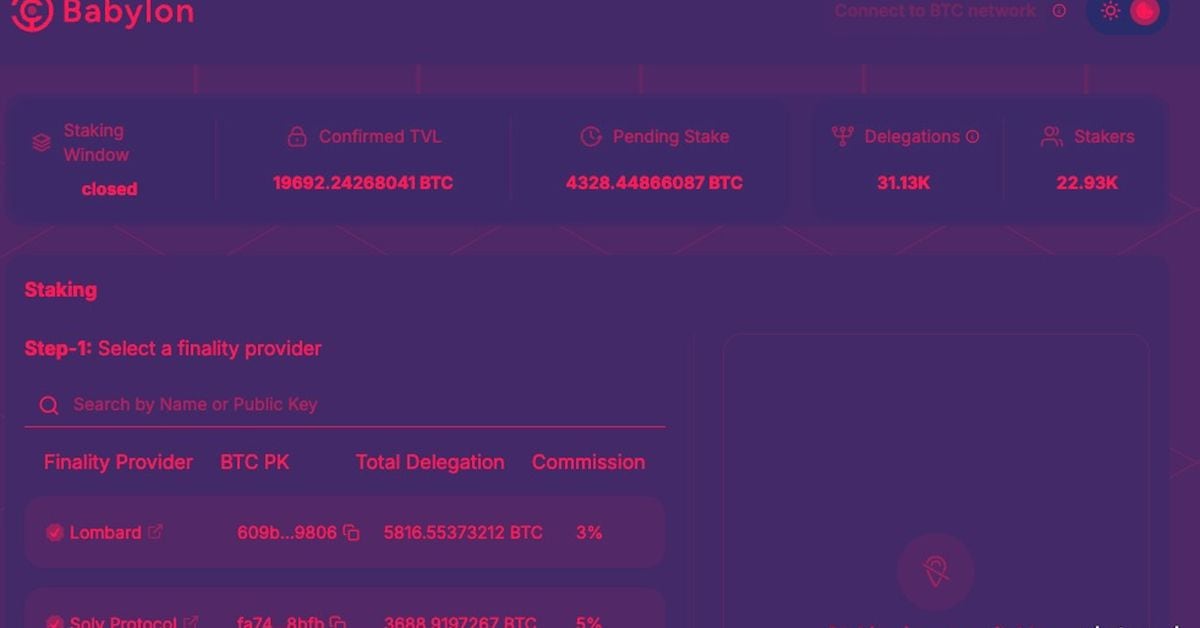

Babylon, a Bitcoin staking platform billed as a new way of providing the original blockchain’s security to new protocols and decentralized applications, pulled in about $1.5 billion worth of bitcoin on Tuesday after briefly opening to additional deposits. Source

Category: ICO

Crypto’s Token Lockup Orthodoxy Is a Scam

The dominant model of token distribution in the crypto space these days is the so-called “low-float, high FDV” launch. In this model, projects launch with a low fraction of the total supply in circulation, where most of the supply is locked, typically unlocking gradually after a year. This low circulation is often coupled with, and perhaps even explicitly designed to encourage, a high fully-diluted valuation. According to research by CoinGecko, today nearly a quarter of the industry’s top tokens are low float. Notable recent launches which used this model include…

Solana’s SOL Is ‘Richly Valued’ Versus Ether Price, But Could Still Outperform If Trump Gets Elected: Standard Chartered

SOL’s ratio of market capitalization versus network fee revenues is 250, more than double than ETH’s 121. Solana’s supply grows around 5.5% annually, while ETH’s token inflation rate stands around 0.5% a year, they added. Higher inflation means that SOL’s real staking yield is 1%, compared to ETH’s 2.3%. Meanwhile, 38% of all established developers in the blockchain industry work on the Ethereum ecosystem, with Solana claiming a 9% share. Source

Dollar-Cost Averaging a Favorite of Crypto Investors

“This difference might indicate that lower-income investors need more support with investment decisions, including maintaining regular contributions and sticking to a trading decision without emotional influence,” the report said. “Lower-income investors most often choose riskier strategies like trying to time the market,” the report added, noting that respondents making less than $75,000 tend to prefer that strategy instead of dollar-cost averaging, whereas the vast majority of respondents making more than $150,000 privileged the more cautious route. Source

Binance, FalconX and the Curious Case of 1.35M Missing Solana Tokens

Binance, FalconX and the Curious Case of 1.35M Missing Solana Tokens Source

Layer-2 Scroll Shares Plans for SCR Token Airdrop

The team said that the SCR token would be the first step in its roadmap to decentralization. Source

Satoshi’s Identity Won’t Be Revealed and That’s A Good Thing

For years, journalists, bloggers, and filmmakers have tried to uncover Satoshi’s identity, with the latest attempt coming from HBO’s Money Electric: The Bitcoin Mystery (scheduled to air 9 p.m. ET October 8). So far, none have succeeded. Yet the adoption of bitcoin around the world has continued unabated. Bitcoin was always meant to be bigger than one person. The fact that its creator had gone to great lengths to hide his or her identity was always meant to reinforce its decentralized ethos. Source

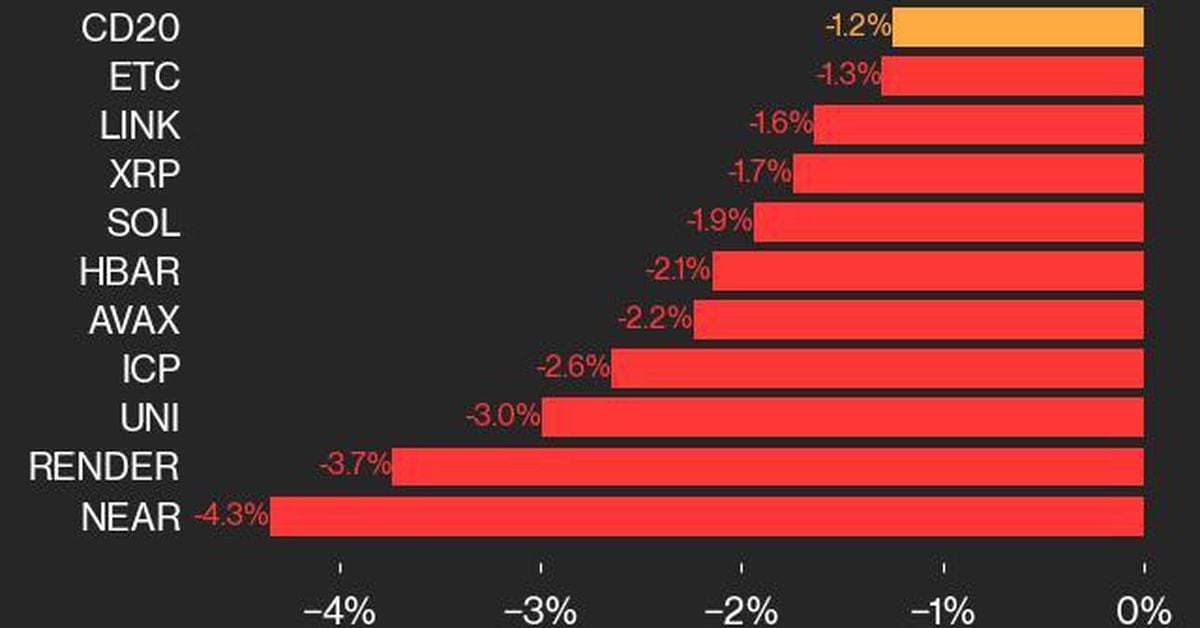

CoinDesk 20 Performance Update: Index Drops 1.2%, With NEAR and RENDER Posting Biggest Declines

Aptos bucked the trend, rising 2.7% despite the broader index decline. Source

Crypto.com Sues SEC, Chair Gary Gensler After Receiving Wells Notice

Crypto.com’s filing “seeks declaratory and injunctive relief to prevent the Securities and Exchange Commission (‘SEC’) from unlawfully expanding its jurisdiction to cover secondary-market sales of certain network tokens sold on Crypto.com’s platform,” the suit said. Source

RWA Issuer Midas Expands Tokenized Products to Retail Users with Regulatory Nod in Europe

Along with the success of T-bill tokens, new types of yield-bearing tokenized products emerged such as Ethena’s USDe “synthetic dollar,” which generates yield from market neutral trading positions also known as the “basis” trade. Midas launched its own version with mBASIS earlier this year, and has over $4 million of assets under management. Source