Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto markets awoke on Wednesday to the first meaningful bout of selling in more than a month, and Kev Capital TA did not sound surprised. In a late-night livestream, the analyst told viewers that Bitcoin’s failure to clear the “brick-wall” band between $120,000 and $123,000 had made an altcoin shake-out “the most obvious pullback spot ever,” capping four straight weeks of euphoric gains across Ethereum, Solana, Dogecoin, XRP and the rest of the sector.

Crypto Bulls Crushed: Why Altcoins Ran Out Of Gas

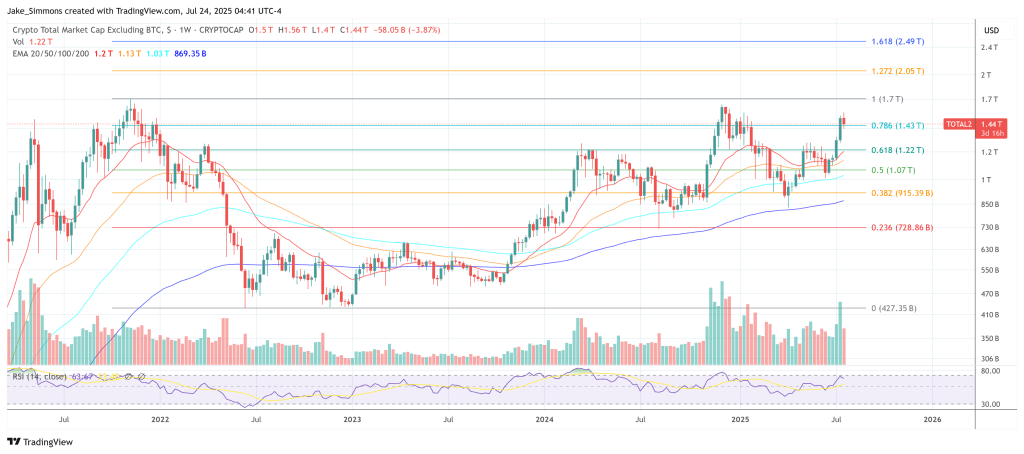

“Daily RSIs were at ninety on everything, including ETH, while Bitcoin was pinned under one-twenty,” he said. “That is a textbook sell wall. You don’t blast through that after running straight up for a month.” His chart of Total-2—the market-cap index that strips out Bitcoin—showed the gauge banging into the exact horizontal ceiling that had turned back altcoins in May, August and November 2021, again in December 2024, and once more in January this year. Each rebuff, he reminded the audience, had sparked corrections of 30-to-60 percent in the majors and far larger drawdowns in the speculative tail.

Kev’s core message was that nothing in the current tape resembles a lasting top for the cycle. The move, he argued, is a pressure-release that clears excess leverage and restores “risk-free long exposure” for disciplined traders who skimmed profits on the way up.

The fulcrum remains Bitcoin. Until the largest asset can establish weekly closes above the 1.0886 Fibonacci extension at $119,964, altcoins will “run out of gas.” He located initial Bitcoin support at $116,400, with deeper cushions at the $112–113k band and, in a worst-case flush, the $106.8k shelf. A break below the first of those levels “isn’t necessary” in his view, but he warned new entrants against treating a ten-percent dip in their favorite microcap as a buying opportunity: “If Total-2 drops another thirty percent, your altcoin is going down a lot more than ten.”

Why, then, does he remain upbeat? Kev cited a confluence of on-chain and macro tailwinds that, in his back-testing, have never failed to resolve higher. Bitcoin’s weekly Hash Ribbons flashed a buy signal nine weeks ago and has advanced only eight percent since—far below the historical mean of thirty-eight to one-hundred-one percent that materialises two to nine weeks after the trigger. A second, still-pending buy signal is “coming within the next week or two,” stacking probabilistic odds in favour of a leg higher.

Related Reading

At the same time, he noted, the Federal Reserve’s quantitative-tightening program is “barely selling anything on the balance sheet,” while Truth Inflation’s real-time gauge pins headline CPI at 2.0–2.1 percent. A spate of tariff de-escalations—including a tentative, across-the-board fifteen-percent cut in EU-US duties announced moments before he went live—suggests that inflation risks are skewing lower rather than higher. “As long as the macro stays quiet—low inflation, steady labour market, dovish policy projections—valuations can march north,” he argued, adding that upcoming earnings from Google, Tesla and the rest of Big Tech will feed directly into crypto multiples because “the guidance is correlated whether you like it or not.”

Seasonality is the wild card. August and September are notoriously fickle for risk assets, a period he likened to “the biggest vacation month of the year and then back-to-school.” Yet he stressed that cyclicality alone cannot trump a supportive macro backdrop. Instead, he expects a period of choppy consolidation—anchored by Bitcoin’s tussle with $120k and the golden-pocket bounce in Bitcoin Dominance—before the market’s next sustained advance. “We are like the running back; the offensive line has opened the hole, but we haven’t burst through it yet,” he said. “If macro stays resilient, this is the year it finally happens.”

His forward timeline therefore hinges on two visible catalysts: A decisive Bitcoin breakout above $123,000. When that prints on a multi-day close, he believes the four-year Total-2 ceiling will snap, unleashing capital rotation back into ETH and the broader alt market. “Everything leads back to Bitcoin,” he said. “Crack that wall and the catch-up trade reignites.”

Related Reading

Second is the continuation of the benign macro mix through Q3. Should inflation hold near two percent and the Fed confirm an end-to-QT schedule in its September meeting, Kev projects the next Hash-Ribbons signal will “play out as violently bullish as the model has ever shown,” delivering what he calls the “last six-month window” of the cycle.

Asked in chat “when this pullback will be over,” the analyst refused to pin a date on it. “I’m not looking at the clock,” he replied. “Time doesn’t matter; the levels do.” Still, his body language betrayed optimism: he plans no further sales, sees no need to add until volatility subsides, and—despite acknowledging August’s chop potential—spoke repeatedly about “riding what I have” into the final quarter of 2025.

In other words, the cool-down now underway is less a bear-market omen than the mandatory breather before a potential breakout. Traders who missed the July run are advised to watch Bitcoin’s $116k and $112k buffers for signs of an exhaustion wick, monitor Bitcoin Dominance for a failure rally below sixty percent, and keep an eye on the next CPI print.

If those dominoes fall in line, Kev Capital is confident the real fireworks—an altcoin surge that carries Total-2 into price discovery for the first time since 2021—will begin “sooner than most people think, and definitely while everyone’s still on summer holiday.”

At press time, TOTAL2 stood at $1.44 trillion.

Featured image created with DALL.E, chart from TradingView.com