Chainlink (LINK) has been a standout in the crypto market recently, registering an 11% increase over the past six days, even as the broader crypto market sentiment remains subdued.

Will Uptober Start Early For Chainlink?

A significant factor that might be driving this price action is the behavior of LINK’s major holders. On-Chain analysis firm, Santiment, highlighted this in a recent tweet, stating: “Chainlink’s key shark tier that holds between 10K-100K LINK has been on an accumulation spree.”

Diving deeper into the data, there are now 3,127 wallets holding between 10,000-100,000 LINK, marking the highest level since December 3, 2022. These wallets have added a staggering $9.6 million worth of LINK in just three days. Since September 3rd, there’s been a 3.2% rise in the number of wallets in this category, with 98 new wallets emerging. This group has accumulated 0.154% of the entire LINK supply in the same period.

However, Chainlink’s journey hasn’t been entirely smooth. The token has been ensnared in a sideways range for an exhausting 485 days, which is over 15 months. The LINK/BTC pair has been on a downward trajectory for more than three years.

Chainlink’s much-anticipated release of the Cross-Chain Interoperability Protocol (CCIP) was met with significant hype. Yet, despite its potential to revolutionize cross-chain communication, its release didn’t provide the expected boost to LINK’s price.

Also the news that a tokenization experiment by interbank messaging system Swift and Chainlink successfully transferred value across multiple blockchains could not move price substantially. In June Chainlink and Swift announced that they would be collaborating with dozens of financial institutions such as BNP Paribas, BNY Mellon, The Depository Trust & Clearing Corporation and Lloyds Banking Group and others.

However, the upcoming Chainlink’s SmartCon in October from October 2nd to 3rd might be the catalyst the token needs. Rumors are rife about a potential major announcement between Swift and Chainlink Labs, which could connect web3 infrastructure to the banks involved in previous tests.

If history is any indication, Chainlink could experience a surge in price leading up to the event, driven by the euphoria and speculation. “Uptober” could come early for the Chainlink price.

LINK Technical Analysis

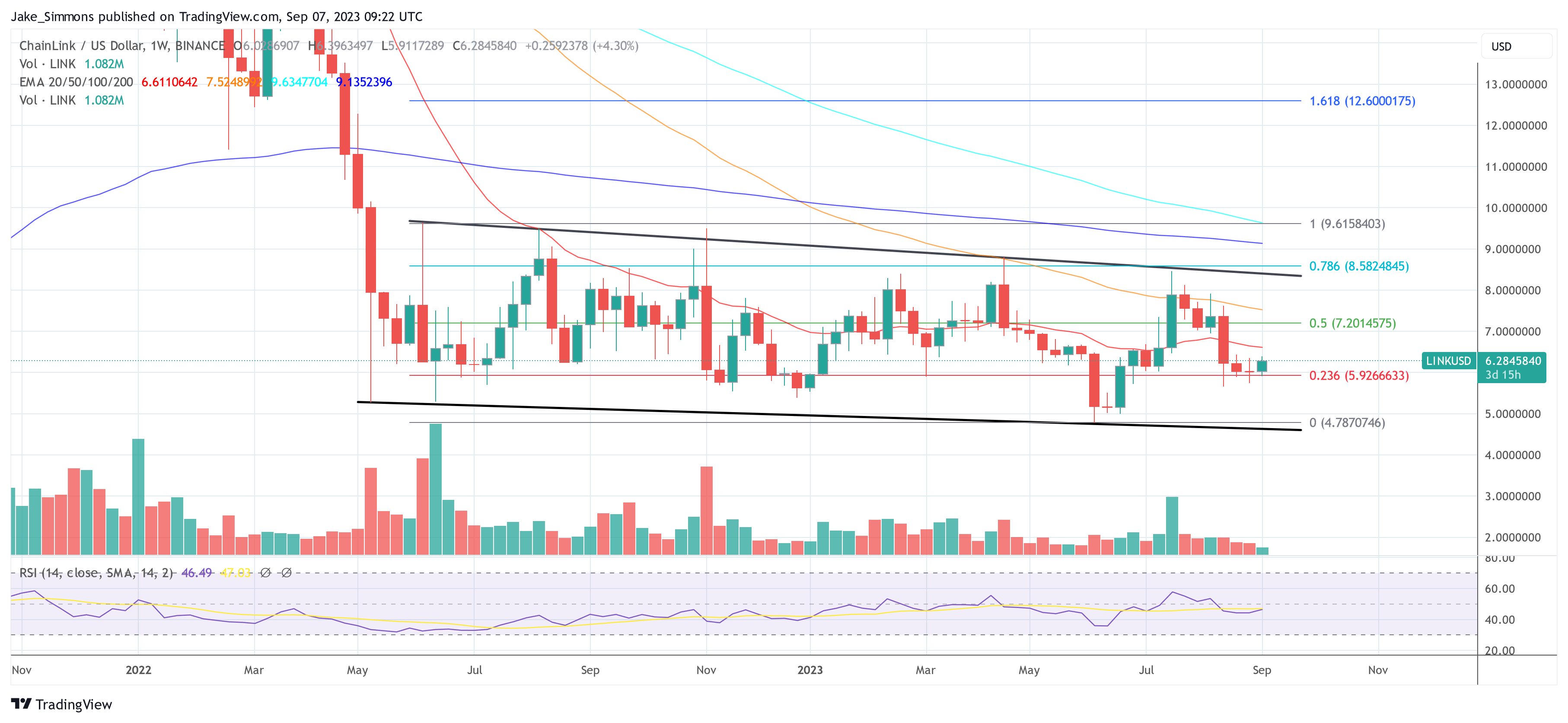

The recent 11% surge in LINK’s price suggests that the market might already be reacting to the upcoming hype. However, the 4-hour chart indicates a rejection at the 23.6% Fibonacci retracement level at $6.37, which aligns closely with the 200 EMA at $6.40. For LINK to sustain its upward trajectory, it’s imperative to breach this level, with the next significant target being the 50% Fibonacci retracement level at $7.08.

The 1-week chart paints a picture of LINK’s prolonged downtrend. The recent hold above the 23.6% Fibonacci retracement level at $5.92 is a positive sign for the bulls, potentially paving the way for another try on the upper trendline of the downtrend channel.

However, several difficult challenges lie ahead. The 50% Fibonacci retracement level at $7.20 is the first major resistance. If LINK can push past this, a breakout from the 15-month downtrend channel becomes possible. For this to happen, Chainlink would need to break above the $8.30-$8.40 area as it currently stands, and would then encounter the 78.6% Fibonacci retracement level at $8.58. Large selling pressure can be expected at this point.

Should LINK falter at this juncture, a return to the downtrend channel is likely. Conversely, if the $8.58 mark is surpassed, it would signal a significant win for the bulls, potentially setting LINK on a path to challenge its 15-month high at $9.61.

Featured image from iStock, chart from TradingView.com