Already a bull on MicroStrategy, Canaccord Genuity upped its price target on the stock to $400 from $372 following the news. “We believe the company’s relatively conservative strategy of keeping most of its holdings unencumbered has been prudent,” wrote analyst Joseph Vafi and team. “Institutional investors are continuing to work on their Bitcoin and overall digital-asset strategies, in our view. As such, we expect to see continued mainstream adoption, which we believe bode well for the medium term and supports our view that BTC is biased higher over time.”

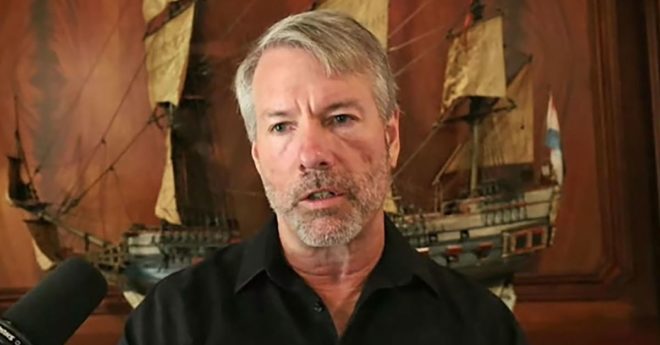

Charlie Munger Hasn’t Taken the Time to Study Bitcoin: MicroStrategy’s Michael Saylor