- Ark Invest’s “Bitcoin Monthly” May Report shows fundamentals are stronger than ever for Bitcoin.

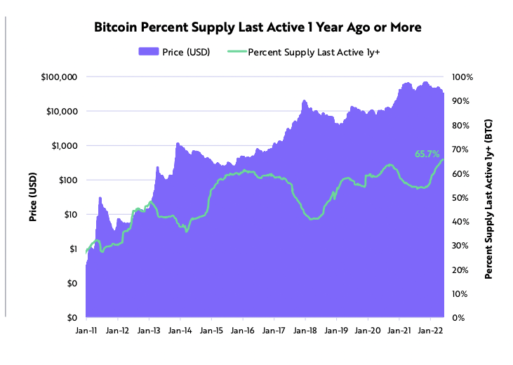

- According to the report, 66% of Bitcoin’s supply has not moved in over a year.

- Short-term holders appear to have already capitulated, with their positions dropping 35% over breakeven price.

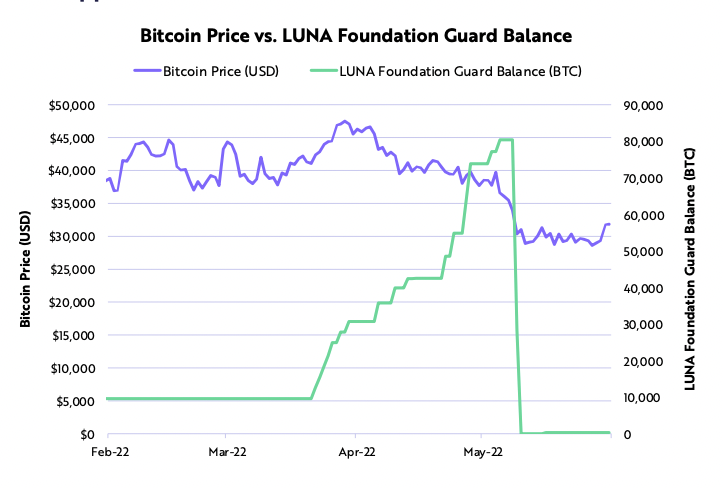

- The impact of Terra’s UST & Luna collapse on Bitcoin appears to be contained.

Ark Invest’s “Bitcoin Monthly” report authored by CEO Cathie Wood and other ARK Invest analysts provides a crypto market summary and details of relevant on-chain activity.

According to the report, ‘hodlers’ are stronger than ever, as 66% of Bitcoin’s supply has not moved over a year as demonstrated in the graph below. This shows the market’s longer-term focus and a current holder base with stronger conviction.

Short Term Holders Appear to Have Capitulated

The report follows to confirm that according to data collected from Glassnode, short term positions fell -35% below their breakeven price. This percentage last seen on January 2022, July 2020, and March 2020. The positions of aggregate long term and short term holders still remains above breakeven price suggesting that a widespread capitulation may have not occurred.

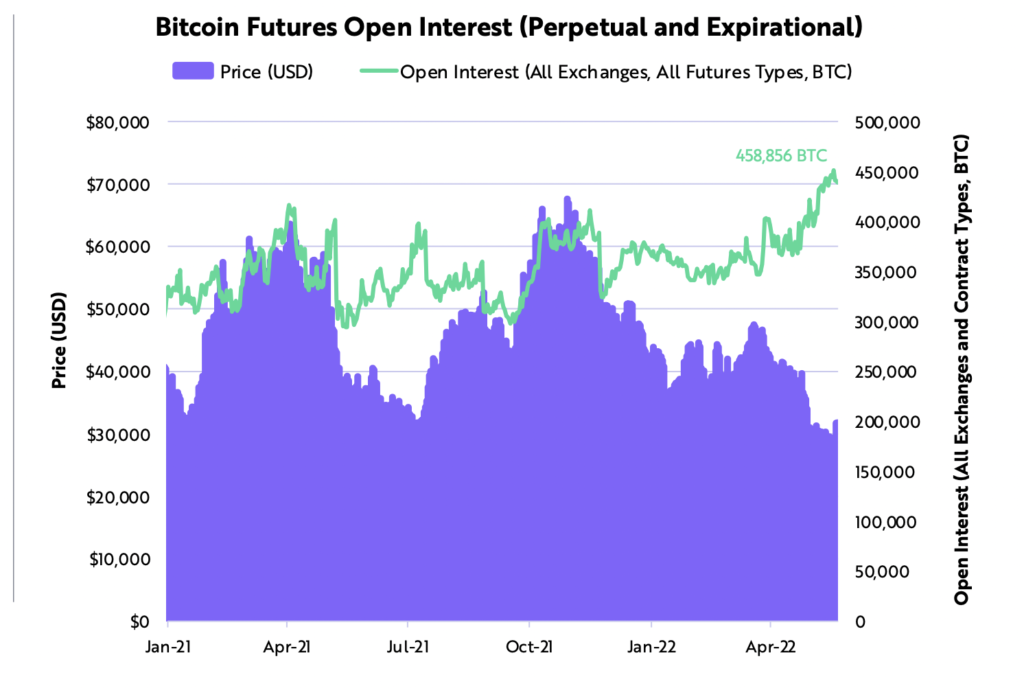

Bitcoin’s Open Interest in the futures market has also reached an all-time high at approximately 480,000 BTC. Ark Invest continues to make a bullish remark on the Open Interest analysis confirming that Bitcoin’s Perpetual Contracts are currently trading at a very bullish discount to spot.

Terra – The biggest crypto fiasco since Mt Gox

Terra’s UST, one of the largest algorithmic stablecoins breaking its peg caused an overall market stir which destroyed roughly 2.7% of crypto’s total market cap, most market cap destroyed after Mt Gox scandal which took roughly 5.7% of crypto’s market cap.

While the systemic impacts of Terra’s collapse should not be underestimated, it’s impact on Bitcoin appears to have been contained

ARK INVEST

An overview of Bitcoin Price vs. Luna Foundation Guard Balance below:

Bitcoin Breaks it’s Longest Ever Red Streak

After a very long few months of red on the market, it appears that Bitcoin is close to breaking this streak and moving towards a more bullish direction. At the start of the week, Bitcoin opened green at 30,000 and is now sitting at 31,295 according to data from CoinGecko.

This move brought other altcoins with it such as Solana’s $SOL token which had a 6.6% increase in the last 24 hours and Cardano’s $ADA which increased at an impressive 24.6% in the last 24 hours. Cardano’s surge could also be based due to anticipation around the latest Hard Fork, dubbed the Vasil Hard Fork.

Overall the total market cap increased to 3.1% in the last 24 hours, setting it at $1.33 Trillion. The top gainer in the Top 20 crypto’s in the last 24 hours remains Cardano’s $Ada at a 24.6% increase.