On-chain data shows there is major resistance ahead for Chainlink, a sign that could be troubling for the rally’s sustainability.

Only 55% Of Chainlink Investors Are In Profit So Far

As explained by an analyst in a post on X, Chainlink is still behind Bitcoin in terms of investor profitability despite the LINK price outperforming BTC in the year so far.

The below chart shows what the LINK address concentration looks like on the different price ranges that the asset has previously visited:

The different on-chain resistance and support levels of the asset | Source: @hmalviya9 on X

Here, the size of the dot represents the number of investors or addresses who purchased their coins inside the particular price range. It would appear that the ranges below $10 are host to the cost basis of a hefty number of holders.

Since the LINK price is above these levels right now, these investors would naturally be in a state of profit. These addresses only make for about 55% of the network total, however, implying that a significant number of them are still sitting at a loss. From the chart, it’s visible that the $16 to $27 range in particular has a considerable density of investors.

In on-chain analysis, major support and resistance levels are defined on the basis of the number of investors that are at a particular range. This is because of the fact that whenever the spot price interacts with the cost basis of an investor, they become more likely to show a move.

When the price retests the cost basis from above, the holder may decide to buy more. The reason behind this is that they might tend to believe that the level, which had been profitable for them earlier, might produce gains in the future again, so it would appear like an ideal point of accumulation for them.

On the other hand, the red holders might see the break-even point as a decent exit point, as they might fear that the cryptocurrency would go back down in the near future, so going out here at least means they can avoid taking any losses.

Such buying or selling from just a few investors when the price retests their common cost basis doesn’t produce any effects on the macro scale, but if a large number of investors bought at the same level, the reaction might be more pronounced.

Thus, the Chainlink levels ahead until the $27 mark might prove to be a source of some heavy resistance, making the rally hard to sustain through them.

The analyst notes, however, “once LINK breaks the $27 mark, the ensuing rally is expected to be substantial. Alongside this, the wallet profitability ratio is projected to surpass 80%.”

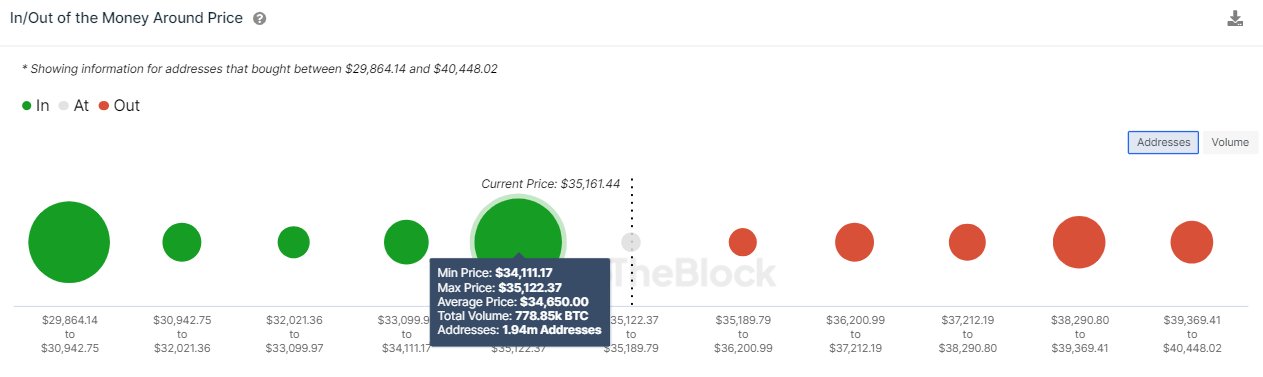

As mentioned before, Bitcoin’s investor profitability distribution is looking much better so far, as the below chart from IntoTheBlock shows:

Looks like the current price levels have a substantial amount of investors | Source: IntoTheBlock on X

Bitcoin is currently battling against the resistance offered by the current investor-packed $34,100 to $35,100 range. Once BTC is through these levels, however, the road towards $40,000 might prove to be relatively easy.

LINK Price

Following its 12% rally in the past week, Chainlink is now sitting just below the $12.9 mark.

LINK has exploded more than 67% in the past month | Source: LINKUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com