Bankrupt crypto lender Celsius is battling a Chapter 11 bankruptcy with billions of dollars in claims made by various parties. A new estimate by the Bank of the Future suggests that the troubled crypto lender could likely repay the claims if the price of Bitcoin (BTC) and Ether (ETH) — two assets held by the firm — doubled their current market prices.

Simon Dixon, the founder of Bank of the Future — a crypto-centered investment firm — tweeted the estimated price BTC and ETH would need to reach for Celsius to repay all its claims and keep all other assets.

Based on the final deal with the Fahrenheit consortium, which won the bid to acquire the assets of Celsius in May, if the BTC price touches $54,879 and the ETH price reaches $3,750, Celsius could repay all claims from the price appreciation of both assets. In June, Celsius appealed in court to convert all its altcoins into Bitcoin and Ether to maximize the value of assets.

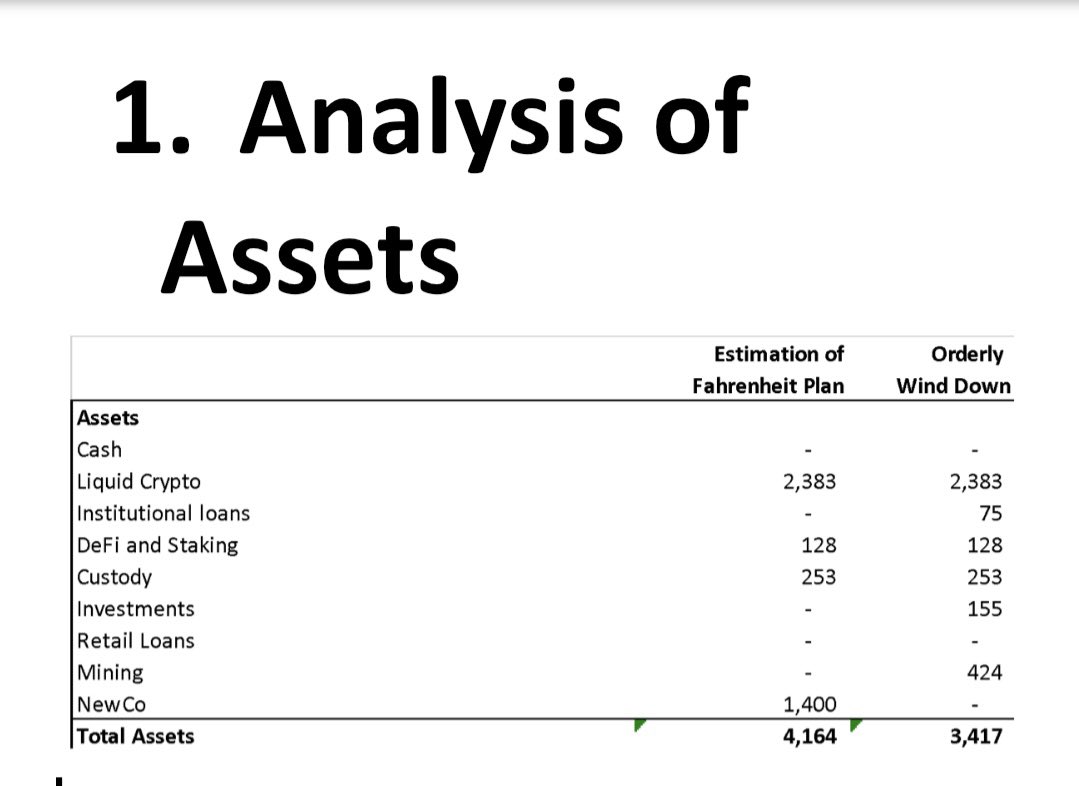

Dixon noted that these estimates are based on “imperfect knowledge made by the BF [Bank of the Future] internal investment banking team with no access to privileged information.” The new restructuring plan under Fahrenheit includes mining, institutional loans, investments valued at approximately $1.4 billion and $450 million in liquid crypto.

The firm also shared a comparison between Fahrenheit’s recovery plans and the Blockchain Recovery Investment Consortium (BRIC) — a holding company affiliated with the Winklevoss-owned Gemini Trust — wind-down plans. The total recovery under the orderly wind-down comes to $3.519 billion, which exceeds the total assets available at $3.417 billion. This discrepancy is accounted for by the variable cost.

The return to retail borrowers is approximately $339 million. Bank of the Future estimates suggests the recovery is about 65% for both options, which could increase to about 75%, assuming 10% of claims are unclaimed. 41.4% of recovery under the Fahrenheit plan is in equity, with the remaining 58.6% in liquid crypto. Only 12.4% of recovery under BRIC orderly wind down is in equity, with the remaining 87.6% in liquid crypto.

Related: Celsius adds over 428K stETH to Lido’s lengthening withdrawal queue

Dixon said creditors should fight to get out of the bankruptcy proceedings before the end of 2023, or before the price of BTC and ETH hit the estimated mark. He added that to avoid “another rug pull, we will need to fight hard against it if it comes up.“

It is very important that we get out of Chapter 11 before #Bitcoin & $ETH approach these numbers to avoid another rug pull that we will need to fight hard against if it comes up.

Estimation of the price of #BTC and $ETH (50/50 basis) at which claims may be paid in full: $BTC… pic.twitter.com/PITQV3pIGM

— Simon Dixon (@SimonDixonTwitt) July 19, 2023

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Tiffany Fong flames Celsius, FTX and NY Post: Hall of Flame