Key Notes The workflow automates order taking, execution, settlement, and data synchronization across blockchain systems. The uMINT fund operates on Ethereum distributed ledger technology as part of the UBS Tokenize initiative. UBS manages $6.9 trillion in assets and previously tested blockchain through Singapore’s Project Guardian. UBS announced on Nov. 4 the completion of the world’s first live, in-production tokenized fund transaction. The Swiss banking giant executed an end-to-end workflow involving subscription and redemption requests for a tokenized money market fund. The transaction marks a milestone in the institutional adoption of…

Category: Reviews

4 Reasons Crypto Market Hasn’t Recovered Yet

Key Notes Even though the Fed ended QT, it is not enough to inject the liquidity that the crypto market needs. Crypto market liquidations and ETF outflows are another reason behind market selloffs. Ted Pillows also pointed to persisting macroeconomic and geopolitical headwinds. The crypto market is struggling to remain stable, even amid a couple of positive macroeconomic narratives, such as the US Federal Reserve’s 25-basis-point rate cut. Popular crypto analyst Ted Pillows has posted to explain the possible cause of the current sector-wide downtrend. Fed rate cuts, a US–China…

Arthur Hayes Says Hidden US QE Will Fuel Next Crypto Rally

Key Notes Hayes claims a “stealth QE” by the US Treasury and Fed could spark a crypto bull run. Tight liquidity and rising government debt could lead to renewed monetary expansion. Hayes predicts traders could see major price swings once liquidity returns to markets. . According to BitMEX co-founder Arthur Hayes, the United States is quietly preparing for what he calls a “hidden quantitative easing” (QE) program. He believes that this could lead to the next major rally in Bitcoin BTC $104 421 24h volatility: 3.0% Market cap: $2.08 T…

Bitget Launches $2M Interest-Free Loans to Boost Altcoin Liquidity

Key Notes Market makers can borrow up to 2 million USDT at zero interest by meeting 50% of standard trading volume requirements through Bitget’s unified trading accounts. The initiative targets professional quantitative firms and new institutional clients not currently enrolled in Bitget’s existing financing programs. Bitget’s standard institutional loans support up to 5x leverage and use a loan-to-value ratio system with liquidation triggered at 90% LTV. Bitget announced an Institutional Financing Program on Nov. 4 offering zero-interest loans to market makers focused on altcoin trading. The initiative allows qualified participants…

DOGE Plunges After 1B Tokens Dumped — What’s Next?

Key Notes Whales sold over 1 billion DOGE in a week, as per Ali Martinez. DOGE broke down from an ascending channel. Martinez suggested that a major move is coming for DOGE. Dogecoin DOGE $0.17 24h volatility: 5.7% Market cap: $25.06 B Vol. 24h: $3.73 B holders saw a massive surge in selling pressure, with over 1 billion tokens dumped by whales in just one week, according to on-chain data shared by market analyst Ali Martinez. Over 1 billion Dogecoin $DOGE sold by whales in the past week! pic.twitter.com/pjUwFAqtEM —…

Strategy Unveils Euro STRE Stock Backed by Bitcoin

Key Notes Strategy plans to fund STRE dividend payments primarily through additional capital raising activities, including stock sales. The STRE stock is junior to Strategy’s $8.25 billion in existing debt and ranks below the company’s STRF and STRC preferred shares. First dividend payments are scheduled for Dec. 31, 2025, with quarterly payments thereafter on the last day of each quarter. Strategy Inc announced a proposed initial public offering of 3,500,000 shares of 10.00% Series A Perpetual Stream Preferred Stock on Nov. 3. The STRE Stock has a face value of…

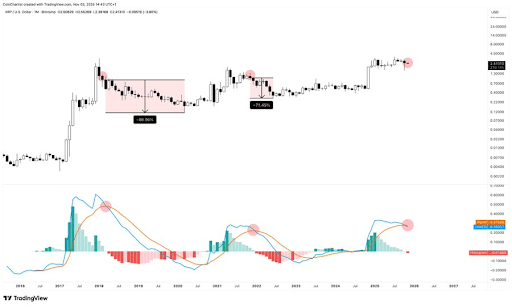

Rare Chart Formation That Led To An 87% XRP Price Crash Has Resurfaced

Crypto analyst Tony Severino has revealed a rare chart formation, which presents a bearish outlook for the XRP price. This comes amid a market downtrend, with concerns that XRP may have topped in this market cycle. Rare Chart Pattern That Sparked 87% XRP Price Crash Resurfaces In an X post, Severino revealed that the XRP monthly LMACD has crossed bearish for the third time ever. He noted that the past two bearish crossovers resulted in an 87% and 71% drawdown after the signal fired. The analyst added that this signal,…

XRP Eyes $2 as Whales Dump 1M Coins

Key Notes XRP whales offloaded nearly 900,000 XRP in the last five days, adding to the selling pressure. Analyst said XRP price is forming a lower high after rejection at $2.7. Failure to reclaim this resistance could trigger a deeper correction. Grayscale updated its spot XRP ETF application, with analysts expecting an approval soon. XRP XRP $2.27 24h volatility: 5.4% Market cap: $136.26 B Vol. 24h: $7.04 B has extended another 7% loss in the last 24 hours, dropping to the crucial support at $2.25 level. On Nov. 4, XRP…

Crypto Liquidations Hit $1.33B as BTC, ETH, XRP, DOGE Swing

Key Notes Bloomberg noted that crypto market investors have yet to come out of the October shock while repelling new demand. BlackRock Bitcoin ETF (IBIT) reportedly offloaded 24,000 BTC worth $2.75 billion, adding to the selling pressure. Traders remain cautious and sidelined despite improving macro conditions like Fed rate cuts, upcoming pivot to quantitative easing (QE), etc. Crypto market liquidations have soared to $1.33 billion once again, with yet another selling pressure as Bitcoin BTC $103 768 24h volatility: 3.7% Market cap: $2.07 T Vol. 24h: $82.33 B and altcoins…

Bitcoin ETFs Bleed $187M as BTC Falls to $104K

Key Notes Bitcoin ETFs saw $186.5 million in net outflows, led entirely by BlackRock’s IBIT. BTC price plunged to $104,500, marking an 8% weekly decline. Further downside is possible if short-term selling pressure spreads to long-term holders. Bitcoin’s BTC $103 968 24h volatility: 3.6% Market cap: $2.07 T Vol. 24h: $82.02 B rocky start to November has worsened after spot ETFs tracking the cryptocurrency recorded $186.5 million in net outflows on Nov. 3. According to latest data, every Bitcoin ETF saw zero inflows, with only BlackRock’s IBIT responsible for the…