- CoinShares saw a weekly inflow of $193 million into its crypto investment products.

- Europe dominated the inflows with $147 million, while the Americas recorded $45 million.

- Solana also saw its highest weekly inflow, with $45 million.

CoinShares has published its weekly report on digital assets fund flows, and it holds some positive signs for the market. The report highlights that inflows into crypto investments products totaled $193 million, the highest since December 2021.

The spike in inflows is a sign that the market’s sentiment is changing. The inflow was largely dominated by entities in Europe, with the continent accounting for $147 million, while the Americas made up the remainder at $45 million.

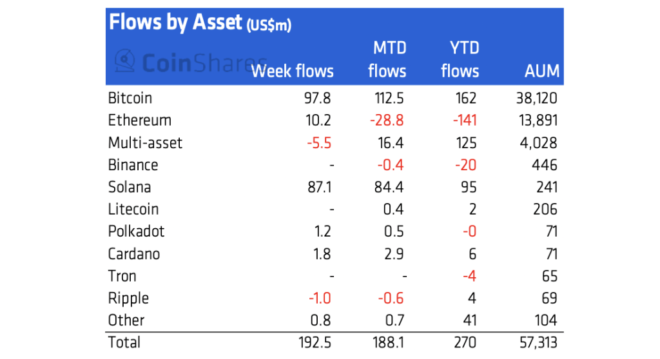

It wasn’t just bitcoin and ethereum that saw increased investment, as solana recorded its largest single week of inflows, with a total of $87 million. That represents 36% of CoinShares’s assets under management. The total AUM of Solana is $241 million, making it CoinShares fifth-largest investment product.

Bitcoin saw a total inflow of $98 million and ethereum $10.2 million. Bitcoin’s year-to-date inflow now stands at $162 million. Other assets also generally saw investment, though not on the scale of the aforementioned assets.

The market has been having a strong week on nearly all accounts — most notably the price of assets and the overall market cap surging by double digits over the past week. All of these developments have brought some long-needed optimism for the market, which took a hit earlier this year.

The next few weeks will be crucial in setting realistic targets for bitcoin and other assets. Analysts have put $51,000 as a long-term resistance target, and technical indicators are bullish.

A Bull Run in Sight?

Investors will be keeping a close eye on the market as it appears on the verge of a bull run. Up over 16% in the past days, bitcoin looks like it could be breaking out of the stagnation of the $40,000–$50,000 range. Ethereum has done even better on the back of many positive developments in its ecosystem.

Several developments suggest that a bull run may indeed be around the corner. Small holders of bitcoin and ethereum are increasing, with the number of addresses with more than 0.1 BTC and ETH both up this year.

Clarity in regulation, especially in the United States via President Biden’s executive order, also tentatively suggests better prices. At the very least, investors have perked up about the market and see greener days ahead.