Why holidays attract crypto scammers

The holiday season is supposed to be about rest, family and celebration. Unfortunately, it is also one of the busiest times of the year for cybercriminals.

Scammers take advantage of increased online shopping, festive promotions and emotional spending to trick people into handing over their money.

For cryptocurrency users, these scams can be especially damaging because crypto transfers are typically irreversible. Scammers know crypto transactions are irreversible, and many people are still learning how to handle their assets safely.

So, how do scammers target crypto users during the holidays, and what tactics do they use?

Let’s find out.

During the holidays, several conditions make scams easier to carry out and harder to detect.

-

First, people spend more time online. Between online shopping, travel bookings and festive social media activity, users see more ads and messages than usual. Scammers use this extra noise to slip in fraudulent links or fake offers.

-

Second, emotions run high. People are more generous, optimistic and sometimes stressed. Scammers know emotions can cloud judgment. They exploit this by offering “holiday bonuses,” “Christmas giveaways” or “year-end investment opportunities” that sound time-sensitive and exciting.

-

Third, people are distracted. With busy schedules and celebrations, fewer users take the time to verify links, apps or wallet addresses. A small lapse in attention can lead to significant crypto losses.

Which crypto scams surge as fraudsters exploit the festive season?

From phishing emails and fake wallet apps to bogus token sales and romance scams, criminals ramp up schemes during the holidays, targeting users with promises of bonuses, investments and love, all to steal crypto.

Phishing emails and fake wallet websites

Phishing scams remain one of the top ways criminals steal crypto. During the holidays, they often disguise phishing attempts as promotions or account alerts.

For example, an email may appear to come from a trusted exchange like Coinbase or Binance, claiming you have received a “holiday bonus.” The message includes a link to a fake login page. Once you enter your credentials, the attacker drains your account.

Scammers have also created fake wallet apps that mimic real ones. In past holiday seasons, security teams have found fraudulent apps on Google Play and the Apple App Store posing as popular wallets. Once installed, they request private keys or seed phrases, which are then sent to scammers.

Fake investments and token presales

Fraudsters often set up fake investment platforms or “holiday token presales.” They promise guaranteed returns or exclusive early access to a new coin or non-fungible token (NFT) collection. Victims are asked to deposit crypto on the platform. After enough people invest, the website disappears, and the scammers vanish with the funds.

In late 2025, authorities in London arrested five men suspected of running crypto scams that may have cost victims over 1 million British pounds. The schemes reportedly involved websites claiming to offer presale investment opportunities in new cryptocurrencies. This is a common pattern in fake presale scams that promise big returns.

Romance and “pig butchering” scams

The holidays can be lonely for some people, which can make them more vulnerable to emotional manipulation. In these scams, often called “pig butchering,” criminals create fake identities on dating or social platforms and build trust over weeks or months. Eventually, they introduce crypto as a shared “investment opportunity.”

In one of the most widely reported romance crypto scams, Shreya Datta, a tech professional based in Philadelphia, lost $450,000 after meeting a man on the dating app Hinge who claimed to be a French wine trader.

Over several weeks, he gained her trust and persuaded her to invest in what appeared to be a legitimate cryptocurrency trading platform. The deception unraveled only when the app demanded a 10% “income tax” fee before allowing withdrawals. That prompted Datta’s brother to investigate and uncover the fraud.

Many of these frauds intensify around Christmas and New Year, when victims are more emotionally vulnerable and online communication increases.

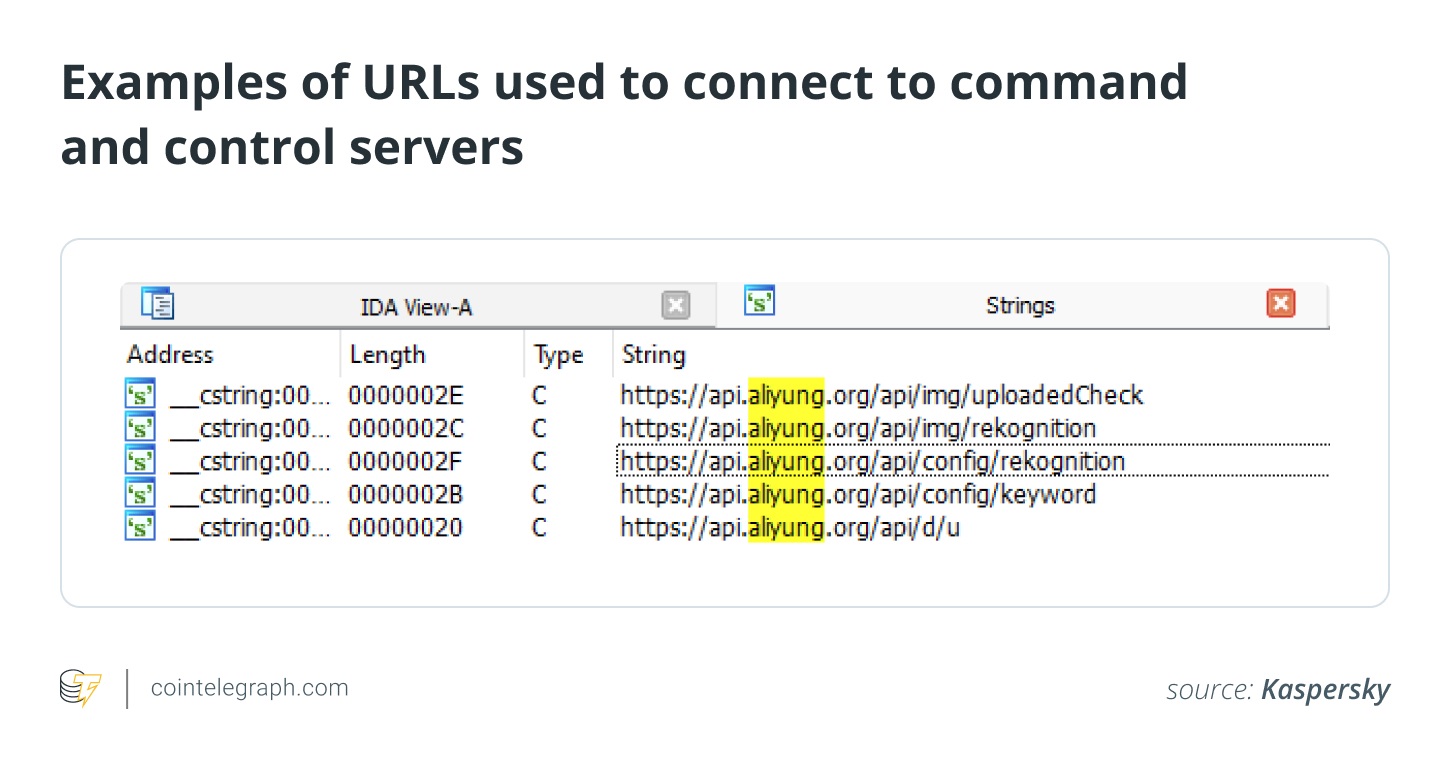

Did you know? A new campaign called “SparkCat” has been reported to have infected Android and iOS apps on official stores with a malicious SDK that uses optical character recognition (OCR) to steal crypto wallet recovery phrases. According to Kaspersky, the tainted apps were downloaded more than 242,000 times on Google Play, and many developers were likely unaware their apps had been compromised.

Impersonation and recovery scams spike during the holidays

Fraudsters pose as regulators, exchange staff or even charity organizers to trick victims into transferring funds. Others impersonate tech support or recovery agents to exploit people who have already been scammed.

Impersonation and fake authority messages

Scammers often pretend to be from official agencies or customer support. They may claim to represent financial regulators, exchanges or even law enforcement. The message might warn that your wallet has been compromised or that new regulations require immediate action. Victims are then asked to transfer funds to a “safe wallet” for verification.

Reports show phishing campaigns can spike sharply around major shopping periods. Attacks linked to Black Friday rose by more than sixfold compared with the start of November, and Christmas-themed scams increased by over 300% during the busiest shopping week of the year.

Even more alarming is how technology has evolved. With the help of AI, scammers can now replicate a person’s voice using as little as three seconds of audio. That makes it possible to trick relatives or friends into believing they are speaking with you.

Fake holiday tokens and pump-and-dump projects

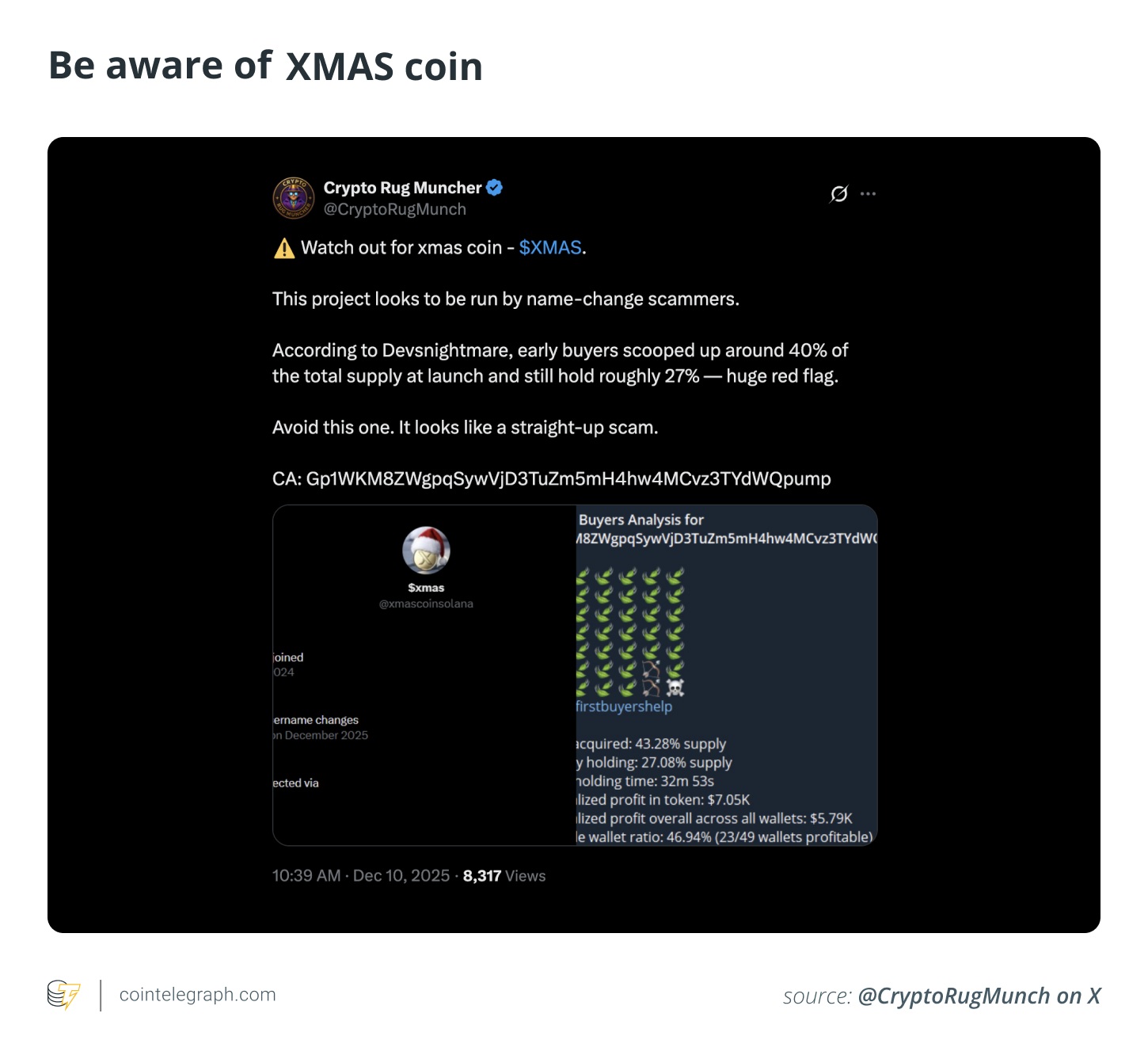

Another growing trend during festive periods involves fraudulent “holiday-themed” cryptocurrencies. One example is a project that appeared under the name Xmas Coin (XMAS). The coin’s promoters have been reported to be linked to previous “name-change” scam projects that rebrand and relaunch under new titles to attract unsuspecting investors.

Analysts at Devsnightmare warned that early buyers acquired nearly 40% of the total token supply at launch and continued to hold around 27%, suggesting classic pump-and-dump behavior. With such concentrated ownership and recycled branding tactics, experts caution that Xmas Coin shows signs consistent with a coordinated exit scam.

Investors should steer clear of any token offering that shows similar patterns or lacks transparency around ownership and liquidity.

Fake tech support and recovery offers

After someone is scammed, another group of fraudsters may contact them and offer help to recover lost funds. They often pose as blockchain investigators or legal services.

Victims who are desperate to get their money back are tricked into paying additional fees or sharing sensitive information. These follow-up scams often appear right after holiday scam waves, when victims start searching for help online.

Did you know? In one UK-based case reported in 2025, a man and his wife had more than 250,000 pounds drained from their crypto wallet after being contacted by someone claiming to be from a cybercrime unit. The caller said their personal information was compromised. It was a “scare and impersonation” scam that combined trust abuse with pressure tactics.

How to stay protected from crypto scams during holidays

Stay alert this holiday season: Verify every offer, use only official apps, protect your keys, strengthen account security, think before acting on emotion, confirm charities and giveaways and stay informed to keep your crypto safe from scams.

Here’s how to stay protected:

-

Be suspicious of unsolicited offers: If someone you do not know offers an investment opportunity, claims you have won a prize or urges you to act fast, stop and verify the source before taking any action.

-

Use only official links and apps: Always download wallet or exchange apps directly from the company’s verified website or the official app stores. Avoid links in emails or social media messages.

-

Never share private keys or recovery phrases: No legitimate company or employee will ever ask for them. Keep them offline and secure.

-

Enable strong security: Use two-factor authentication (2FA), unique passwords and avoid using public WiFi for crypto transactions.

-

Be cautious of emotional manipulation: Scammers often build trust or use fear to pressure you into decisions. Take time to verify before sending any funds.

-

Double-check charities and giveaways: Donate only to verified organizations, and be wary of anyone promising to double your crypto.

-

Stay informed: Follow alerts from trusted financial authorities and cybersecurity agencies. Awareness is one of the best defenses.

The festive season should be about joy, not regret. By slowing down, verifying sources and recognizing red flags, you can enjoy your holidays without falling into a scammer’s trap.

This article is for educational purposes and is not financial or legal advice. If you suspect fraud, contact your exchange’s official support, report the scam to local authorities and preserve screenshots, addresses and transaction hashes.