Bitcoin’s projected climb gained fresh momentum as Ripple CEO Brad Garlinghouse and Binance CEO Richard Teng voiced bullish long-term expectations, reinforcing broad confidence that the asset could push higher amid strengthening market structure and growing institutional participation. Industry Leaders Share Bullish Bitcoin Targets Bitcoin’s long-term momentum continues to draw bullish outlooks from major industry leaders […] Original

Category: Bitcoin News

Bitcoin ETFs Rebound to Inflows as Ether Outflows Deepen

Bitcoin exchange-traded funds (ETFs) snapped back into positive territory with healthy inflows, while ether ETFs logged another day of red. Solana and XRP maintained momentum with steady entries, signaling that investor appetite is shifting more broadly across the crypto ETF landscape. BTC ETFs Turn Positive as Solana and XRP Post Gains Some trading days feel […] Original

Blackrock CEO Doubles Down on Bitcoin While Urging Faster Tokenization of All Assets

Blackrock’s chief executive explained a dramatic pivot toward bitcoin’s long-term potential, framing the asset as protection in an era of fiscal strain while championing tokenization as the next force set to reshape global markets. Blackrock CEO Backs Bitcoin While Advancing Tokenization of All Assets Blackrock CEO Larry Fink shared last week at the New York […] Original

Big Buyers Storm In as Bitcoin’s Rebound to $91K Triggers Massive Liquidation Wave

After spending the morning flirting with the dungeon below $88,000, BTC clawed its way upward and blasted to an intraday high of $91,767. Bitcoin’s latest rebound didn’t just flip the script on weekend traders — it triggered a full-blown liquidation bonfire across the crypto market as deep-pocketed buyers muscled shorts into oblivion. Heavy Buyers Reappear […] Original

No Santa Rally? Bitcoin Derivatives Markets Hint at a Cold December

Bitcoin slid under $88,000 on Sunday morning, putting the market squarely in “so much for the Santa Rally” territory. With derivatives traders scrambling for footing and open interest wobbling across major venues, bitcoin is signaling that December may be more coal than candy canes. Bitcoin’s December Stumble Sends Derivatives Markets Scrambling Bitcoin’s drop under $88,000 […] Original

Bitcoin Price Watch: Bulls Stall Below $90K While Bears Lick Their Chops

Bitcoin price is rangebound today between $88,990 to $89,473 over the last hour, perched just below the psychological $90K marker as traders wrangle over its next move. With a market capitalization of $1.78 trillion and a 24-hour trading volume of $21.62 billion, the coin remains the heavyweight champ of crypto—though its footing looks increasingly cautious. […] Original

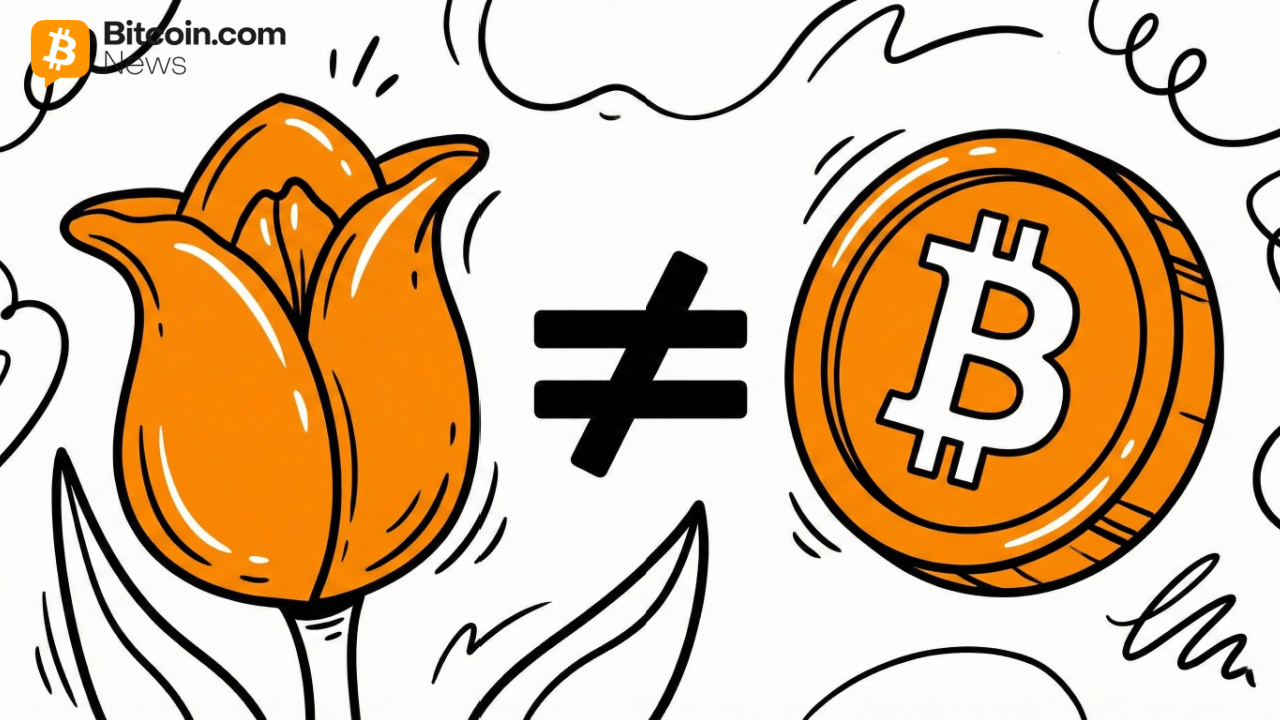

Why Bitcoin Isn’t a Digital Tulip — and Why It Will Never Be

Recent opinion pieces have drawn parallels between bitcoin and tulips because of the speculative frenzy surrounding the latter in the 1600s. I explain why those comparisons are unfair and why analyzing bitcoin solely as a store of value misses the point entirely. Bitcoin Is Not a Digital Tulip, Even if the NGU Thesis Has Stalled […] Original

Robert Robert Kiyosaki Offers Crash Advice With Deep Bitcoin Conviction—What Investors Need to Know

Robert Kiyosaki urges people to brace for deepening financial turmoil by building new income streams, securing essential trade skills, and accumulating hard assets as he warns of a severe global downturn approaching 2026. Kiyosaki’s Recession Playbook and Asset Warnings Robert Kiyosaki, author of the best-selling book Rich Dad Poor Dad, has weighed in on what […] Original

JPMorgan Predicts Bitcoin Rising Toward $170K With Gold-Like Trends

JPMorgan sees bitcoin primed for a powerful climb as gold-like trading patterns and shifting market dynamics set the stage for major upside potential in the months ahead. JPMorgan Flags Bullish Bitcoin Momentum Global investment bank JPMorgan said bitcoin could advance toward $170,000 within the coming months, outlining a bullish scenario tied to its tendency to […] Original

Bitcoin Price Watch: Technicals Signal Caution, Not Capitulation

Bitcoin currently sits at $89,618, with a market capitalization of $1.78 trillion and a 24-hour trading volume of $45.76 billion. Over the past day, its price has oscillated within a narrow band from $88,420 to $91,290—suggesting hesitation among both bulls and bears. This isn’t a stampede; it’s more of a tense chess match at the […] Original