Last week, the Base Layer 2 network hit its ATH in daily transactions of about 1.88 million, higher than Optimism and Arbitrum combined.

Coinbase Global Inc (NASDAQ: COIN) launched its Ethereum-based layer two (L2) network dubbed Base earlier in August. Less than two months later, the layer two network has registered exponential growth following high adoption by leading DeFi projects. Moreover, the Base network offers reliable security, and sustainable and scalable services all without any native token. According to on-chain data provided through BaseScan, a product of Etherscan, the Coinbase-backed L2 network Base registered 1,882,770 transactions on Thursday, September 14, 2023.

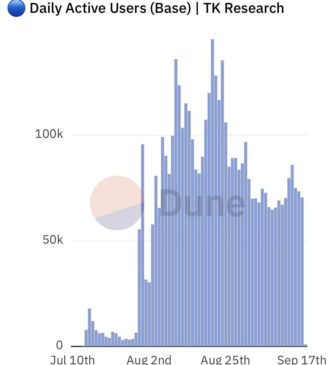

Notably, the Base networks have averaged around 70k, according to aggregate data provided via dune analytics.

Photo: Dune

Base Network’s Performance in Relation to Other L2s

The layer two industry has experienced significant growth in the past year amid mainstream adoption of the DeFi ecosystem by institutional investors and retail trades. The Ethereum network, which takes pride in more than $21 billion through its total value locked (TVL) program, has the leading layer two ecosystems in the crypto industry. Moreover, the Ethereum ecosystem is often plagued by network congestion that leads to high transaction fees and unwarranted delays.

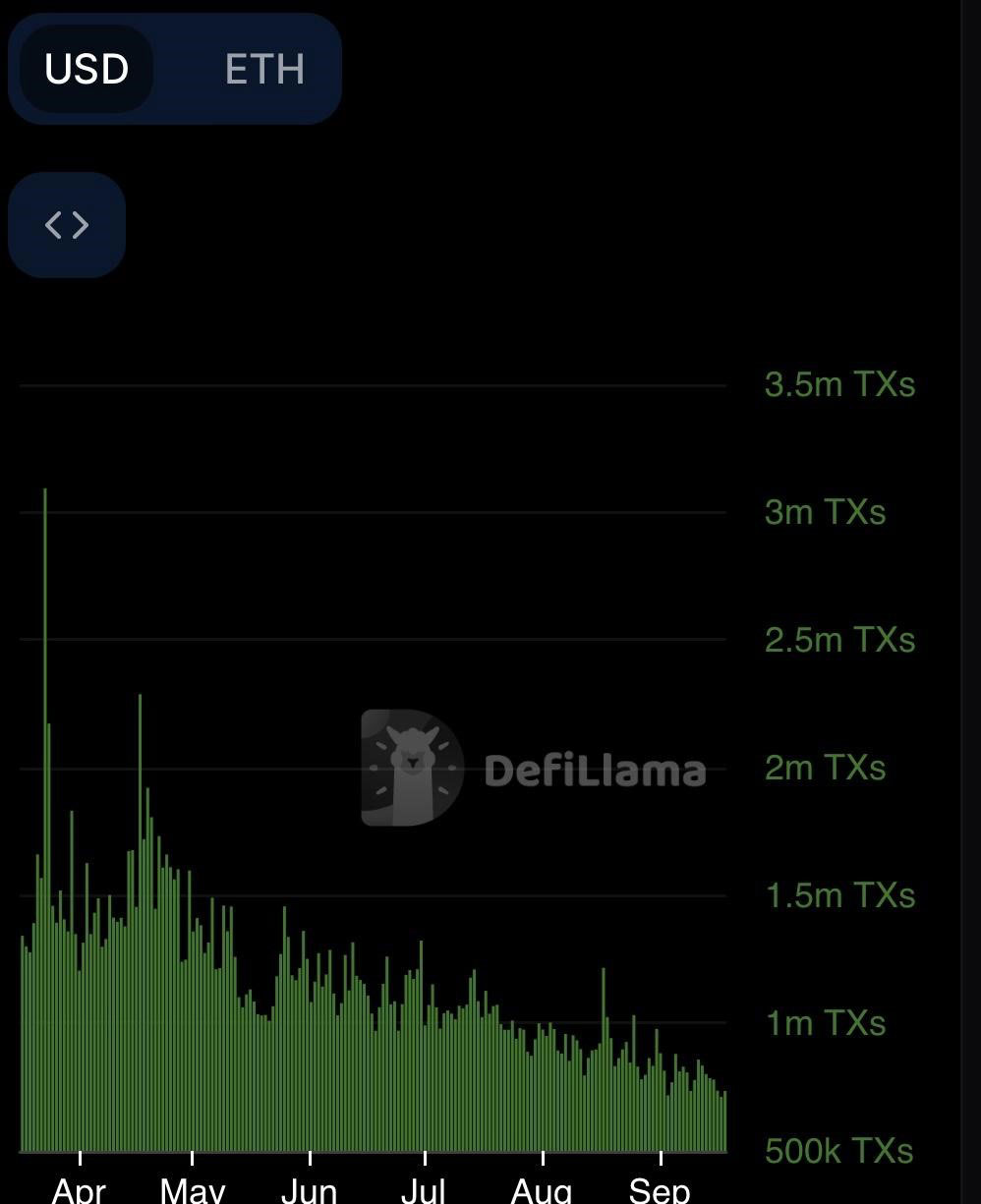

The Polygon (MATIC) network is the leading L2 ecosystem on the Ethereum blockchain with a total value locked (TVL) of about $795 million, and a stablecoins market capitalization of about $1.29 billion. According to aggregate data from defillama, the Polygon network registered about 306k active users in the past 24 hours. However, Polygon’s transaction volume on a daily basis has been declining YTD, amid the emergence of other L2 networks.

Photo: DefiLlama

Another major layer two network in the Ethereum ecosystem is the Arbitrum (ARB), which was launched earlier this year, after months of meticulous development. Notably, the Arbitrum network had a total value locked (TVL) of about $1.69 billion and a stablecoins market capitalization of over $1.61 billion.

Photo: DefiLlama

From the two examples above, it is evident that their daily transaction volume has been declining in recent months. The Base network, on the other hand, has seen its daily transactions volume remain high since its official launch.

Built on Optimism’s OP Stack, the Base network is touted as a secure and scalable EVML2 ecosystem.

Bigger Picture

The high adoption of Coinbase exchange has significantly helped the Base network obtain users’ attention within a short period. As of reporting time, the Base network is used by brands like Chainlink (LINK), Animoca Brands, AAVE, Infura, and Dune, among many others. With Coinbase highly invested by institutional investors, the direct development of Ethereum layer two platforms is an indication its DeFi ecosystem is about to be explored further during upcoming crypto bull markets.

Let’s talk crypto, Metaverse, NFTs, CeDeFi, and Stocks, and focus on multi-chain as the future of blockchain technology.

Let us all WIN!