Despite crypto market turbulence, active contributors across Bitcoin, Ethereum, and Solana’s top projects have increased by an average of 71.6% per year since January 2018, according to a new report.

The findings come from an August 2 report sent to Cryptox by technology investment firm Telstra Ventures, which found that Solana had the most significant annual increase in monthly-active contributors, growing at a compound annual growth rate of 173% since January 1, 2018.

Contributors are developers who push updates to code on GitHub, a code repository for computer programs.

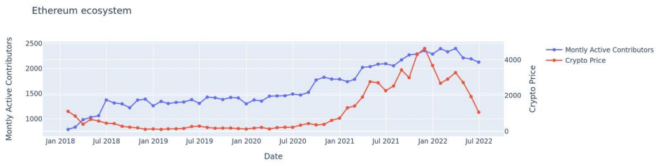

Ethereum was second with a 24.9% compound annual growth of monthly contributors since 2018 and Bitcoin was third with a “slow and steady” 17.1% yearly increase.

Telstra also noted that it found Ethereum to have the “largest and strongest” developer community out of the three blockchains. The network had nearly 2,500 monthly active contributors in April, which fell to over 2,000 contributors in July, coinciding with a fall in the crypto price.

The higher number of active contributors could be due to the greater deal of output needed to prepare for the upcoming Merge in which the network transitions into Proof-of-Work consensus.

The amount of monthly active contributors on Ethereum in July was more than four times higher than Bitcoin’s 400 contributors and nearly seven times higher than Solana’s 350 contributors.

The report however noted that the contributor count fell by 9% since last November, coinciding with a fall in the cryptocurrency’s price since its peak.

VC investment opportunities

The technology investment firm also found that among the top ten fastest growing projects across Bitcoin, Ethereum and Solana, around 40% of projects have not had any venture capital backing, meaning that investment opportunities remain abundant.

Those projects include Ethereum-based investment protocol OlympusDAO, smart contract developer ApeWorx, maximum extracted value (MEV) researcher Flashbots, and Solana-based NFT standard MetaPlex.

Related: Investors shifting toward lower-risk crypto yields — Block Earner GM

Venture capital funding in crypto throughout 2022 has shifted focus from decentralized finance (DeFi) to Web3 applications, according to research from Cryptox in July. Web3 investments accounted for 42% of the $14.67 billion invested in crypto projects in Q2, bringing the first half total to $29.33 billion.

Telstra Ventures is a technology-focused venture capital firm with 84 companies in its portfolio of investments and $30 billion in assets under management. It has invested in blockchain companies Blockdaemon and FTX exchange.

Data were derived from 1,000 active organizations that contribute more than 30,000 open source projects on Bitcoin, Ethereum, and Solana. Eligible projects for study have at least 100 stars in GitHub repositories and were active between January and April 2022.