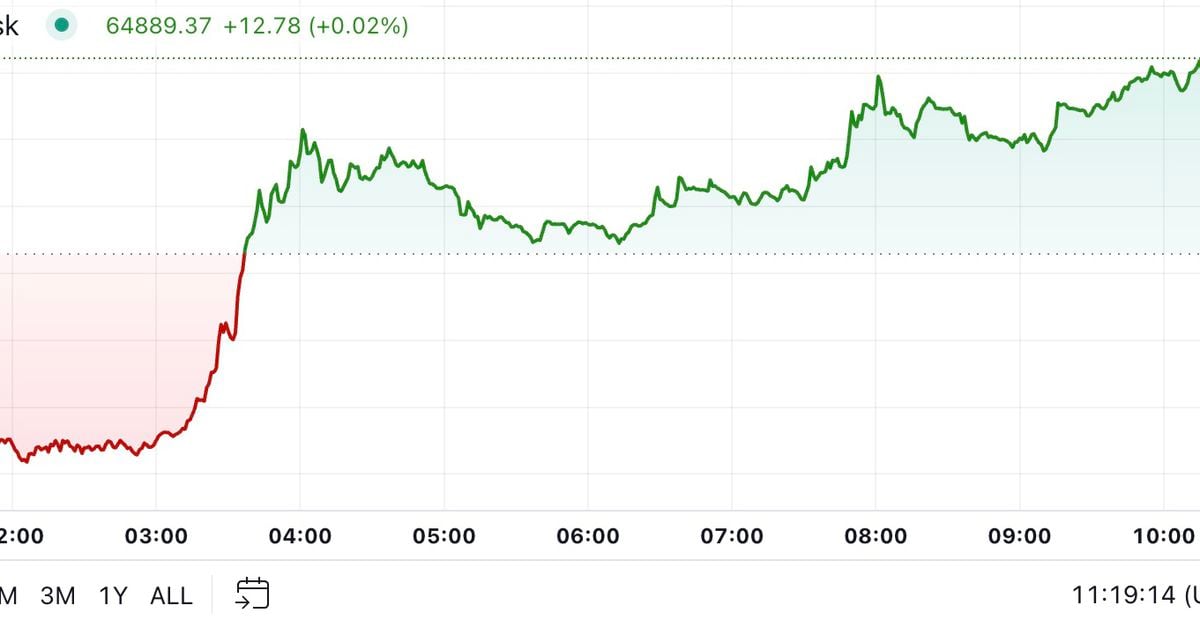

Bitcoin Nears $65K as Chinese Stocks Rebound

Bitcoin moved to near $65,000 after Chinese stocks shrugged off mixed reactions to stimulus plans to finish the day higher. BTC traded at nearly $64,900 during the late European morning, over 3.4% higher in the last 24 hours. The broader digital asset market, as measured by the CoinDesk 20 Index, has risen about 2.9%. Latest announcements from the Chinese government regarding stimulus plans fell short of expectations, but the Shanghai Composite Index still closed the day over 2% higher. “Chinese equities rebounded off the weekend disappointments, so risk sentiment will…

Crypto Custodian Copper Appoints Former SEC Advisor Amar Kuchinad as New Global CEO

Former CEO Dmitry Tokarev will continue as the board’s founder director. Source

Samara Asset Group Plans $32.8M Bond to Expand Bitcoin (BTC) Holdings

Patrik Lowry, CEO of Samara, emphasized the importance of the bond, saying, ““The proceeds will allow Samara to further expand and solidify its already robust balance sheet as we diversify into new emerging technologies through new fund investments. With Bitcoin as our primary treasury reserve asset, we also enhance our liquidity position with bond proceeds.”. Source

Crypto Neobank Banq’s Bankruptcy Case Dismissed by U.S. Judge

N9’s lawsuit also alleges that Jiles, in his capacity as Banq’s chair, failed to create a non-compete agreement with former Banq CEO Scott Purcell, instead only putting one in place between Purcell and Prime Trust. N9 claims in the lawsuit that Jiles leveraged his control over Banq to benefit Prime Trust, prioritizing its interests and leading to Banq’s downfall. Source

Altcoin Selling Pressure Looms as $500M in Token Unlocks Scheduled This Week

The 37 million WLD emission, representing the rate at which new tokens are created over time, will increase the token supply by 7%. The tokens will be distributed to team members, advisors, and investors. Initially, these early contributors’ WLD tokens were intended to be subject to a three-year lock-up schedule, which was extended to a five-year schedule in July. Source

Ethena Labs Proposes SOL for USDe’s Collateral

If the proposal is approved by Ethena’s Risk Committee – which is independent of Ethena Labs – SOL will be gradually integrated as a collateral asset for USDe, with an initial allocation target of $100-200 million in SOL positions. This initial allocation would represent roughly 5-10% of SOL’s open interest, similar to its 3% stake in BTC’s global open interest and 9% in ETH. Source

Bitcoin (BTC) Price Bounces 7% to $63K as Crypto Traders Eye China Stimulus Update

Bitcoin, the leading crypto asset by market capitalization, shot up 7% from Thursday’s trough below $59,000 after the hotter U.S. CPI inflation report, bucking this week’s trend of giving up gains during the U.S. trading hours. Recently, BTC was up 5.5% over the past 24 hours, outperforming the broad-market CoinDesk 20 Index’s (CD20) 4.7% advance. Source

Donald Trump-Supported Crypto Project World Liberty Financial (WLFI) to Start Token Sale Next Week

Members of the Trump family, including Donald Trump, publicly championed the project on social media, with the former president being titled as “Chief Crypto Advocate” Two of his sons, Eric Trump and Donald Trump Jr., are involved as “Web3 Ambassadors,” while his other son Barron Trump is listed as “DeFi Visionary.” Source

Arkham (ARKM) Token’s Price Soars 16% on Report of Planning Derivatives Exchange

The crypto derivatives market has booked $3 trillion trading volumes last month, more than double of the size of the spot market, according to a CCData report. The implosion of FTX, however, dealt a significant blow to the sector, while market leader Binance’s dominance sank to a four-year in September. Source