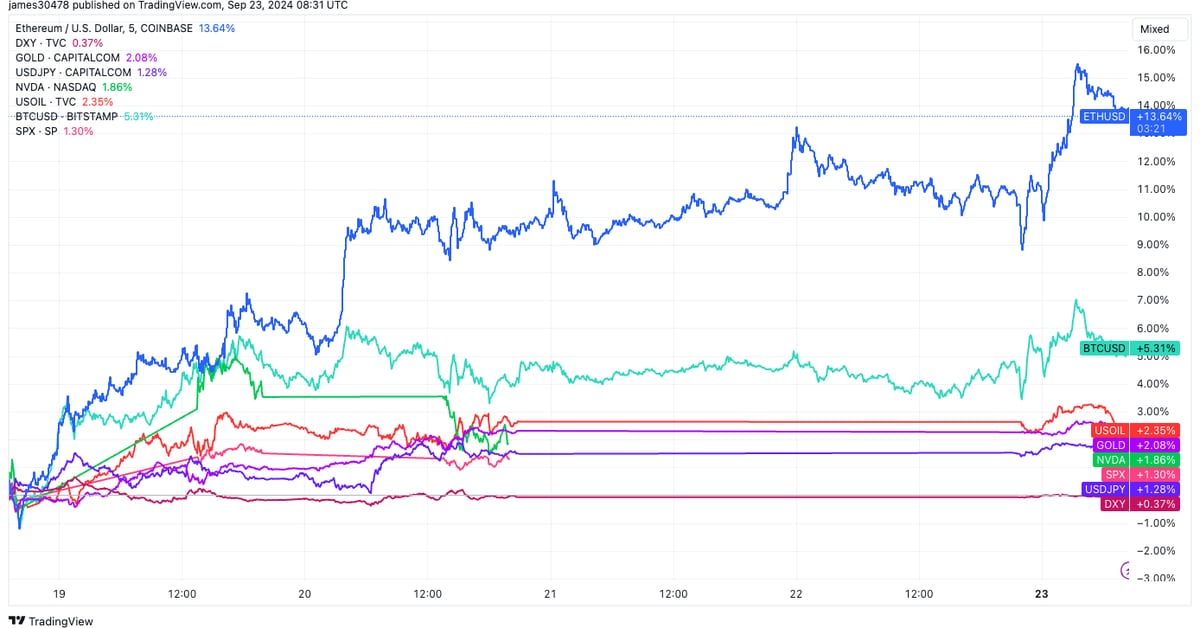

Following the FOMC decision, several key macro assets have reacted positively. The U.S. Dollar Index (DXY) rose by 0.36%, pushing the index back above 101, a level widely regarded as vital. Meanwhile, the USD/JPY exchange rate, which had dropped to around 141 just before the Fed’s announcement, has since climbed to approximately 143.5. The weakening yen has further bolstered risk-on assets, including cryptocurrencies. Source

Category: ICO

Core Scientific, on Cusp of Becoming a Major Force in AI Hosting, Initiated at Buy: Canaccord

The broker started coverage of the bitcoin miner with a buy rating and a $16 price target. Source

Is Canada Giving up on Retail CBDC Completely?

Particularly because the Bank also said it would “continue to monitor global retail CBDC developments and publish some related research,” there would “be further opportunities for Canadians to provide input on a potential digital dollar,” and that all the research done so far would be “invaluable if, at some point in the future, Canadians … decide they want or need a digital Canadian dollar.” Source

Harris Says Her White House Will ‘Invest in America’s Future’ Which Includes ‘Digital Assets’

“To build that opportunity economy, I will bring together labor, small business, founders and innovators, and major companies. We will partner together to invest in America’s competitiveness, to invest in America’s future,” Bloomberg quoted Harris as saying. “We will encourage innovative technologies like AI and digital assets while protecting consumers and investors. We will create a safe business environment with consistent and transparent rules of the road.” Source

Bitcoin (BTC) Price and Hashrate Divergence May Set the Scene for a Potential Rally, Historical Data Shows

Consistent with this pattern, bitcoin has already shown signs of recovery, gaining about $9,000 since the local bottom on Sept. 6, representing a 15% increase in value. This divergence between bitcoin’s (BTC) price and its hash rate started to shape up in July and then persisted into early September, when the computing power of the network reached an all-time high of 693 exahashes per second (EH/s) on a seven-day moving average, while bitcoin’s price was near $54,000. Source

The Next Stage for Public Good Funding in Crypto

Companies such as Uniswap, Optimism, Yearn, Gnosis, and 1Inch are examples of early Gitcoin grantees. The collective market caps of those that launched tokens, alongside the private valuations of others that raised capital without live tokens, far exceed the amount of funding initially provided. While many of these companies have given back to the ecosystem by donating to public goods, raising new funds for future rounds remains a challenge. This is especially true during bear markets, when capital is scarce, and venture funding is harder to secure. Source

Why We Won’t See CBDCs Everywhere

So, I understand why, if you view CBDCs as a tool to bring these costs down, you’d favor pushing along their development. But the fact remains that to fix cross-border payments through CBDCs, you’d need to rely on solid worldwide geopolitical relationships. And, unfortunately, we don’t have those. The world is too fragmented, too unruly, to allow CBDCs to be implemented globally. Source

Iggy Azalea to Release Online Casino Motherland in Boost for MOTHER Token

The online casino and gaming platform will be released in November. Source

Prediction Markets Go to Washington(‘s Appeals Court)

As of the time I’m writing this, the contracts are still halted. The appeals court scheduled a hearing for Thursday, giving each party 15 minutes to make its case – though ultimately it ran for some 2.5 hours. We’ll presumably find out if the contracts can restart before the election happens after the hearing, but there’s no firm timeline here. And of course, there’s still the broader question about the appeal itself and how that may go. Source

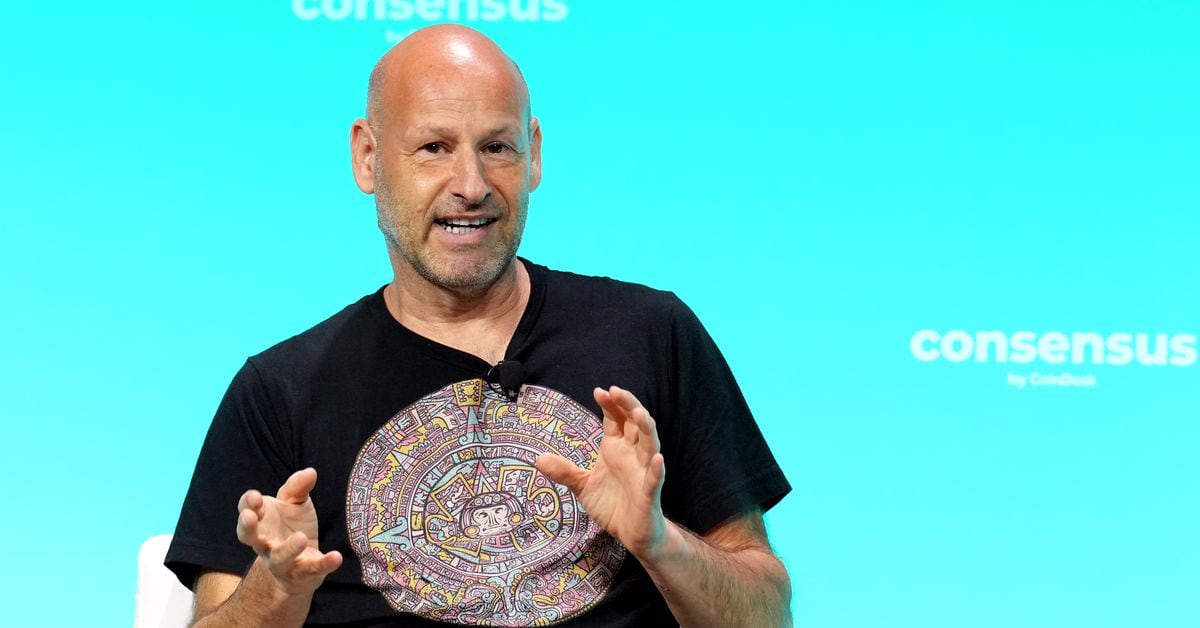

Consensys’ ETH Suit Against U.S. SEC Dismissed by Texas Court

Judge Reed O’Connor of the U.S. District Court for the Northern District of Texas noted in a Thursday filing that “because withholding consideration subjects plaintiff to scant, if any, hardship, the claim lacks a ripe case or controversy.” In other words, since there’s no clear future threat to Consensys, there’s no point in this judge weighing in. Source